What are the fundamental considerations for portfolio weights and rebalancing rules over the long run? In the July 2012 version of his book excerpt entitled “Dynamic Portfolio Choice”, Andrew Ang elaborates these considerations as derived from two precepts: (1) periodic or conditional rebalancing of the components of a diversified portfolio is foundational to long-term investing; and, (2) target weights for portfolio components can vary for each rebalancing interval as investment opportunities change and investor liabilities, income and risk tolerance evolve. Using mostly theory and some simple example portfolios composed of U.S. stocks and Treasuries during 1926-1940 and 1990-2011, he concludes that:

- A diversified portfolio, periodically rebalanced, eventually outperforms buying and holding the best component. For U.S. stocks (commodities), the gross long-term premium from annual rebalancing is approximately 1% (3.5%).

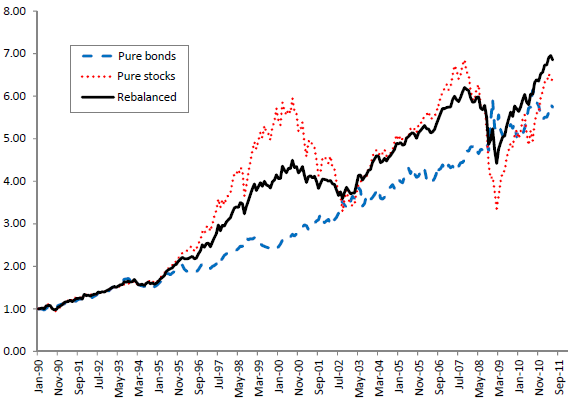

- By decreasing (increasing) positions in assets that have done well (poorly), rebalancing is effectively a counter-cyclical (value) strategy, as illustrated in the chart below.

- Rebalancing is essentially short volatility and regime changes, thereby earning part of the volatility risk premium. The greater the volatility, the greater the rebalancing premium.

- When there are strong reversals from steep crashes, rebalancing does very well.

- Conversely, rebalancing underperforms buy-and-hold during long trends.

- A rebalancing premium is accessible only for assets viable over the long run, so that rebalancing does not buy assets that eventually disappear. Diversification across broad asset classes or strategies (global equities, global sovereign bonds, global corporate bonds, real estate and commodities rather than individual stocks or individual countries) mitigates the risk of disappearing assets.

- More sophisticated rebalancing is contingent (rather than calendar-driven) on factors such as gap between current and optimal weights, trading frictions and asset volatility. For example, an investor may set bands around optimal allocations, with movement outside the bands triggering rebalancing. When trading frictions or asset price volatility is high, the bands are relatively wider.

- The following considerations drive changes in optimal portfolio weights over time:

- Investor risk tolerance declines over time as investment horizon shrinks, reducing the attractiveness of volatile assets.

- While rebalancing works when asset returns fluctuate randomly (with expected returns and volatilities simply extrapolated from long-run histories for each asset), it works better when asset returns vary predictably. Shifts in asset allocations based on predictable variations improve rebalancing performance, provided the variations fall within the shrinking investment horizon. Magnitudes of allocation shifts depend on strength of return predictability.

- For an investor with liabilities, the optimal portfolio includes a segment that matches returns to liability liquidation requirements (by maximizing return-liability correlation).

The following chart, taken from the paper, compares the gross cumulative values of $1 initial investments in U.S. stocks, U.S. Treasury bonds and simple quarterly rebalancing of a portfolio with 60% allocation to U.S. stocks and 40% allocation to U.S. Treasury bonds during 1990 through 2011. Terminal values are $6.10 for stocks, $7.12 for bonds and $7.41 for the diversified, rebalanced portfolio. Rebalancing effectively locks in some of the upside volatility of stocks.

In summary, theory and evidence indicate that investors can earn a material premium via simple periodic (or contingent) rebalancing of a diversified set of conservatively selected assets to weights based on long-run historical extrapolation (and investor risk tolerance), and that some additional premium may accrue from varying asset weights based on return predictability.

The author separately concludes that return predictability is weak, warranting only small deviations from “random walk” portfolio weights.

Cautions regarding findings include:

- The book excerpt is more theoretical than empirical. It is not specific on portfolio component selection and weighting.

- Examples are based on indexes and gross returns. Including reasonable trading frictions for constructing tradable assets from indexes and for rebalancing actions may affect findings.