Wars both consume crude oil and potentially disrupt supplies. Do they reliably drive up oil price? In their November 2012 paper entitled “Crude Oil as a Safe Haven Asset in Times of War”, Tomasz Wisniewski and Ayman Omar examine the behaviors of crude oil price and stock market indexes around severe international crises and wars. They construct a sample of crises from the July 2010 version of the International Crisis Behavior (ICB) database, excluding events scoring below “6” on the severity scale (such as protests, diplomatic sanctions and withholding economic aid). They also extract a war subsample (border clash/crossing by military forces, invasion of air space, sea/air military operations and large-scale military attacks/bombing). They use the Cushing, Oklahoma West Texas Intermediate (WTI) spot price as crude oil price, but also test the Brent spot price as a robustness check. They consider S&P 500 and MSCI World as representative stock market indexes. They define the crisis/war impact interval as 50 trading days before through 50 trading days after outbreak. They define the effect of a crisis/war on price as the “abnormal” return compared to price behavior during the 150 trading days prior to the impact interval. Using daily crude oil spot price and stock index levels around 64 instances of severe international crises and 43 wars during January 1987 through December 2007, they find that:

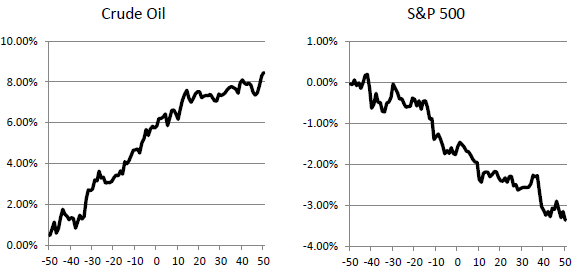

- On average (see the chart below):

- Crude oil price increases abnormally from 50 trading days before through 50 trading days after outbreaks of international crises (8.5%) and wars (12.1%).

- The S&P 500 Index decreases abnormally from 50 trading days before through 50 trading days after outbreaks of international crises (-3.4%) and wars (-4.7%). Effects on the S&P 500 Index tend to be stronger than those for the MSCI World Index.

- Roughly two thirds (one third to one half) of the move in crude oil price (the S&P 500 Index) occurs during the 50 trading days before outbreak, suggesting that oil traders are more informed than stock traders.

- Crude oil therefore provides a safe haven to equity investors from the risk of international crises and wars. A permanent long position in crude oil futures contracts or a crude oil exchange-traded fund (ETF) should be part of a well-constructed portfolio.

The following chart, taken from the paper, compares average cumulative abnormal returns for spot crude oil and the S&P 500 Index from 50 trading days before (-50) to 50 trading days after (50) 64 international crises during January 1987 through December 2007. Day 0 denotes crisis outbreak. “Abnormal” return is relative to price behavior during the 150 trading days prior to Day -50. Results for a subsample of 43 wars are similar but somewhat stronger.

In summary, evidence suggests that investors may be able to soften blows of international crises and wars on equity portfolios by holding crude oil derivatives.

Cautions regarding findings include:

- Measuring a “return” for spot crude oil ignores the costs of buying, storing and selling the oil.

- The authors do not test their assertion that crude oil commodity futures contracts and ETFs are good substitutes for spot holdings. Due to anticipation by speculators and costs of rolling contracts to maintain a continuous position, prices for these derivatives may behave quite differently from spot prices.

- Much of the average effect of crises on crude oil and stock prices is is pre-outbreak. Full event-by-event exploitation therefore problematically requires investor anticipation of qualifying crises. Moreover, the July 2010 version of the ICB database is the current version, so it is not a feasible source of real-time events.