Do hedge fund-like mutual funds work like hedge funds? In his September 2014 paper entitled “Hedge Funds versus Mutual Funds (2): An Examination of Multialternative Mutual Funds”, David McCarthy evaluates mutual funds categorized by Morningstar as “multialternative” after further subcategorizing them as: Global Asset Allocation (active asset allocation across a broad set of global markets); Multistrategy (investing across distinct investment styles); and, Replication (quantitatively mimicking the returns of a hedge fund index). He profiles these groups, compares their asset class and factor exposures to those of hedge fund indexes, and compares their performances to those of hedge fund indexes. He considers three benchmarks: the Hedge Fund Research (HFR) Relative Value Multistrategy Index; the HFR Fund of Funds Diversified Index; and, the long-only Morningstar Global Allocation Index. Using monthly returns as available for 30 Global Asset Allocation, 33 Multistrategy and four Replication mutual funds established as of January 2013 along with contemporaneous returns for asset class proxies, factors and benchmarks during January 2008 through December 2013, he finds that:

- About half the multialternative mutual funds launch since the beginning of 2010, and they tend to be small.

- In contrast to findings from prior research that equity long/short mutual funds are similar to equity long/short hedge fund, multialternative mutual funds may not be good substitutes for hedge funds, instead exhibiting behaviors between those of hedge funds and long-only funds. Specifically, based on monthly returns over the entire six-year sample period:

- Return correlations between multialternative mutual fund subcategories (HFR indexes) and the S&P 500 Index range from 0.81 to 0.91 (0.68 to 0.79).

- Betas for multialternative mutual fund subcategories (HFR indexes) relative to the S&P 500 Index range 0.24 to 0.47 (0.18 to 0.25).

- Multialternative mutual fund subcategory returns generally exhibit higher U.S. equity and U.S. government bond exposures and much more negative U.S. dollar exposures than do HFR index returns.

- The four-factor (market, size, book-to-market, momentum) model of U.S. stock returns explains multialternative mutual funds subcategory returns substantially better than it explains HFR index returns.

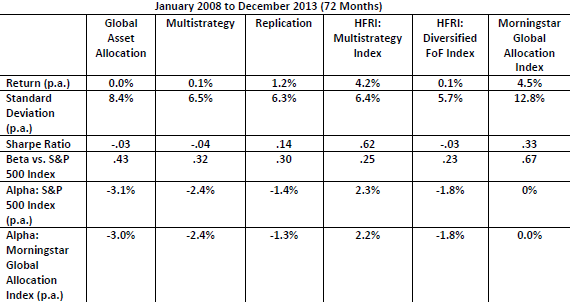

- Multialternative mutual funds materially underperform comparable hedge funds. Specifically, based on equally weighted monthly returns over the entire sample period (see the table below):

- Global Asset Allocation, Multistrategy and Replication mutual fund subcategories have annualized Sharpe ratios of -0.03, -0.04 and 0.14, respectively.

- The HFR Multistrategy Index, the HFR Diversified Index and the Morningstar Global Allocation Index have annualized Sharpe ratios of 0.62, -0.03 and 0.33, respectively.

- Results for the last three years of the sample period show even greater disparities, with both HFR indexes outperforming all three multialternative mutual fund subcategories (despite higher equity betas in an equity bull market).

- Outliers do not drive findings. Very few individual multialternative mutual funds add value over the full sample period or the recent subperiod.

- Multialternative mutual funds managed by Diversified Investment Firms outperform those managed by Specialized Investment Firms (but are still not attractive).

The following table, taken from the paper, summarizes per annum (p.a.) performance statistics for the three subcategories of multialternative mutual funds and the three benchmark indexes. Mutual funds mostly underperform the benchmarks.

In summary, available evidence indicates that the performance of multialternative mutual funds is unattractive in absolute terms, risk-adjusted terms and relative to hedge fund indexes.

As noted, the available sample period and the available subsamples of multialternative mutual funds are small.