Does quantitative technical analysis work reliably in currency trading? If so, where does it work best? In their May 2013 paper entitled “Forty Years, Thirty Currencies and 21,000 Trading Rules: A Large-Scale, Data-Snooping Robust Analysis of Technical Trading in the Foreign Exchange Market”, Po-Hsuan Hsu and Mark Taylor test the effectiveness of a broad set of quantitative technical trading rules as applied to exchange rates of 30 currencies with the U.S. dollar over extended periods. They consider 21,195 distinct technical trading rules: 2,835 filter rules; 12,870 moving average rules; 1,890 support-resistance signals; 3,000 channel breakout rules; and, 600 oscillator rules. They employ a test methodology designed to account for data snooping in identifying reliably profitable trading rules. They also test whether technical trading effectiveness weakens over time. In testing robustness to trading frictions, they assume a fixed one-way trading cost of 0.025%. Using daily U.S. dollar exchange rates for nine developed market currencies and 21 emerging market currencies during January 1971 through July 2011, they find that:

- Among developed market currencies, the Swiss franc appreciates the most on average (4.0% per year) and the UK pound depreciates the most (0.9% per year). Among emerging market currencies, the Czech koruna appreciates the most (2.7% per year) and the Turkish lira depreciates the most (29.3% per year).

- Short-term annualized interest rates for daily trading in developed countries range from 2.3% to 8.1%. Those in emerging countries range from 2.4% to 37.1%.

- The most (least) volatile currency among developed markets are the Swiss franc (Canadian dollar). Among emerging markets, the most (least) volatile currency is the Indonesian rupiah (Taiwanese dollar).

- There is evidence of exchange rate predictability in most developed and emerging markets based on either gross mean excess return or gross Sharpe ratio.

- Among developed market currencies, strong exchange rate predictability exists in the 1970s and 1980s, but gradually disappears since the early 1990s.

- Emerging market currencies are generally more predictable than developed market currencies, and most Asian currencies appear to be highly predictable. Predictability persists into the 2000s.

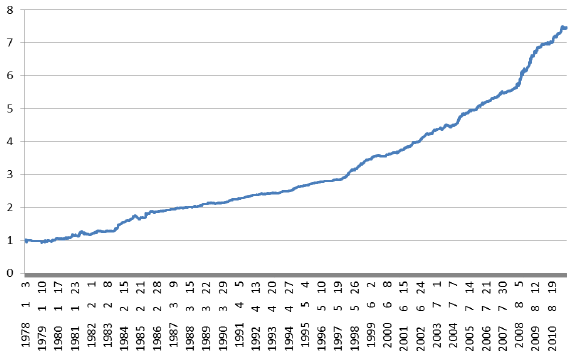

- Predictability translates to net profitability for a number of technical trading rules, especially in emerging markets. An equally weighted portfolio of optimal technical trading rules applied to emerging market currencies, rebalanced as new currencies become available, generates a compound annual return of 9% and a Sharpe ratio of 1.31 over 24 years (see the chart below).

- Technical predictability and profitability appear to derive more from temporary behavioral overreaction/underreaction rather than from volatility, autocorrelation, risk premiums (buy and hold), volatility, market crises or central bank interventions.

- Market maturity, and the associated degree of informational efficiency, is an important determinant of technical analysis profitability.

The following chart, taken from the paper, tracks the net cumulative value from investing $1 in an equally-weighted portfolio of the 13 most predictable emerging market currencies using the best trading rule (highest Sharpe ratio) for each. Currencies enter the portfolio as they become available over the sample period, triggering rebalancing. One-way trading friction is 0.025%. The terminal return over about 24 years is 746%, representing an annualized return of 9%. Net annualized Sharpe ratio is 1.31. There are no significant drawdowns.

Note that this performance is ideal, incorporating two types of look-ahead bias. A trader operating in real time would not know which emerging market currencies are most predictable or which rule is optimal for each such currency.

In summary, evidence suggests that technical currency trading is still potentially profitable in emerging markets, especially those that are least developed.

Cautions regarding findings include:

- As noted, there is compounded look-ahead bias in the example of profitability for the emerging markets currency portfolio. A trader operating in real time would not know which currencies and rules work best over a future sample period.

- The assumed level of trading friction may not be applicable across all currencies over the entire sample period, or realistic for all traders.