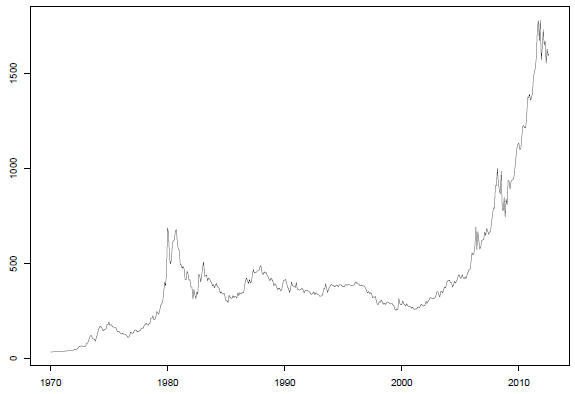

Does the rapid appreciation in gold price over the past decade represent a price bubble? In the October 2012 draft of their paper entitled “A Gold Bubble?”, Dirk Baur and Kristoffer Glover test for bubbles in gold price over the past four decades. Their test method is purely technical, focusing on price explosiveness and requiring no assessment of fundamental value. They consider also a complementary behavioral explanation of the technical analysis. Using daily and monthly gold prices in U.S. dollars during January 1970 through August 2012 (see the chart below), they find that:

- Based on monthly data:

- Analysis of the entire sample period indicates are statistically significant bubbles during 1970-1980 and 2008-2012.

- Analysis of a subsample starting in 1990 indicates a bubble during 2006-2012.

- Analysis of a subsample starting in 2000 indicates a bubble during 2002-2012, interrupted briefly in 2008.

- Use of daily rather than monthly data generates very similar results.

- When investors dominate, gold price is mean-reverting (consistent with real supply and demand). When threshold-oriented chartists (whose demands depend on price) dominate, gold price is explosive. That latter currently dominate, consistent with data showing that fundamental demand for gold is relatively low compared to investment demand.

The following chart, taken from the paper, shows the behavior of gold price in dollars over the entire sample period. Technical analysis indicates two episodes of explosive price increase during the 1970s and 2000s, with exact beginning and ending dates dependent on the sample period used.

In summary, evidence from technical analysis indicates that gold price is currently in bubble territory.

The authors note that the safe haven property of gold may therefore be gone, and with it the stabilizing effect of a safe haven on the financial system. Perhaps some neglected asset will (in retrospect) take over this role.

Cautions regarding findings include:

- The different analysis summarized in “Gold Bubble? No” reaches the opposite conclusion.

- The paper does not predict the timing of the deflation of the current bubble.

Also relevant are “Modeling and Forecasting the Price of Gold” and “Gold as Diversifier Versus Safe Haven”.