Do recent reactions of gold price to interest rate-related U.S. economic announcements (rising on rate-suppressing news) mean that gold acts like a bond? In their September 2013 paper entitled “What if Gold is a Bond?”, Claude Erb and Campbell Harvey re-examine the relationship between gold price and interest rates as proxied by U.S. government bond prices. Using monthly spot gold price, 10-year U.S. Treasury note (T-note) yield and U.S. Treasury Inflation-Protected Securities (TIPS) yield as available during January 1975 through August 2013, they find that:

- Since the inception of TIPs trading in 1997, lower real and nominal U.S. interest rates relate to a higher nominal gold price. In both cases, the R-squared statistic is above 0.72, indicating that changes in interest rates explain at least 72% of the variation in gold price.

- If this recent negative relationship persists, an increase in interest rates to a moderate 4% means that gold price would fall below $1,000.

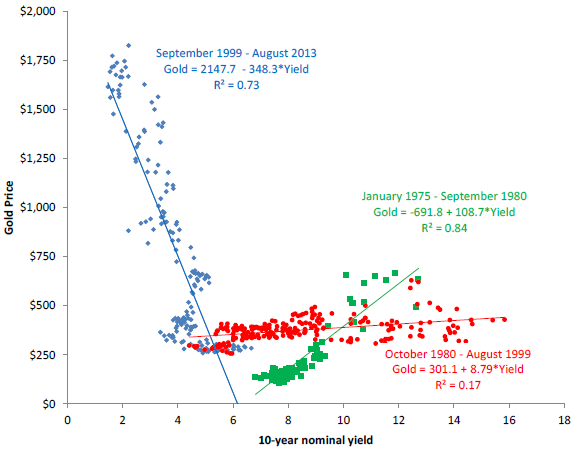

- However, since the beginning of 1975, the correlation between gold price and nominal T-note yield is negative, positive or non-existent during different subperiods (see the chart below). This inconsistency undermines belief that gold consistently acts like a bond.

The following scatter plot, taken from the paper, relates gold price to nominal T-note yield during three subperiods since the inception of legal gold futures trading in the U.S., as follows:

- January 1975-September 1980: gold price increases sharply (to an all-time high in real terms), with the relationship between gold price and T-note yield significantly positive.

- October 1980-August 1999: nominal gold price persistently declines, with no significant relationship between gold price and T-note yield.

- September 1999-August 2013: gold price generally rises, with a strong negative relationship between gold price and T-note yield.

Essentially, the relationship between gold price and T-note yield is positive, negative or non-existent depending on the subsample.

In summary, evidence since 1975 does not support belief in a persistent relationship between gold price and U.S. interest rates.

Cautions regarding findings include:

- Results perhaps suggest an unexplored non-linear relationship between gold price and interest rates.

- The analysis is U.S.-centric.

See “Future of the Price of Gold” for broader speculations on the price of gold by the same authors.