Do the behaviors of the most widely accepted stock market factors (size, book-to-market or value, and momentum) vary with the economic trend? In the June 2014 version of their paper entitled “Macroeconomic Determinants of Cyclical Variations in Value, Size and Momentum premium in the UK”, Golam Sarwar, Cesario Mateus and Natasa Todorovic examine differences in the sensitivities of UK equity market size, value and momentum factor returns (premiums) to changes in broad and specific economic variables. They define the broad economic state each month as upturn (downturn) when the OECD Composite Leading Indicator for the UK increases (decreases) that month. They also consider contributions of six specific variables to economic trend: GDP growth; unexpected inflation (change in CPI); interest rate (3-month UK Treasury bill yield); term spread (10-year UK Treasury bond yield minus 3-month UK Treasury bill yield); credit spread (Moody’s U.S. BBA yield minus 10-year UK government bond yield); and, money supply growth. They lag economic variables by one or two months to align their releases with stock market premium measurements. Using monthly UK size, value and momentum factors and economic data during July 1982 through December 2012, they find that:

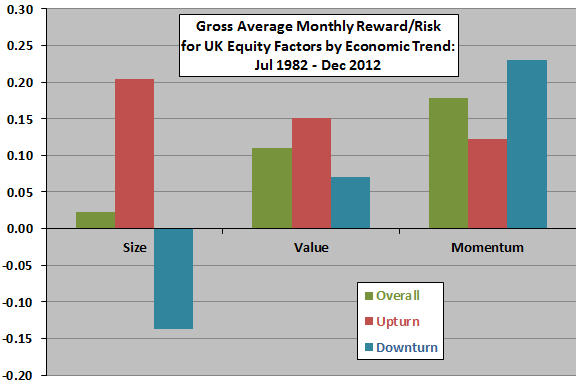

- All three gross factor premiums exhibit dependence on economic trend (see the chart below):

- The gross size premium is markedly positive (negative) during economic uptrends (downtrends).

- While consistently positive, the gross value premium is stronger during economic uptrends, while the gross momentum premium is stronger during economic downtrends.

- Interest rates, term structure and credit spread are the most important drivers of factor premium cyclicality.

- GDP growth, money supply growth and inflation play lesser roles in premium cyclicality.

The following chart, constructed from data in the paper, summarizes gross average monthly reward-to-risk ratios (average return divided by standard deviation of returns) for the UK stock market size, value and momentum factors overall and when the UK economy is improving (upturn) or deteriorating (downturn). Upturn means that the OECD Composite Leading Indicator for the UK increases, while downturn means that the indicator decreases.

Results indicate that the size premium is very sensitive to the economic trend and that the sensitivities of the value and momentum premiums are opposite.

In summary, evidence indicates that economic deterioration depresses UK stock market size and value factor premiums but enhances the momentum factor premium, with interest rate, term structure and credit spread most indicative of the economic trend.

Cautions regarding findings include:

- Economic variable-factor premium relationships are contemporaneous rather than leading. An investor would have to predict the economic trend to exploit relationships with stock market premiums.

- Factor returns are gross, not net. Incorporating costs associated with monthly factor portfolio turnovers would reduce these returns. Since portfolio turnover may vary by factor, the relative sizes of gross and net premiums may differ.