Which method of relative currency valuation works best for currency trading? In their February 2015 paper entitled “Currency Value Strategies”, Ahmad Raza, Ben Marshall and Nuttawat Visaltanachoti run a horse race of four currency value strategies:

- Real Exchange Rate: nominal spot exchange rate with the U.S. dollar times the ratio of local consumer prices in local currency to U.S. consumer prices in U.S. dollars.

- Real Exchange Rate Change: one minus the ratio of the average real exchange rate between 5.5 and 4.5 years ago to the real exchange rate three months ago.

- Purchasing Power Parity: from the Organization for Economic Co-operation and Development (OECD).

- Big Mac Index: raw version from the Economist.

Their approach is to calculate excess returns in U.S. dollars from a portfolio that is iteratively long (short) the fifth of currencies that are most undervalued (overvalued) per each of these four metrics and hold the positions over periods ranging from one week to 12 months. Using weekly and monthly spot and forward foreign exchange rate data for 39 developed and emerging market currencies versus the U.S. dollar during January 1972 through July 2013, they find that:

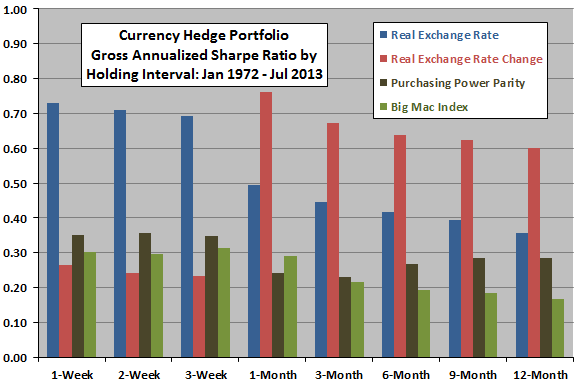

- The Real Exchange Rate and Real Exchange Rate Change strategies win parts of the horse race (see the chart below):

- The Real Exchange Rate strategy generates the largest gross excess returns for holding intervals up to one month (about 7% annualized).

- The Real Exchange Rate Change strategy produces the largest gross excess returns for holding intervals of one to 12 months (about 7% annualized).

- Purchasing Power Parity and Big Mac Index strategies generally underperform the other two.

- A combination approach based on all four metrics is especially effective for short holding intervals, generating gross annualized excess returns of 13%-15% for holding intervals of one to three weeks.

- When restricted to freely floating currencies, gross excess returns of the Real Exchange Rate Change strategy for holding intervals of one to 12 months increase to about 10% annualized, with performances of other strategies less affected.

- Currency value strategy returns are largely independent of currency carry trade returns and are insensitive to a broad range of macroeconomic variables. However, the Real Exchange Rate and Real Exchange Rate Change strategies perform better when the U.S. economy is expanding and when the U.S. dollar is depreciating.

- Most of the strategies have low turnovers and are therefore robust to trading frictions.

The following chart, constructed from data in the paper, summarizes gross annualized Sharpe ratios for each of the four currency value strategy hedge portfolios across all holding intervals. The Real Exchange Rate strategy wins for holding intervals less than one month, while the Real Exchange Rate Change strategy wins for holding intervals of one to 12 months.

In summary, evidence indicates that the Real Exchange Rate (Real Exchange Rate Change) strategy is the most attractive currency value strategy for holding intervals less than one month (one to 12 months).

Cautions regarding findings include:

- As noted, reported performance statistics are gross, but are robust to trading frictions.

- Some investors may not be able to trade currencies using the approach described and would bear management fees for delegation.