What pitfalls face forecasters trying to predict financial markets with economic data series? In their November 2012 preliminary paper entitled “Forecasting through the Rear-View Mirror: Data Revisions and Bond Return Predictability”, Eric Ghysels, Casidhe Horan and Emanuel Moench examine the predictive power of economic data to predict annual returns for U.S. Treasury notes (T-note) with constant maturities of two, three, four and five years. They focus on the effects of publication delays and use of as-released (real-time) versus revised data. They consider a set of 68 monthly economic variables for which initial release (as well as revised) values and release dates are available since the early 1980s. Using annual T-note returns and both as-released and revised data for these 68 economic variables (such as industrial production, employment, housing indicators, personal income, price indexes and money stock) from ArchivaL Federal Reserve Economic Data) during March 1982 through December 2011, they find that:

- The average publication delay for the 68 economic variables is about 13 days after the end of the calendar month reported.

- The statistics of as-released and final revised values of economic variables are quite different. Also, revisions for most series exhibit negative monthly autocorrelation, with a positive (negative) revision one month indicating a negative (positive) revision next month.

- Much of the in-sample ability of economic variables to predict T-note returns derives from both ignoring initial publication delays and using revised rather than as-released values. Moreover, the incremental predictive information of revised data largely disappears in truly real-time, out-of-sample tests.

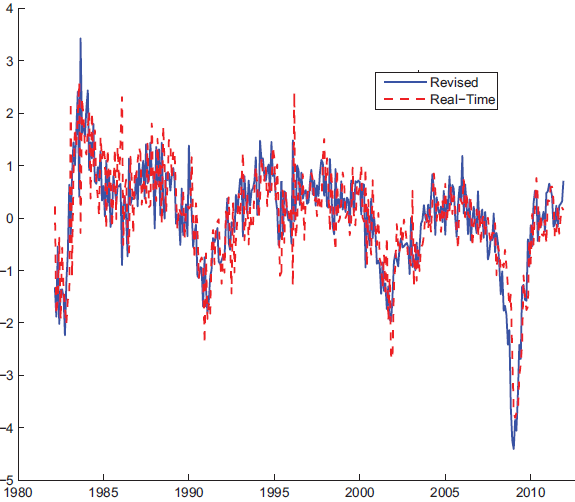

The following chart, taken from the paper, compares the first principal components separately extracted from as-released (real-time) and revised series of 68 monthly economic variables. While as-released and revised components are similar, the latter often leads the former, highlighting the look-ahead bias derived from ignoring revision effects.

In summary, evidence indicates that carefully accounting for publication delays and data revisions undermines belief in the ability of economic variables to predict bond returns.

The methodological cautions in the paper apply generally to forecasting.