What happens to the S&P 500 Implied Volatility Index (VIX) after days when it changes dramatically? To ensure that a trader could have identified the days selected in real time and to accommodate volatility regime changes, we define a dramatic change as an advance or decline of at least four standard deviations of the daily VIX changes over the preceding four years (1,008 trading days). Using daily closes for VIX from January 2, 1990 through August 10, 2011, we find that:

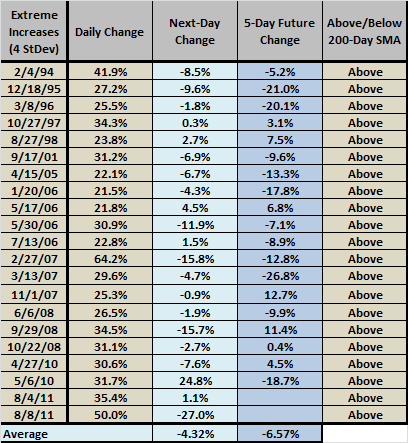

The following table provides information about the days satisfying the definition of a dramatically positive daily change for VIX, listing: the close-to-close change for that day; the close-to-close change the next day; the change over the five days after the dramatically positive day; and, whether the prior-day close is above or below the 200-day simple moving average (SMA) of VIX. Based on the definition, the first day that could be identified is about the end of 1993.

- The average next-day change in VIX is -4.32%, with high variability.

- 71% of next-day changes (15 of 21) are negative.

- The average change in VIX is over the five days after a dramatic increase is -6.57%, with high variability.

- All dramatic increases occur when VIX is above its 200-day SMA.

Relaxing the threshold for dramatic increases to three standard deviations increases sample size from 21 to 55, with average next-day change in VIX -3.62% (again with high variability and a large fraction of observations occurring when VIX is above its 200-day SMA).

What about dramatic drops in VIX?

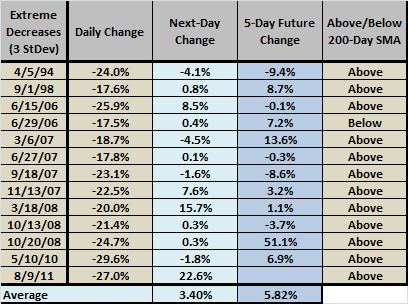

Based on a threshold of four standard deviations, there is only one dramatically negative daily change for VIX on 6/15/06 (-25.91%). VIX snapped back the next day (8.49%), but the snapback disappeared over the next four days.

Relaxing the threshold to three standard deviations generates the following 13 dramatically negative daily changes for VIX, indicating reversion on average after dramatic drops in VIX. 9 of 13 next-day changes in VIX are positive.

In summary, VIX on the day after dramatic daily changes (as defined) tends to partially revert based on both average change and frequency, but with high variability.

Cautions regarding findings include:

- Given the variability, sample sizes are very small.

- Next-day changes are close-to-close, and next-day open to next-day close changes may be different.

- Trading the next day would of course incur trading frictions.

- Other methods of defining dramatic changes in VIX may produce different results.