A reader suggested Condor Options as a guru for review. To conduct a review, we evaluate the Condor Options Newsletter Performance table of iron condor trades (with a few hedging trades) available via the Condor Options Performance self-assessment. This table includes entry and exit dates, trade duration, specific positions/strike prices, initial value (credit), total amount risked (Real Risk), final value (credit), final value as a percentage of amount risked (% Return), risk-adjusted trade size, return on investment (Trade ROI) and cumulative value of a $1,000 initial investment (VAMI). The initial and final trade values account for bid-ask spread by sampling actual fill quotes, but they do not account for broker trading commissions. This evaluation accepts the basic premises of performance assessment as presented in the table. Using the Condor Options Newsletter Performance table as of the end of June 2011, covering closed trades from initial position entry on 5/11/07 through 6/10/11 (162 trades), we find that:

Key points regarding table construction are:

- As noted, entry and exit values account for bid-ask spreads but not broker commissions.

- Trade size is one eighth of currently available capital.

- There appear to be a few calculation errors in the table derived from calculating risk-adjusted trade size using a superseded level of available capital. This review slightly simplifies calculations to avoid those errors. The simplification does not materially change cumulative account values (VAMI) .

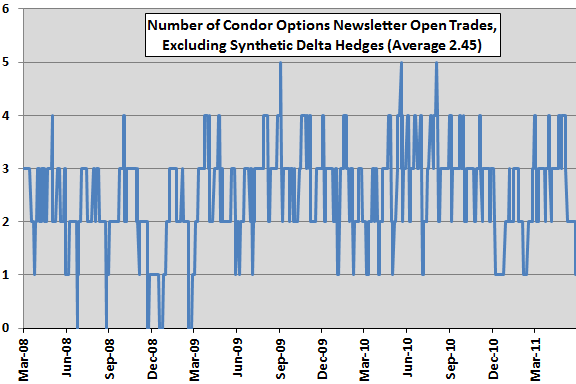

The following chart summarizes the number of Condor Options Newsletter Performance table open trades, excluding 18 delta hedges used to hedge specific iron condor positions over the sample period. The number of open positions ranges from zero to five, with average 2.45. In other words, a trader setting each position at one eighth of available capital would on average be in trades (cash) about 31% (69%) of the time. A more aggressive trader setting each position at one quarter of available capital would on average be in trades (cash) about 61% (39%) of the time.

Note that there are likely open trades at the very end of the sample period which would slightly increase the average number of open positions. Including the 18 delta hedges as separate trades would also increase the average.

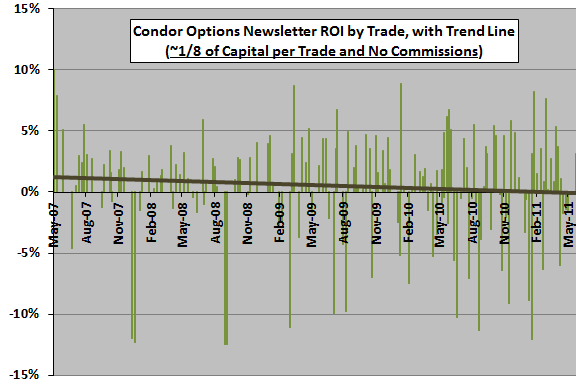

Is there any trend in investment return?

The next chart shows the ROI by trade for all 162 closed trades in the sample based on allocating approximately one-eighth of available capital to each trade and no broker trading commissions (as presented by Condor Options), with a best-fit linear trend line.

Trade-by-trade return trends down over the sample period, perhaps because market conditions early in the sample are more favorable to iron condor profitability than conditions later in the sample. Another possible explanations is that the sample has a purely lucky start or an unlucky end. A third possibility is that the market adapts to an iron condor strategy over the sample period.

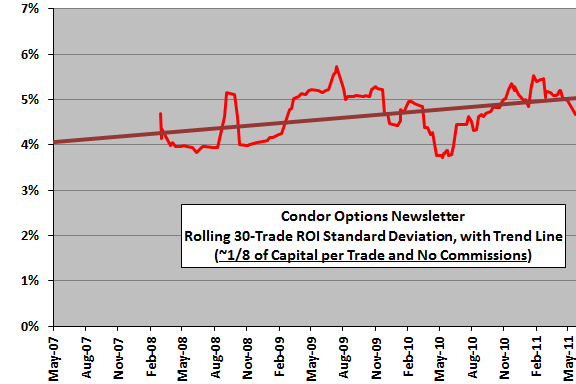

Is there any trend in ROI volatility?

The next chart tracks the standard deviation of ROI for the 30 most recently closed trades over the available sample based on allocating approximately one-eighth of capital to each trade and no broker trading commissions (as presented by Condor Options), with a best-fit linear trend line. The trend line slopes upward. There is no decrease in ROI volatility that would tend to compensate for the above trend downward in ROI per trade.

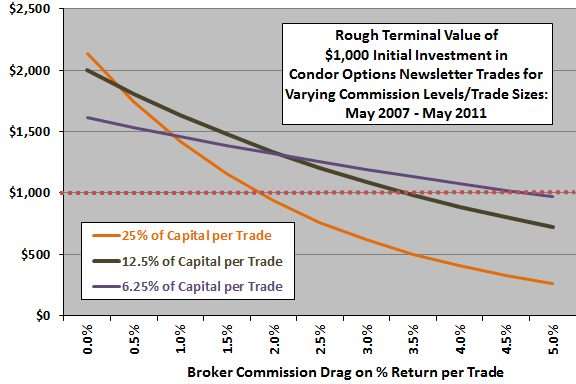

What happens to performance when we vary the allocation of capital per trade and include broker trading commissions?

The final chart summarizes the sensitivity of Condor Options Newsletter cumulative performance (scaled to an initial account value of $1,000 per the Condor Options Newsletter Performance table) to:

- Three levels of capital allocation per trade: approximately one fourth (25% of available capital per trade); approximately one eighth (12.5% of available capital per trade, as above); and, approximately one sixteenth (6.25% of available capital per trade).

- Debits to the percentage return per trade ranging from 0% to 5%. Note that an iron condor for the options recommended would typically involve entering and exiting multiple contracts of four options. The eight commissions in aggregate could represent a substantial percentage of capital committed for small accounts.

Results show that taking more risk with larger positions increases performance with no broker commissions, but increases sensitivity of performance to the level of broker commissions. The baseline allocation of one eighth of capital to each trade has a breakeven broker commission of about 3.5%. Breakeven occurs at higher (lower) commission levels for a less (more) aggressive capital allocation.

In summary, evidence suggests that investor who can trade options with low broker fees may be able to apply the Condor Options Newsletter trade recommendations profitably, but the profitability of these recommendations may be declining over time.

Cautions regarding findings include:

- To the extent that iron condor profitability depends on broad market conditions (such as volatility regime or bull versus bear), the sample period is very short.

- Bid-ask spreads experienced by newsletter subscribers may differ from those estimated by Condor Options in estimating trading performance.

- Presumably, there are open trades as of the last close not shown in the Condor Options Newsletter Performance table. If open positions tend to be more or less profitable than closed positions, accounting for open positions may affect overall newsletter performance.