What is the best way to generate price trend signals for trading futures/forward contracts? In their December 2013 paper entitled “CTAs – Which Trend is Your Friend?”, Fabian Dori, Manuel Krieger, Urs Schubiger and Daniel Torgler compare risk-adjusted performances of three ways of translating trends into trading signals:

- Binary signals (up or down) trigger 100% long or 100% short trades. When trends are strong (ambiguous), this approach generates little trading (whipsaws/over-commitment to weak trends). The price impact of trading via this approach may be substantial for large traders.

- Continuously scaled signals trigger long or short trades with position size scaled according to the strength of up or down trend; the stronger the trend, the larger the position. Changes in trend strength generate incremental position adjustments.

- Empirical distribution signals trigger long or short trades with position size scaled according to the historical relationship between trend strength and future return. The strongest trend may not indicate the strongest future return, and may actually indicate return (and therefore position) reversal. Changes in trend strength generate position adjustments.

They test these three approaches for comparable trends exhibited by 96 futures/forward contract series, including: 30 currency pairs, 19 equity indexes, 11 government bond indexes, 8 short-term interest rates (STIR) and 28 commodities. They consider two risk-adjusted return metrics: annualized return divided by annualized volatility, and annualized return divided by maximum drawdown. They ignore trading frictions. Using prices for these 96 series from 1993 to 2013, they find that:

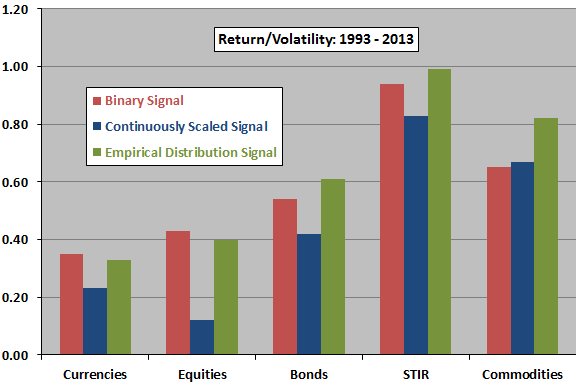

- Based on gross return/volatility (see the first chart below):

- Binary signals and empirical distribution signals produce similar results across asset classes, with the latter having a slight edge.

- Continuously scaled signals generally (except for commodities) underperform both other methods.

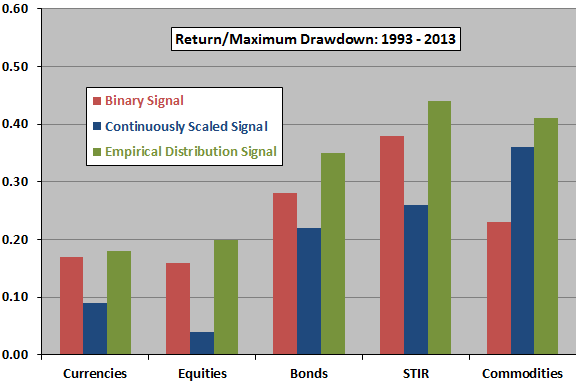

- Based on gross return/maximum drawdown (see the second chart below):

- Empirical distribution signals uniformly beat both other methods across asset classes.

- Binary signals outperform continuously scaled signals except for commodities.

- Regarding gross average profitability of short positions:

- Binary signals are effective only for commodities.

- Continuously scaled signals are effective only for currencies and commodities.

- Empirical distribution signals are effective for currencies, equities and commodities.

- None of the methods work for bonds and STIRs.

The following charts, constructed from data in the paper, summarize performance of the above three ways of translating trend data into trading signals based on gross annualized return divided by annualized volatility (upper chart) and gross annualized return divided by maximum drawdown (lower chart). Overall, empirical distribution signals offer the best gross performance.

In summary, evidence suggests that trading signals exploiting detailed information about the relationship between asset price trend strength and future asset return are more effective than simpler trend trading signals.

The terminology used above differs from that in the paper, hopefully in clarification.

Cautions regarding findings include:

- The authors do not specify the trend measurement parameters and partial trade size rules used in testing. Different specifications may generate different results.

- As noted, reported results are gross, not net. Since different ways of generating signals from trend data may produce different levels of portfolio turnover, and different traders may bear different trading frictions, net findings may differ from gross findings.

- Applying the three different ways of trend translation to the same sets of data introduces data snooping bias, such that the best performance likely overstates reasonable expectations. Moreover, there are opportunities for snooping within each approach to trend translation. Since the empirical distribution signals are most subject to optimization, results for this approach may carry more snooping bias than binary signals or continuously scaled signals.