Does diversification into alternative asset class investments, which may carry high management fees, help on a net basis? In the December 2014 version of their paper entitled “Fees Eat Diversification’s Lunch”, William Jennings and Brian Payne examine the diversification benefits of different asset classes after accounting for associated investment management fees. They focus on fees relative to allocation alpha, the expected return after accounting for market risk (volatility). Allocation alpha is a passive return derived from strategic allocation. They consider 45 asset classes with long-term (10-15 years) expected returns, risks and correlations per J.P. Morgan’s “Long-term Capital Market Return Assumptions.” They apply asset class investment management fees from a biennial fee survey performed by a major institutional investment consulting firm, segmented into three investor types: small endowment, state pension, and high-quality (fee-advantaged) foundation. Using the specified asset class performance estimates and associated investment management fees, they find that:

- Investment management fees for some diversifying asset classes are very high relative to diversification benefits.

- For five of 11 asset classes typically considered as diversifiers by institutions and private wealth managers, fees consume most of the gross allocation alpha.

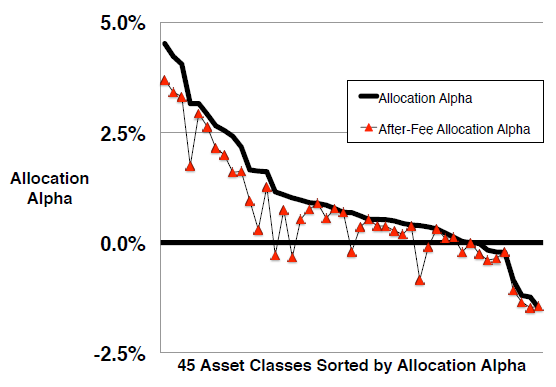

- Across all 45 asset classes, a number of positive gross allocation alphas become unattractive after accounting for fees (see the chart below). Requiring that fees consume no more than half the gross allocation alpha eliminates 40% of asset classes.

- Analysis suggests that investors should be especially careful regarding the fee impacts for hedge funds, private equity and global bonds. In contrast, some real assets and emerging markets have attractive net allocation alphas.

- Passive forms of diversifying asset classes often present larger net allocation alphas than corresponding active forms.

- Individuals generally pay higher investment management fees than institutions, making diversification even more difficult.

The following chart, taken from the paper, summarizes gross (black line) and net (red triangles) allocation alphas for all 45 asset classes covered in J.P. Morgan’s “Long-term Capital Market Return Assumptions,” sorted in descending order of gross allocation alpha. Nine asset classes are clearly unattractive (negative gross allocation alphas). After accounting for investment management fees, many other asset classes become unattractive. Fees vary widely and do not relate systematically to gross allocation alpha.

In summary, evidence suggests that investors should be careful to consider net diversification benefits in evaluating addition of alternative asset classes to their portfolios.

Cautions regarding findings include:

- As noted in the study, the degree to which specific analyses are realistic depends on the accuracies of the J.P. Morgan asset class performance estimates and the consulting firm fee survey results.

- As noted, achieving net diversification benefits is likely even more difficult for individuals than indicated above for institutions.