Can traders reliably play price jumps associated with surprising economic news releases? In their September 2011 paper entitled “Information Driven Price Jumps and Trading Strategy: Evidence from Stock Index Futures”, Hong Miao, Sanjay Ramchander and Kenton Zumwalt examine the relationship between surprises in announcements for eight U.S. macroeconomic indicators and jump returns for Dow Jones Industrial Average (DJIA), NASDAQ Composite Index and S&P 500 Index futures. They define surprises for each economic indicator based on “standardized” values defined as the gap between actual values and consensus forecasts divided by the standard deviation of gaps. They test the profitability of a high-frequency trading strategy constructed to exploit the surprise-jump relationship for 10:00 AM announcements via nearest index futures contracts, taking one-minute long (short) positions during 10:01-10:02 AM after positive (negative) surprises. When there are multiple 10:00 AM announcements, trades trigger only if all surprises have the same direction. They assume trading friction of one tick for each one-way transaction. Using tick-by-tick nearest or next-nearest to maturity (depending on volume) futures contract prices and pre-announcement consensus (median) forecasts and actual values for monthly macroeconomic indicators during 2001 through 2010, they find that:

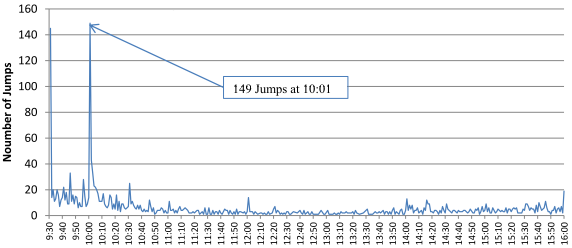

- DJIA, NASDAQ Composite Index and S&P 500 Index futures exhibit significant jumps during 89%, 87% and 45% of trading days during the sample period, respectively, all with pronounced peaks in jump frequency at 10:00 AM (see the first chart below). Futures for all three indexes have slightly more negative than positive jumps, with average absolute magnitudes in the range 0.14%-0.22%.

- 10:00 AM macroeconomic news releases account for 48%-56% of index futures jump returns during 10:00-10:01 AM.

- Consumer Confidence announcements have the largest impact, matching over a fifth of these jumps, with Institute for Supply Management (ISM), Leading Economic Index (LEI) and New Home Sales also prominently explanatory.

- 70-80% of the 20 largest 10:00-10:01 AM jumps match 10:00 AM news releases.

- Positive (negative) jumps follow good (bad) economic indicator surprises, with bad news more powerful on average than good news.

- Over the entire sample period, cumulative gross (net) futures contract trading profits for the 10:01-10:02 AM positions described above are 26%-39% (16%-29%) for the three indexes.

- Of 516 trades in DJIA futures, 271 (245) are long (short) with cumulative profit 14.3% (11.5%). Results are similar for the other two indexes.

- S&P Index futures trading generates the largest cumulative return (39.0% gross and 29.3% net).

- The strategy is significantly profitable in all years except 2006.

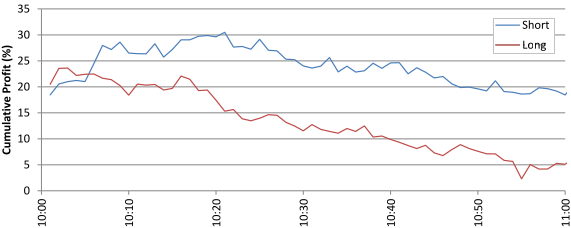

- Trade profitability concentrates in a very short interval after announcements (see the second chart below).

- However, macroeconomic announcements at 8:30 AM do not produce significantly more jumps compared to non-announcement days. Applying the above trading strategy to 8:30 AM announcements (with 8:31-8:32 AM trades) does not generate significant cumulative net profits over the sample period.

The following chart, taken from the paper, shows the frequency of price jumps in S&P 500 Index nearest-contract futures by minute during market trading hours. 48%-56% of the jumps comprising the spike during 10:00-10:01 AM coincide with macroeconomic indicator announcements.

The next chart, also from the paper, shows cumulative gross returns for long and short S&P 500 Index futures trades initiated at 10:01 AM, according to whether 10:00 AM macroeconomic indicator news is surprisingly good or bad. For both long and short trades, most of the profits accrue in the first minute, and profits diminish after 15-20 minutes. Combining long and short trades, maximum cumulative gross profit (51.1%) occurs for 10:16 AM exits. Results for DJIA and NASDAQ Composite futures are similar.

In other words, although the market absorbs surprises rapidly, full price impoundment takes several minutes. The market appears more strongly and persistently sensitive to bad news than good news.

In summary, evidence indicates that traders may be able to exploit surprises in 10:00 AM (but not 8:30 AM) macroeconomic indicator announcements via immediate quick trades in market index futures aligned with the direction of surprise.

It appears also that there may be slower fade trades commencing about 15-20 minutes after good news.

Cautions regarding findings include:

- The tested trading strategy requires real-time information, close attention and quick action.

- The assumed level of trading friction may not be realistic for some traders.

- There appears to be look-ahead bias in jump standardization (using the entire sample period to calculate standardizing divisors), but this bias may not be material to trading strategy returns.