Do investors focus on dividends, thereby elevating associated stock prices as ex-dividend date approaches? In the September 2011 draft of their paper entitled “The Dividend Month Premium”, Samuel Hartzmark and David Solomon examine the price behavior of stocks with scheduled quarterly, semiannual and annual dividends during the expected dividend month and around expected ex-dividend dates. Using daily and monthly price and cash dividend data for a broad sample of U.S. stocks during January 1927 through December 2009, along with widely used risk adjustment factors, they find that:

- Companies that paid dividends 3, 6, 9 and 12 months have 85%, 85%, 83% and 88% probabilities of paying a dividend this month, respectively.

- Over the entire sample period, the average monthly gross return for stocks expected to pay a dividend this month is 1.38% (standard deviation 5.77%), compared to 1.01% (standard deviation 5.76%) for stocks that paid a dividend within the last year but not expected to pay a dividend this month and 1.01% (standard deviation 8.56%) for stocks that paid no dividend within the last year.

- After adjusting for market, size, book-to-market and momentum factors, an equal-weighted (value-weighted) portfolio that is:

- Long all stocks expected to pay a dividend this month generates an average gross monthly alpha of 0.41% (0.24%).

- Long (short) stocks expected to pay a dividend this month (all other stocks) generates an average gross monthly alpha of 0.53% (0.32%).

- Long (short) stocks expected to pay a dividend this month (stocks that paid a dividend within the past year but not paying this month) generates an average gross monthly alpha of 0.37% (0.29%). (See the first chart below.)

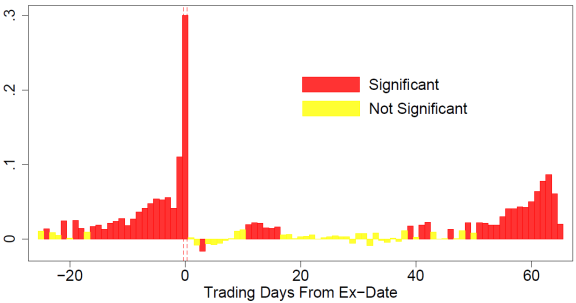

- Daily returns of dividend payers tend to increase as ex-dividend day approaches, peaking at an equal-weighted 0.30% on ex-dividend day, and tend to be negative immediately afterwards (see the second chart below).

- The dividend month premium is larger among stocks that pay higher dividends and are less liquid, and during times of economic uncertainty (0.17% per month higher during recessions).

- The dividend month premium persists across subperiods.

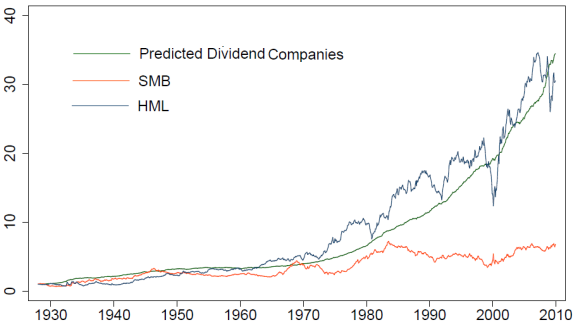

The following chart, taken from the paper, compares gross cumulative values of $1 investments initiated at the end of 1927 in portfolios reformed monthly to exploit:

- The dividend-month premium (long stocks expected to pay a dividend this month and short those that paid a dividend within the past 12 months but not expected to pay a dividend this month, Predicted Dividend Companies).

- The size effect (small cap minus big cap, SMB).

- The value premium (high minus low book-to-market ratio, HML).

Gross terminal portfolio values at the end of December 2009 are $34.46 for the dividend month premium, $6.78 for the size effect and $30.52 for the value premium. The dividend month premium is clearly larger than the size effect and roughly as large, but less volatile than, the value premium.

The next chart, also from the paper, shows average equal-weighted daily four-factor (market, size, book-to-market, momentum) alphas in percent from 25 trading days before through 65 trading days after ex-dividend date over the entire sample period. Alphas generally grow between dividend announcement and ex-dividend dates, and then become small or negative between dividends, growing again as the next dividend approaches.

In summary, evidence indicates that dividend-focused investors create a dividend month premium by reliably bidding up the prices of stocks scheduled to pay dividends as ex-dividend data approaches.

Cautions regarding findings include:

- Reported returns are gross, not net, and dividend month premium portfolio monthly turnover would be substantial. Including reasonable trading frictions and shorting costs would materially reduce (perhaps even eliminate) the premium at a net level.

- Given potential shorting issues, the long-only dividend month premium may be most realistic.

- Analyses involve portfolios of many stocks. Small investors may not be able to spread capital across enough stocks to capture the dividend month premium reliably.