Can Treasury Inflation-Protected Securities (TIPS), with principal indexed to the U.S. non-seasonally adjusted Consumer Price Index for all urban consumers (CPI), play a valuable role in asset class diversification? In the January 2011 draft of their paper entitled “Optimal Portfolio Choice in Real Terms: Measuring the Benefits of TIPS”, Alvaro Cartea, Jonatan Saul and Juan Toro apply mean-variance optimization to measure the empirical diversification benefits of TIPS for long-term and short-term investors with portfolios including various combinations of equities, nominal Treasuries, commodities and real estate. Using nominal monthly returns for all TIPS issued before August 2009, grouped by maturity, for the period March 1997 through March 2010 (157 monthly observations) and contemporaneous returns for nominal U.S. Treasury instruments, U.S. stocks, commodities and U.S. home prices, they find that:

- Based on the entire available sample:

- TIPS with longer maturities outperform those with shorter maturities (about 8.2% versus 6.4% annualized).

- TIPS outperform comparable nominal Treasuries (but the opposite is true during recessions).

- The volatility of TIPS monthly returns is lower than that for comparable nominal Treasuries.

- There is a high return correlation between TIPS and nominal Treasuries, particularly for longer maturities.

- The return correlation between TIPS and the S&P 500 Index is higher than that between nominal Treasuries and the S&P 500 Index.

- For rational long-term investors (see the first chart below):

- TIPS generally crowd out nominal Treasuries in the optimal portfolio.

- When real estate is included in the portfolio, the value of TIPS essentially disappears.

- For rational short-term investors (see the second chart below):

- TIPS partly displace nominal Treasuries for risk-averse investors.

- When gold, commodities or real estate is included in the portfolio, the value of TIPS diminishes.

- When a broad set of asset classes are included, less risk-averse investors obtain no benefit from TIPS.

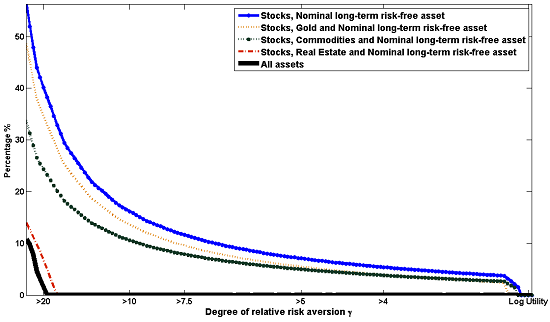

The following chart, taken from the paper, summarizes the mean-variance diversification benefit of TIPS for long-term investors (vertical axis) according to their level of relative risk aversion (horizontal axis) during March 1997 through March 2010. The measure of diversification benefit is the rate at which adding TIPS improves portfolio reward/risk. Relative risk aversion ranges from highly risk-averse (left) to risk-seeking (right). The distinct curves are for different sets of asset classes included in the portfolio.

In general, the higher the relative risk aversion, the greater the diversification benefits of adding TIPS to the portfolio. However, including real estate (based on home prices) essentially obviates the need for TIPS for long-term investors.

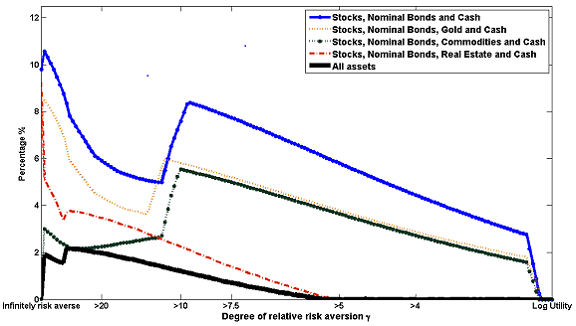

The next chart, also from the paper, summarizes the mean-variance diversification benefit of TIPS for short-term investors (vertical axis) according to their level of relative risk aversion (horizontal axis) during March 1997 through March 2010. The measure of diversification benefit is again the rate at which adding TIPS improves portfolio reward/risk. Relative risk aversion again ranges from highly risk-averse (left) to risk-seeking (right). The distinct curves are again for different sets of asset classes included in the portfolio.

In general, TIPS displace nominal Treasuries but have no value for less risk-averse investors who are already well-diversified.

In summary, evidence from actual TIPS pricing indicates that TIPS offer material diversification benefits for: (1) most long-term investors who do not have real estate in their portfolios; and, (2) short-term investors who are relatively risk-averse and not already well-diversified.

Reasons to be cautious about the findings include:

- The sample period is short for judging equilibrium TIPS behavior in terms of number of business (inflation) cycles.

- The liquidity of TIPS has generally increased over time since introduction, such that early data may impound a material non-recurring liquidity premium.

- The Modern Portfolio Theory optimization methodology assumes well-behaved return distributions, in conflict to some degree with actual data.