How effective is technical cloning of hedge funds (attempting to capture a hedge fund’s future returns via a portfolio of liquid assets that empirically replicates the fund’s historical returns)? In the July 2012 version of their paper entitled “Send in the Clones? Hedge Fund Replication Using Futures Contracts”, Nicolas Bollen and Gregg Fisher test whether a replication process can capture some of the benefits of hedge funds (diversification and high Sharpe ratio) while avoiding associated high fees, illiquidity and opacity. They choose one broad and nine strategy-focused hedge fund indexes as targets for replication. They seek to replicate hedge fund index returns with combinations of five fully collateralized futures contracts: U.S. Dollar Index; 10-year T-Note; Gold; Crude Oil; and, S&P 500 Index. Fully collateralized means that they cover potential exposure (positive or negative) with cash earning the risk-free rate (one-month LIBOR). Specifically, they set weights for the futures contracts each month based on linear regression of monthly returns for a hedge fund index versus returns for the five futures contracts over a rolling historical window (see the figure below). They calculate futures contract returns based on holding the nearest-to-expiration contract and rolling to the next maturity five days before expiration. While this process could exploit hedge fund index timing of market factors, it cannot capture any idiosyncratic (non-factor) alpha. Using monthly returns for the ten hedge fund indexes and the five futures contract series during January 1994 through December 2011, they find that:

- Over the available sample period, clone portfolios achieve correlations of future returns over 0.50 for seven or eight out of ten hedge fund indexes, depending on the length of the historical regression window.

- The length of the historical regression window, likely the most important cloning variable, dramatically affects both the size of futures positions and monthly turnover.

- Cloning effectiveness largely derives from matching hedge fund index exposure to the stock market. Clone returns generally exhibit high correlations with S&P 500 Index returns (often exceeding 0.80 during 2008-2011).

- Annual returns and monthly Sharpe ratios of clones are generally lower than those of respective hedge fund indexes. Using a 12-month (48-month) regression window, three (three) of ten clones have higher Sharpe ratios than their hedge fund indexes.

- Neither the hedge fund indexes nor their clones demonstrate successful timing of factors underlying the futures contracts at a monthly frequency. In fact, maintaining equal weights on the five futures contracts (monthly gross Sharpe ratio 0.22) generally beats both the clones and the hedge fund indexes.

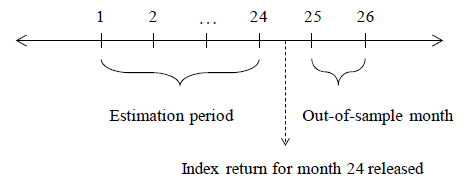

The following figure, taken from the paper, illustrates the process for specifying monthly weights for the five futures contracts in clone portfolios based on a 24-month historical window for regression of hedge fund index and futures contracts returns. Since the hedge fund index return for month 24 is not available until the middle of month 25, specified weights apply from the end of month 25 to the end of month 26. The study additionally tests historical regression windows of 12, 36 and 48 months.

In summary, evidence indicates that cloning of hedge fund indexes with liquid futures contracts is to some degree possible, but that clones generally underperform respective hedge fund indexes and neither clones nor hedge fund indexes effectively time clone components at a monthly frequency. In comparison, equal weighting of clone components is relatively attractive.

Cautions regarding findings include:

- As stated in the paper, clone returns are gross, not net. Including trading frictions and management fees would lower clone returns.

- The amount of collateral required to cover futures contract exposures may vary from month to month, complicating implementation.