Do equity styles and sectors exhibit exploitable momentum? In their August 2012 paper entitled “Do Style and Sector Indexes Carry Momentum?”, Linda Chen, George Jiang and Kevin Zhu investigate whether nine style indexes and 12 sector indexes exhibit price momentum. Each month, they form an equally weighted momentum portfolio that is long (short) the third of indexes with the highest (lowest) cumulative returns over the past 3, 6 or 12 months and hold for the next 1, 3, 6 or 12 months. They also test a dynamic style momentum portfolio that each month overweights (underweights) by 10% the third of past winner (loser) style indexes, with 0.2% monthly rebalancing friction. Using monthly levels for the selected indexes during July 1997 through October 2007, they find that:

- Style indexes exhibit strong price momentum. For example, the annualized gross return of a long-short momentum portfolio based on 6-month ranking and 6-month holding intervals is 13.4%.

- Sector indexes exhibit some, but much less, price momentum. For example, the annualized gross return of a long-short momentum portfolio based on 6-month ranking and 6-month holding intervals is 6.7%.

- Style (sector) index momentum derives from individual stock return momentum (earnings momentum).

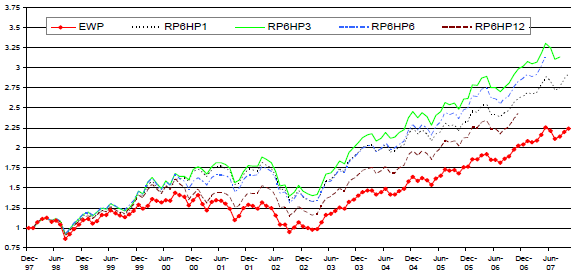

- A dynamic style momentum strategy that each month overweights past winners by 10% and underweights past losers by 10% outperforms an equally weighted combination of the style indexes on a net basis (see the chart below).

The following chart, taken from the paper, plots the net cumulative values of $1 initial investments in:

- A benchmark equally weighted portfolio of all style indexes (EWP).

- Four dynamic strategies that overweight past winners and underweight past losers by 10%, using a 6-month ranking interval and:

- A 1-month holding interval (RP6HP1)

- A 3-month holding interval (RP6HP3)

- A 6-month holding interval (RP6HP6)

- A 12-month holding interval (RP6HP12)

Monthly rebalancing friction is 0.2% of portfolio value. All dynamic strategy portfolios outperform the EWP benchmark, with 3-month and 6-month holding intervals beating 1-month and 12-month holding intervals.

In summary, evidence from a short sample indicates that investors may be able to exploit style index price momentum.

Cautions regarding findings include:

- The sample period ends in 2007. It would be interesting to extend the analysis by five years.

- The study uses indexes rather than tradable assets. The estimated trading friction for switching/reweighting among indexes is arguably too low to account for the costs (trading frictions and management fees) of constructing tradable funds from the indexes. These costs may vary by style and sector (for example, large versus small capitalizations).

- Calculations of annualized momentum effects (long-short portfolios) ignore both trading frictions and the costs of shorting the worst-performing indexes.

- The sample period is short in terms of the number of independent ranking and holding intervals for the longer-interval alternatives. It is also short in terms of number of bull and bear markets, the mix of which may be relevant to findings.

- Considering many combinations of ranking and holding intervals introduces data snooping bias, such that the best-performing combinations overstate reasonable out-of-sample expectations.

See “Doing Momentum with Style (ETFs)”, “Simple Sector ETF Momentum Strategy” and associated analyses for close-to-current similar analyses applied to style and sector exchange-traded funds (ETF) rather than indexes. These analyses generally conclude that style and sector momentum strategies are not worthwhile unless combined with crash protection, such that modest exploitation of momentum takes place only during bull markets.