Does the S&P 500 implied volatility index (VIX) exhibit predictable behaviors around holidays? If so, is the predictability exploitable? To check, we look at percentage changes in VIX from three trading days before to three trading days after the following annual holidays: New Year’s Day, Super Bowl, Good Friday, Memorial Day, 4th of July, Labor Day, Thanksgiving and Christmas. To test exploitability, we employ iPath S&P 500 VIX ST Futures ETN (VXX), exchange-traded notes that hold short-term VIX futures. Using daily closes of VIX and VXX from their respective inceptions (January 1990 and February 2009) through November 2016 (214 and 62 holidays), we find that:

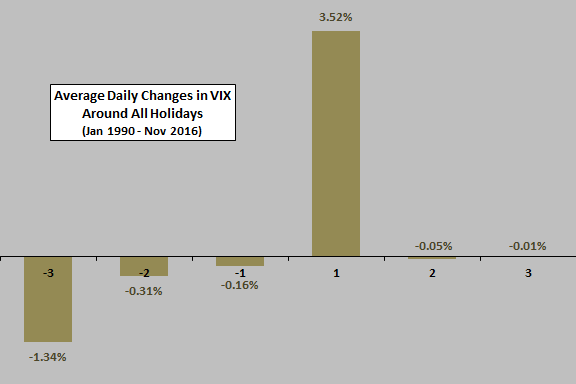

The following chart summarizes average daily percentage changes in VIX from three trading days before (-3) through three trading days after (3) holidays across all 214 holidays in the available sample period. The average daily percentage change in VIX over the entire sample period is 0.20%. Results indicate that VIX tends to decline leading up to holidays but increase strongly the day after holidays.

Do these results hold for each holiday?

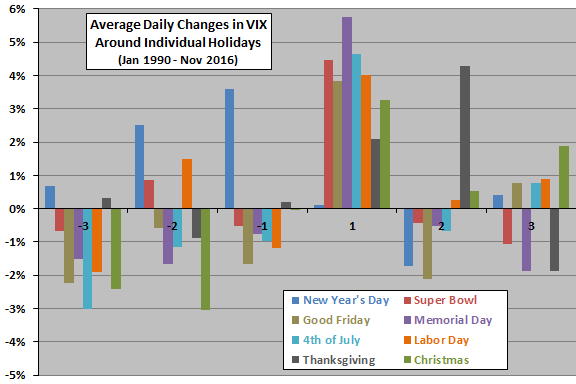

The next chart summarizes average daily percentage changes in VIX from three trading days before through three trading days after holidays for each of the eight holidays in the available sample period (26-27 observations each). The above findings hold for most holidays, but New Year’s Day and Thanksgiving exhibit pronounced differences.

Are results exploitable via VIX derivatives?

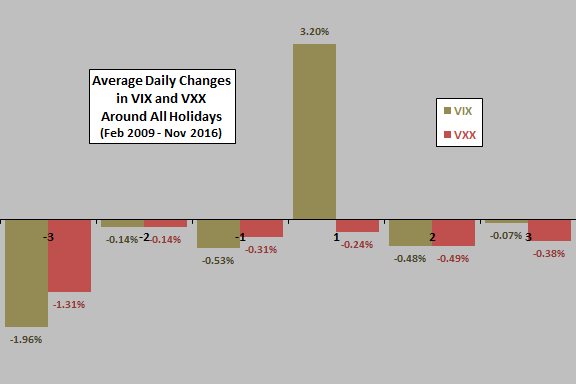

The next chart summarizes average daily percentage change in VIX and average daily return for VXX from three trading days before through three trading days after holidays for all 62 holidays since VXX inception in February 2009. The average daily percentage change in VIX (VXX) over this subperiod is 0.21% (-0.27%).

VIX behavior is consistent with that found above for the entire sample period, but VXX traders apparently anticipate the spike in VIX the day after holidays such that VXX does not rise with VIX.

Does variability of results differ over the event window?

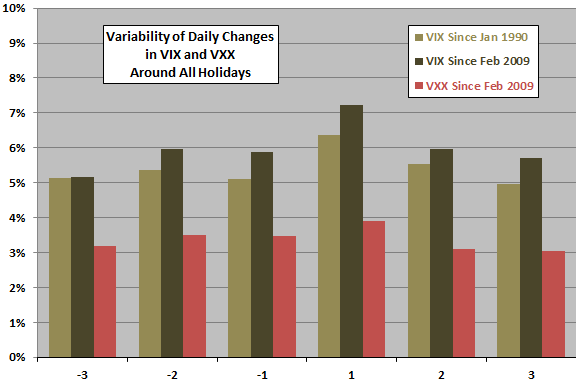

The final chart summarizes standard deviations of daily VIX changes and VXX returns from three trading days before through three trading days after holidays for all holidays since inceptions of both. Results consistently indicate that variability of VIX changes and VXX returns is highest on the day after a holiday.

In summary, evidence from simple tests on available data indicates that VIX tends to jump on the day after holidays, but VIX futures traders (and therefore VXX) apparently anticipate this jump.

Note that the first trading day after two holidays (Good Friday, Super Bowl) and the second trading day after Thanksgiving are Mondays, in consonance with findings in “VIX Calendar Effects”.

Cautions regarding findings include:

- The subsamples for individual holidays since VIX inception are not large, limiting confidence in results.

- The sample of all holidays since VXX inception is not large, limiting confidence in results (although consistency in VIX behaviors for the overall sample and the recent subperiod obviate this concern).

See “Exploit Short-term VIX Reversion with VXX?” and “Short-term VIX Calendar Effects” for other examples of VIX tendencies apparently not exploitable via VXX.