Does focus on nearest-expiration contracts in commodity futures momentum strategies leave money on the table? In their May 2014 paper entitled “Exploiting Commodity Momentum Along the Futures Curves”, Wilma De Groot, Dennis Karstanje and Weili Zhou investigate commodities futures momentum strategies that consider all available contract expirations. They hypothesize that a broadened contract universe could increase roll yield, reduce volatility and lower portfolio turnover. Their generic benchmark strategy each month buys (sells) the equally weighted half of commodities with the highest (lowest) 12-month returns using nearest-expiration contracts. They consider three alternatives to the generic strategy:

- Optimal-roll momentum: each month ranks commodities in the same way as the generic strategy, but buys the most backwardated contract for each winner commodity and sells the most contangoed contract for each loser commodity from among contracts with expirations up to 12 months.

- All-contracts momentum: each month first select for each commodity the contract expiration with the strongest and weakest momentum. Then rank the commodities based on these contracts and buy (sell) the equally weighted half with the highest (lowest) momentum.

- Low-turnover roll momentum: modify the optimal-roll momentum strategy by holding each position until it is about to expire or until it switches sides (long-to-short or short-to-long), whichever occurs first.

They assume fully collateralized portfolios, such that total monthly return for each position is change in month-end settlement price plus the risk-free interest rate (U.S. Treasury bill yield) earned by the collateral. They focus on changes in settlement prices (excess returns). They consider several ways of estimating trading frictions. Using daily and monthly prices of S&P GSCI components during January 1990 through September 2011 (initially 18 commodity series growing to all 24 by July 1997), they find that:

- With conservative trading frictions (about 0.22% per trade), the optimal-roll momentum strategy beats the benchmark by:

- Improving annualized return from 4.0% to 5.9%.

- Reducing annualized volatility from 15.8% to 13.7%.

- Increasing annualized Sharpe ratio from 0.25 to 0.43.

- Reducing maximum drawdown from -30.6% to -25.8%.

- With conservative trading frictions, the all-contracts momentum strategy beats the benchmark by:

- Improving annualized return from 4.0% to 6.5%.

- Slightly reducing annualized volatility from 15.8% to 15.0%.

- Increasing annualized Sharpe ratio from 0.25 to 0.43.

- Reducing maximum drawdown from -30.6% to -23.6%.

- With conservative trading frictions, the low-turnover roll momentum strategy beats the benchmark by:

- Improving annualized return from 4.0% to 8.4%.

- Reducing annualized volatility from 15.8% to 14.0%.

- Increasing annualized Sharpe ratio from 0.25 to 0.60.

- Reducing maximum drawdown from -30.6% to -23.2%.

- For less conservative assumptions about trading frictions, the outperformance of the low-turnover roll momentum strategy shrinks.

- Contracts with the longest times to expiration do not drive profitability improvements, so it is unlikely that additional profits derive from lower liquidity.

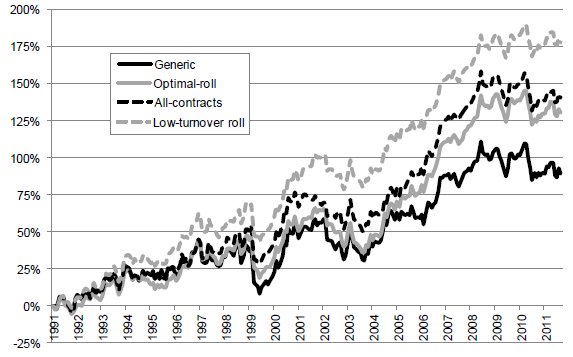

The following chart, taken from the paper, compares cumulative net returns of the generic commodity futures momentum strategy and the three alternative strategies over the entire sample period based on conservative trading frictions of about 0.22% per trade. All alternative strategies beat the generic benchmark. The low-turnover roll momentum strategy performs best (but this outperformance shrinks with less conservative trading frictions). No particular subperiod appears to drive alternative strategy outperformances.

In summary, evidence indicates that commodity futures momentum investors can enhance profitability by considering all contract expirations and limiting trading frequency.

Cautions regarding findings include:

- Testing multiple strategy alternatives on the same set of data introduces snooping bias, such that the best-performing strategy overstates expectations (incorporates luck).

- Findings may differ for portfolios that are not fully collateralized (are leveraged).

- The paper does not account for any costs of data collection/processing (or fees if delegating this effort).