Can equity funds exploit widely accepted stock return anomalies? In their July 2013 paper entitled “Academic Knowledge Dissemination in the Mutual Fund Industry: Can Mutual Funds Successfully Adopt Factor Investing Strategies?”, Eduard Van Gelderen and Joop Huij investigate whether mutual funds that materially adopt investment strategies based on published asset pricing anomalies consistently outperform the stock market. They first use monthly regressions to measure degrees of use of six factor investing strategies (low-beta, small cap, value, momentum, short-term reversal and long-term reversion) across U.S. equity mutual funds. They then calculate market-adjusted returns to determine whether funds employing the strategies outperform those that do not and the market. Using monthly returns for 6,814 U.S. equity mutual funds, and contemporaneous monthly returns for the specified factors, during 1990 through 2010, they find that:

- Over the sample period, gross monthly factor premiums are: low-beta, 0.49%; small cap, 0.20%; value, 0.33%; momentum, 0.60%; short-term reversal, 0.25%; and, long-term reversion, 0.43%. These premiums vary considerably across subperiods.

- Roughly 20% to 30% of funds materially employ small cap and value factor investment strategies. Only 1% to 6% of funds employ low-beta, momentum, short-term reversal and long-term reversion strategies. Value and momentum strategies typically have significant exposure also to small caps.

- Evidence supports belief that funds successfully exploit low-beta, small cap and value factors.

- Funds pursuing a low-beta strategy match the market return with lower volatility. However, the strategy is notably stronger in the first half of the sample than the second.

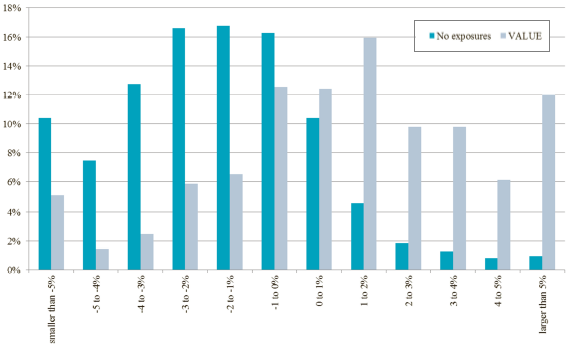

- Funds pursuing a small cap (value) strategy beat the market by an average net annual 0.56% (1.19%). 61% of small cap-oriented funds and 67% of value-oriented funds outperform the market over the long run, compared to just 20% of funds that do not pursue any factor investing strategy (see the chart below). Outperformance is persistent (in fact, stronger in the second half of the sample than the first).

- Evidence for outperformance of funds employing a momentum strategy is mixed, and those employing a short-term reversal strategy appear to underperform the market (high trading frictions may preclude exploitation of these strategies). Funds employing a long-term reversion strategy do not outperform the market.

- Overall, results suggest a conservative approach to incorporating academic insights into investment strategies, with considerable effort devoted to falsification before adoption.

The following histogram, taken from the paper, compares the distributions of market-adjusted returns for U.S. equity mutual funds not employing any factor investment strategies (No exposures) and funds materially employing a value factor investment strategy (VALUE) during 1990 through 2010. Aggregate value fund performance is clearly superior to that of funds not pursuing factor investing strategies. Distributions of low-beta and small-cap funds are also clearly superior to that of no-factor investing funds.

In summary, evidence supports belief that U.S. equity mutual funds materially employing low-beta, small cap and value (momentum, short-term reversal and long-term reversion) strategies on average do (do not) outperform the broad stock market.

Cautions regarding findings include:

- The study does not explore whether the degree of a fund’s commitment to the low-beta, small cap and value factors relates to degree of market outperformance.

- Findings suggest that the use of gross returns to measure anomalies is of limited practical use. Findings based on net returns may differ.