Are the sources of active mutual fund risk mostly common (systematic) or unique (idiosyncratic)? In his July 2014 paper entitled “Components of Portfolio Variance: R2, SelectionShare and TimingShare”, Anders Ekholm decomposes mutual fund return variance (risk) into three sources: (1) passive systematic factor exposure (R-squared); (2) active security selection or stock picking (SelectionShare); and, (3) active systematic factor timing (TimingShare). He demonstrates estimation of these three components based on mutual fund returns (reflecting daily manager actions) rather than holdings (known only via quarterly snapshots). He employs the widely used four-factor (market, size, book-to-market, momentum) model of stock returns to define systematic risk. Using daily returns for a broad sample of actively managed U.S. equity mutual funds and for the four factors during 2000 through 2013, he finds that:

- Over the entire sample period:

- Average annual out-of-sample four-factor alpha calculated with monthly returns is -1.5%.

- Market, size, book-to-market and momentum factors account for an annually averaged 94% of active mutual fund risk, while security selection and factor timing account for 5% and 1%, respectively.

- Security selection (factor timing) risk relates positively (negatively) to future fund performance. Hence, combining them as idiosyncratic risk (1 – R-squared) suppresses their distinct predictive powers.

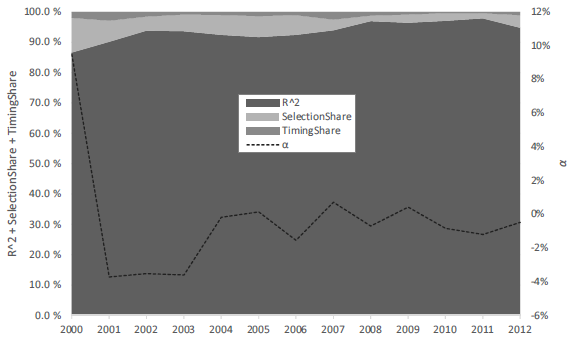

- Over the sample period (see the chart below), stock picking risk generally decreases from a peak in 2000 (coinciding with maximum annual alpha).

The following chart, taken from the paper, tracks average annual R-squared, SelectionShare and TimingShare over the sample period (left vertical axis). In general, systematic risk dominates active mutual fund portfolio risk. Trends suggest that the 2008 financial crisis made fund managers more passive. Average annual systematic factor risk is 91.8 % during 2000-2007 and 96.6% during 2008-2012. Conversely, stock picking and its assocated risk mostly decreases over time.

The chart also tracks average annualized in-sample four-factor alpha based on daily data (right vertical axis). This ideal alpha is attractive only during 2000 (the year of maximum stock picking).

In summary, evidence suggests that systematic risk dominates active mutual fund risk and that idiosyncratic risk related to stock picking (factor timing) relates positively (negatively) to future fund performance.

Results suggest that stock picking works, but market/factor timing does not.

Cautions regarding findings include:

- Periodic screening of available mutual funds for levels of stock picking and factor timing contributions to portfolio risk involves considerable data collection and processing, or cost if delegated.

- The study does not interpret materiality of the abilities of stock picking and factor timing risks to predict fund performance. Moreover, since investors typically cannot hold many mutual funds, they may not be able to exploit statistical findings reliably.

See “Focus on the Most Intensely Active Mutual Funds?” and “Measuring the Level and Persistence of Active Fund Management” for a holdings-based, rather than a returns-based, assessment of mutual fund activeness.