Does modeling gold price relationships with other variables based on entire distributions differ from that based only on distribution means? In their May 2012 paper entitled “Is Gold Overpriced?”, Lingjie Ma and George Patterson apply a quantile regression model (considering effects across the distribution) to investigate long-run relationships between the price of gold and various economic and financial variables. Specifically, they relate gold price to lagged quarterly nominal U.S. GDP growth rate, lagged monthly U.S. unemployment rate, monthly U.S. inflation rate, U.S. dollar index, monthly Dow Jones Industrial Average (DJIA) return, 3-month U.S. Treasury bill (T-bill) yield and monthly West Texas Intermediate crude oil spot price. They compare quantile regression results to those from a conventional Ordinary Least Squares (OLS) model (which focuses on distribution averages). Using daily London P.M. gold prices in dollars per ounce and values for the selected predictive variables from April 1968 (when the price of gold began to move freely) through March 2012, they find that:

- Over the sample period, crude oil price exhibits the strongest correlation with gold price (0.88). The U.S. dollar index (-0.59), the U.S. unemployment rate (0.46), the U.S. GDP growth rate (-0.36), the expected U.S. inflation rate (-0.24, but unstable over subperiods) and the 3-month treasury bill yield (-0.20) exhibit lower, but material, correlations. There is practically no correlation between DJIA performance and gold price (-0.02).

- Based on individual gold-variable relationships, the quantile regression model indicates that:

- At low (high) gold price levels, a 1% increase in the GDP growth rate produces a gold price decrease of $10 ($30).

- At low or median (high) gold price levels, a 1% increase in the unemployment rate produces a gold price increase of $20 ($180).

- For the inflation-targeting subperiod since 1981, changes in the inflation rate do not affect gold price. In other words, gold is not a hedge against inflation during this subperiod.

- Gold price tends to increase (decrease) when the dollar index falls (rises), most significantly when gold price is very high or very low. For these extremes, a one unit decrease in the dollar index produces a $12 increase in gold price.

- DJIA returns do not significantly affect gold price.

- Changes in T-bill yield affect gold price only when it is high. For that case, a 1% increase in T-bill yield produces a gold price decrease of $45.

- Gold price tends to rise and fall with crude oil price, more sensitively when gold price is above its median. In the present environment, a $1 increase in crude oil price produces a gold price increase of $15.

- Based on multivariate analysis, a conventional OLS methodology indicates that gold is currently overpriced, but a quantile regression does not (see the chart below).

- Considering two future U.S. economic scenarios, a quantile regression model predicts a gold price of:

- $1,123, with one standard deviation range $883 to $1,362, for reversion to January 1995 through December 2008 economic conditions.

- $1,582, with one standard deviation range $1,325 to $1,838, for continuation of January 2009 through March 2012 economic conditions.

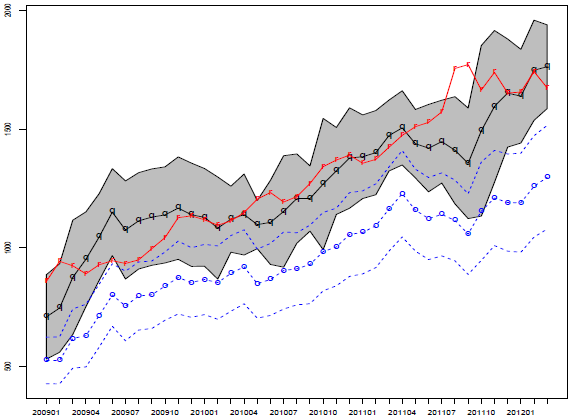

The following chart, taken from the paper, summarizes backtests of multivariate monthly forecasts of gold price (vertical axis) form January 2009 through March 2012 based on:

- Quantile regression (solid black line with “q” and associated solid black 90% confidence band).

- OLS (dashed blue line with “o” and associated dashed blue 90% confidence band).

The solid red line with “r” is the actual spot gold price. The quantile regression forecast is much more accurate than that of OLS, with average forecast deviation from actual price of 8% and the 90% confidence interval capturing all actual prices except August and September 2011.

In summary, evidence from modeling overall distributions of relationships to other variables indicates that gold may not be overpriced under current economic and financial conditions.

Cautions regarding findings include:

- The study does not address the profitability of trading the forecasts presented.

- Both future economic scenarios posited in the paper as alternatives for forecasting gold price may be incorrect.

- There is risk of snooping bias when applying different models to the same set of data.