How can investors capture returns from widely accepted risk factors associated with asset classes and subclasses? In the June 2013 version of his book chapter entitled “Factor Investing”, Andrew Ang provides advice on capturing risk premiums associated with factors such as value, momentum, illiquidity, credit risk and volatility risk. Based on the body of research, he concludes that:

- Factor investing requires looking beyond asset class labels to identify underlying risk exposures.

- Factor risk premiums exist in the long run as compensation for losses during bad times. Investors who cannot bear such losses should avoid factor investing.

- While it is possible to exploit factors without taking short positions, less shorting means greater correlation with market returns (less diversification).

- Many factors recognized today (such as momentum and value-growth) started out as tentative anomalies (alpha). With maturing research and acceptance by institutional investors, they became benchmarks (beta). Applying a factor benchmark to a fund removes from active performance a component available more cheaply.

- Some factors (such as the size effect) disappear.

- There is no consensus on a complete set of factors. Statistical analysis suggests that fewer than ten factors can capture nearly all the variation in expected returns. Investors should keep things simple and start with a few.

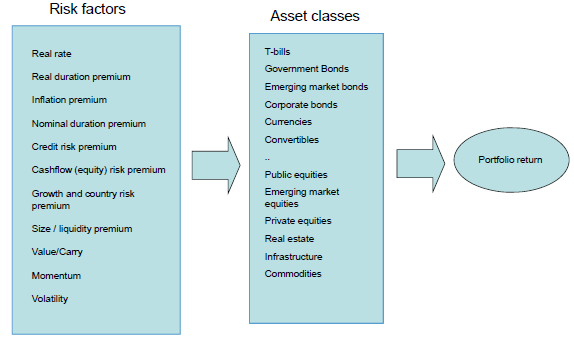

- The three steps in the factor allocation process for an investor are (see the figure below):

- Identify the investor’s competitive advantages and disadvantages and decide which factors are attractive and unattractive.

- Estimate the investor’s tolerance for loss during bad times to decide how much of the attractive factors to pursue.

- Rebalance systematically to reduce (increase) exposure to outperforming (underperforming) factors.

- To the (small) extent that factor returns are predictable, investors can amplify the effect of rebalancing via extreme allocations when expected returns are very high or very low.

The following chart, taken from the draft chapter, summarizes at a very high level how an investor constructs a portfolio to capture a set of risk factor premiums. The investor first selects factors that are attractive based on competitive advantages and then implements exposures to these factors via appropriate assets. Some risk factors translate directly to asset classes (such as the equity risk premium). Others cut across asset classes (such as momentum and value-growth). For example, value-growth derives from book-to-market ratio for equities, interest rates for currencies, yield for bonds and roll return for commodity futures.

In summary, investors can capture risk factor premiums by: (1) selecting factors appropriate to their competitive advantages; (2) matching selected factors to asset classes/subclasses; and, (3) systematically rebalancing to allocate away from (toward) past outperformance (underperformance).

Cautions regarding conclusions include:

- The draft chapter does not quantify potential returns or risks for various factors.

- Identifying competitive advantages and mapping them to risk factors involves judgment.

- As addressed in “Why Extra Risk Earns No Extra Reward?”, empirical research does not always support belief in a reward-for-risk view of investing.