Is equity factor investing a straightforward path to premium capture and diversification? In their October 2014 paper entitled “Facts and Fantasies About Factor Investing”, Zelia Cazalet and Thierry Roncalli summarize the body of research on factor investing and provide examples to address the following questions:

- What is a risk factor?

- Do all risk factors offer attractive premiums?

- How stable and robust are these premiums?

- How can investors translate academic risk factors into portfolios?

- How should investors allocate to different factors?

They define risk factor investing as the attempt to enhance returns in the long run by capturing systematic risk premiums. They focus on the gap between retrospective (academic) analysis and prospective portfolio implementation. They summarize research on the following factors: market beta, size, book-to-market ratio, momentum, volatility, liquidity, carry, quality, yield curve slope, default risk, coskewness and macroeconomic variables. Based on the body of factor investing research and examples, they conclude that:

- Only a few risk factors are empirically reliable, including size, value and momentum.

- Implementable portfolios based on risk factors can produce very different results, depending on:

- The stock universe used.

- The weighting scheme used (such as value-weighted versus equal-weighted).

- The breakpoints employed to select stocks with high and low expected returns (such as top/bottom thirds or top/bottom tenths).

- Portfolio rebalancing frequency (a trade-off between factor tracking and implementation costs).

- Imposing a long-only constraint may substantially alter factor behaviors and premiums, because contributions of the long and short sides of academic factors may differ.

- Such long-only effects are strong for some factors, such as the Betting-Against-Beta factor and momentum.

- Long-only factor returns are highly correlated (via common market exposure) compared to long-short factor returns.

- The body of research on risk factors often ignores trading frictions. When factor portfolio turnover is high, the net premium is substantially lower than the gross premium.

- Optimal allocation of capital across risk factors depends on the alpha, beta and idiosyncratic volatility of each factor, and on the risk and the return of the market portfolio. These variables may be unstable, such that diversification across risk factors is not clearly superior to diversification across asset classes.

- Optimal solutions tend to concentrate in very few factors (driving ad hoc constraints to force diversification).

- The optimal allocation is very sensitive to the universe of factors considered. In other words, including or excluding a single risk factor may strongly impact the solution.

- For long-only implementations, diversification does not reduce drawdown compared to the market portfolio.

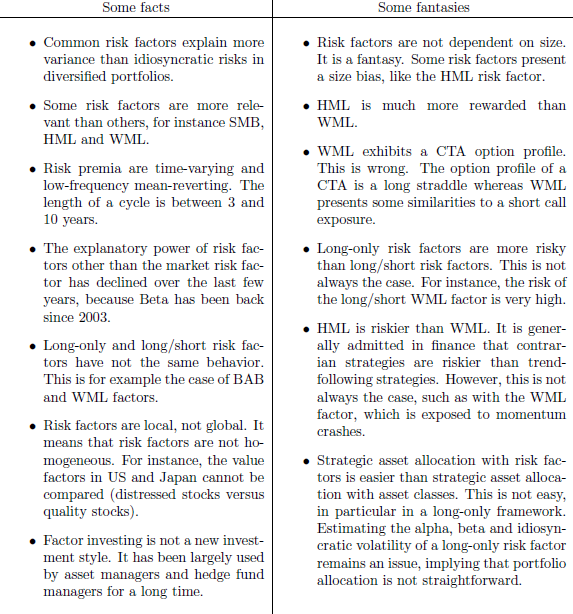

The following table, taken from the paper, summarizes conclusions from the body of research on equity factor investing. SMB (Small-Minus-Big market capitalization), HML (High-Minus-Low book-to-market ratio) and WML (Winners-Minus-Losers past returns) are the size, value and momentum factors, respectively. BAB is the Betting-Against-Beta factor (low beta minus high beta). CTA stands for Commodity Trading Advisors, generally associated with the “managed futures” hedge fund style.

In summary, there are significant obstacles to capture of equity factor premiums identified in academic research, both for single-factor portfolios and for diversified portfolios based on multi-factor allocations.

Cautions regarding conclusions include:

- The paper concentrates on stocks as investment vehicles.

- Trading frictions (and costs of shorting) are generally higher for individuals than institutions.

- Lack of supply of shares to borrow may preclude implementation of the short sides of factor portfolios.

- Factor investing as applied to individual stocks involves a large data collection/processing burden (or fees if delegated to fund managers), thereby impacting net profitability.