How do hedge funds electing not to report to a commercial database differ from those that do? In their July 2014 paper entitled “What Happens ‘Before the Birth’ and ‘After the Death’ of a Hedge Fund?”, Vikas Agarwal, Vyacheslav Fos and Wei Jiang compare performances of equity hedge funds before they begin self-reporting, while they are self-reporting; and after they stop self-reporting to commercial databases. They develop a sample of hedge funds that do and do not self-report by matching hedge fund Securities and Exchange Commission (SEC) Form 13F filings to listings of hedge funds that self-report to any of five major hedge fund commercial databases. They then identify subsamples of hedge funds that: (1) initially do not but later do self-report; and, (2) initially do but later do not self-report. They then use the long-only equity holdings in series of Form 13F to analyze performances and characteristics within subsamples. Using 1,199 series of Form 13Fs for firms that are clearly hedge funds during 1980 through 2008 and contemporaneous data for hedge funds self-reporting to commercial databases, they find that:

- The Form 13F/commercial database matching process isolates 77 hedge funds that clearly begin self-reporting and 187 that clearly stop self-reporting during the sample period.

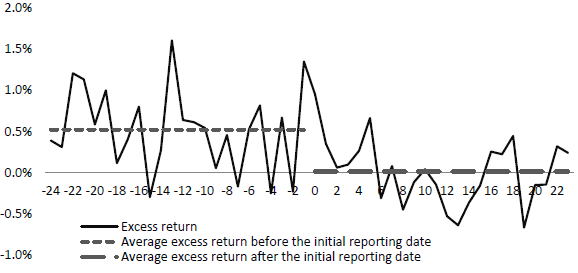

- Funds begin self-reporting after an extended period of high performance, but performance then deteriorates (see the chart below). Average raw return declines by 0.90% per month. Four different measures of average risk-adjusted returns decline by 0.22% to 0.73% per month.

- Average fund performance and net capital flow decline significantly after self-reporting stops. Average raw return declines by 1.9% per month. Four different measures of average risk-adjusted returns decline by 0.12% to 0.28% per month. Reasons for termination of self-reporting generally indicate distress.

- Regarding differences between hedge funds that do and do not self-report to commercial databases:

- Funds with strategies more likely to be revealed through disclosure (concentrated portfolios, low turnover, low dependence on size and value factors) are less likely to self-report.

- Young and relatively small funds ostensibly seeking capital are most likely to initiate disclosure. However, while capital flows are highly sensitive to performance, initiation of self-reporting in itself has limited effect on inflow.

The following chart, taken from the paper, shows average monthly (solid line) and 24-month overall average (dashed lines) market-adjusted returns from 24 months before to 24 months after initiation of self-reporting (time 0) for a subsample of 77 hedge funds. Return estimates are from holdings documented in SEC Form 13F filings. Results indicate that funds tend to initiate self-reporting after a strong run, but cannot thereafter sustain this performance. Possible interpretations are: (1) the early outperformance is lucky; or, (2) monthly public data attracts competitors who reverse-engineer and capture the outperformance.

In summary, evidence indicates that investors should expect hedge fund performance to deteriorate both after initiation of self-reporting to commercial databases and after termination of such self-reporting.

Cautions regarding findings include:

- As noted in the paper, the study: (1) addresses just the long-only equity positions of the hedge funds involved; (2) relies on quarter-end positions, ignoring intra-quarter trading; and, (3) relies on data that may aggregate holdings of multiple hedge funds managed by the same investment company. The authors mitigate these concerns via correlation analysis with self-reported monthly returns from commercial databases.

- As noted in the paper, return calculations from Form 13F series are gross, not net. Incorporation of trading frictions and fund fees would reduce reported returns.