Does a strategy of combining monthly individual stock return reversal with monthly industry momentum enhance results compared to the separate strategies. In their August 2011 paper entitled “One-month Individual Stock Return Reversals and Industry Return Momentum”, Marc Simpson, Emiliano Giudici and John Emery examine the relationship between individual stock return reversals and industry momentum by considering three strategies: (1) a conventional reversal strategy that each month buys (shorts) individual stock losers (winners); (2) a simple industry momentum strategy that each month buys (shorts) the previous month’s winning (losing) industry portfolio; and, (3) a combined reversal-industry momentum strategy that buys (shorts) the losing (winning) stocks within the previous month’s winning (losing) industry portfolio. Using monthly returns, SIC codes and the Fama-French definitions for ten industries over the period January 1931 through December 2010 (960 months) , they find that:

- Over the entire sample period, confirming prior research:

- Monthly individual stock winners (losers) have relatively low (high) next-month gross average returns.

- Monthly industry winners (losers) have relatively high (low) next-month gross average returns.

- The individual stock return reversal effect interacts with the simple industry momentum effect such that shorting past winning stocks within winning industries generates negative returns (see the chart below).

- Over the entire sample period, the combined reversal-industry momentum strategy generates a gross average monthly return of 4.08%, significantly outperforming both the conventional reversal strategy (3.25% per month) and the simple industry momentum strategy (1.59% per month).

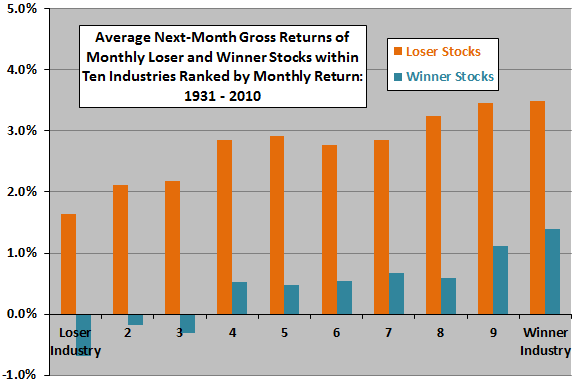

The following chart, constructed from data in the paper, summarizes average next-month gross returns of monthly loser and winner stocks within each of ten industries ranked by monthly return over the entire sample period. Results show that:

- The conventional reversal strategy works within each industry at a gross level.

- The gross return to the short side of the conventional reversal strategy is positive (negative) for winning (losing) industries.

In summary, evidence from simple tests indicates that investors can enhance both a conventional reversal strategy for individual stocks and a simple industry momentum strategy by buying (selling) monthly losing (winning) stocks within the monthly winning (losing) industry.

Cautions regarding findings include:

- Return calculations are gross, not net. Trading is intensive for the reversal and combination strategies. Incorporation of reasonable trading frictions (generally higher for older subperiods and for shorting) would materially reduce calculated returns.

- Because the combination strategy portfolios are smaller than those of the component strategies, they may exhibit relatively high volatility, working against cumulative return.

- Calculations assume that investors can execute prior-month sorts just before monthly closes, thereby taking responsive positions at these same closes. This assumption may be problematic for some investors from calculation burden and trade execution perspectives. Delaying trades until the next trading day would systematically miss part of the the turn-of-the-month effect.

- Related research finds that performance of a conventional return reversal strategy diminishes at the gross level and disappears at the net level in recent decades. Subperiod robustness tests would be helpful.

- Statistical significance tests assume well-behaved return distributions. To the extent that return distributions are wild, these tests lose meaning.