Are firm earnings announcements bound to confound stock traders? In their November 2011 paper entitled “Systematic Noise and News-Driven Return Reversals”, Eric So and Sean Wang examine trading behavior around quarterly earnings announcements. They define pre-announcement return as the market-adjusted return over a three-day window from five days before through three days before earnings announcement date. Each quarter, they sort stocks into quintiles by pre-announcement return, with quintile break points from the distribution of the prior calendar quarter to avoid look-ahead bias. They adjust announcement date one trading day forward for announcements after the market close. Using 183,228 earnings announcement dates and contemporaneous daily stock and stock market returns during 1990 through 2009, they find that:

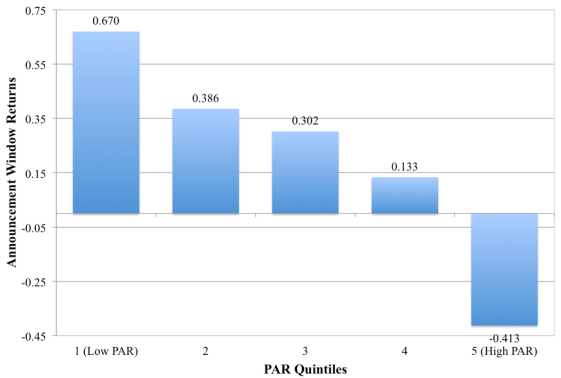

- Pre-announcement stock return relates positively to earnings surprise, but negatively to announcement window (day before through day after announcement date) stock return. The announcement window captures over three-quarters of the return reversal. (See the first chart below.)

- This effect is strongest when investor sentiment is bullish and among stocks with poor information dissemination.

- A hedge strategy that buys (sells) the 20% of stocks with the most negative (positive) pre-announcement returns on an equally weighted basis:

- Generates an average gross return of 1.08% over three-day announcement windows, with average gross four-factor alpha (adjusting for market, size, book-to-market and momentum) also exceeding 1%.

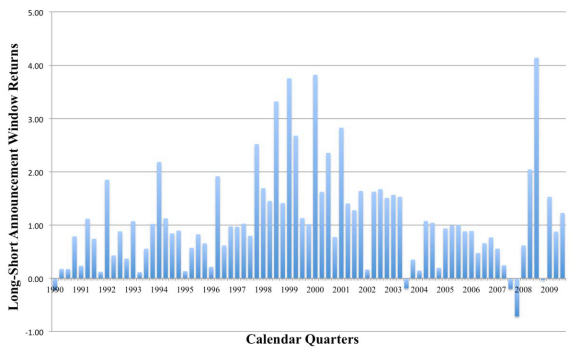

- Is stable over the sample period, exhibiting gross profitability during 74 out of 79 quarters (see the second chart below).

- Using expected (rather than retrospective actual) earnings announcement dates reduces the hedge strategy’s average gross return to 0.76% over three-day announcement windows, with delayed announcements accounting for most of the reduction.

- Applying the hedge strategy to a subsample composed of the 40% of firms with the largest market capitalizations each year (66,051 quarterly earnings announcements over the sample period) also generates an average gross return over 1% during three-day announcement windows, mitigating concerns about announcement date predictability and trading frictions.

The following chart, taken from the paper, summarizes average gross market-adjusted returns during three-day announcement windows by quintile of pre-announcement returns. The average return for each quintile is a quarterly average, subsequently averaged over all quarters from the second quarter of 1990 through the fourth quarter of 2009. It shows that announcement window returns decrease systematically as pre-announcement returns increase and that an equally weighted portfolio that is long (short) the stocks in the lowest (highest) quintile of pre-announcement returns earns an average gross three-day announcement hedge return of 1.08%.

The next chart, also from the paper, presents the average gross announcement window hedge returns by quarter from the second quarter of 1990 through the fourth quarter of 2009. Results indicate that the strategy profitability is persistent, producing positive average gross returns for all but five quarters.

In summary, evidence indicates that investors may be able to exploit a systematic tendency for stocks to reverse pre-announcement returns (from five to three trading days before announcement) during the three-day announcement interval (from day before through the day after).

Cautions regarding findings include:

- As acknowledged in the paper, hedge strategy return calculations are gross. Incorporating reasonable trading frictions (including shorting costs) would reduce reported returns. Persistence of strategy performance among larger stocks mitigates, but does not eliminate, this concern.

- As noted in the paper, clustering and asychronicity of earnings announcements may complicate hedge strategy capital requirements (long and short sides may sometimes be thin or non-existent). Sensitivity tests mitigate, but do not eliminate, this concern.