Is the number of institutional owners of a stock, arguably a proxy for general investor awareness and demand, an important factor in current and future pricing of the stock? In their February 2011 paper entitled “What Makes Stock Prices Move? Fundamentals vs. Investor Recognition”, Scott Richardson, Richard Sloan and Haifeng You investigate the role of institutional ownership breadth in size-adjusted stock price dynamics. They focus on institutional investors with greater than $100 million in equity holdings, as reported quarterly to the SEC via Form 13F. They measure institutional ownership breadth as the number of institutions holding a particular stock relative to the number of institutions holding any given stock. They measure firm size based on total assets. They impose a three-month lag on data to ensure calculations use only publicly available information. Using stock returns, institutional ownership data and accounting data for a broad sample of U.S. firms over the period 1986 through 2008 (35,526 firm years), they find that:

- Differences in fundamentals and institutional ownership breadth each independently explain about one third of the variation in annual stock returns. When combined, they explain roughly half, indicating some overlap in explanatory powers.

- The explanatory powers of fundamentals and institutional ownership breadth depend on return horizon, as follows:

- Differences in fundamentals and institutional ownership breadth explain 8.6% and 18%, respectively, of the variation in quarterly stock returns. In combination, they explain 22%.

- Differences in fundamentals and institutional ownership breadth explain 57% and 38%, respectively, of the variation in five-year stock returns. In combination, they explain 62%.

- The growth in combined explanatory power with return horizon suggests that the missing determinants of stock returns are strongly mean reverting.

- An increase (decrease) in breadth of institutional ownership tends to coincide with high (low) size-adjusted stock returns. In other words, high (low) levels of institutional attention appear to elevate (depress) stock price.

- A portfolio that is long (short) the tenth of stocks with the lowest (highest) prior-year institutional ownership breadth, reformed annually, generates average gross size-adjusted returns of 4.1%, 2.0% and 2.5% in the first, second and third years after portfolio formation.

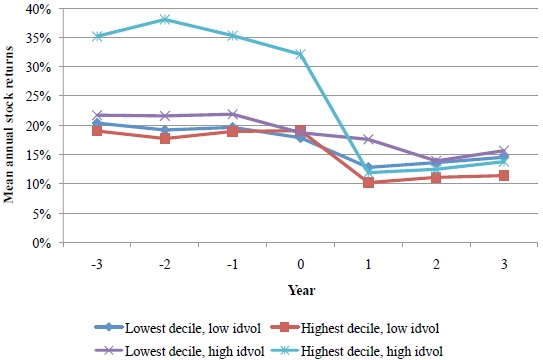

- Idiosyncratic volatility amplifies this future return effect. A portfolio that is long (short) the high-volatility half of the the tenth of stocks with the lowest (low-volatility half of the tenth of stocks with the highest) prior-year institutional ownership breadth, reformed annually, generates an average gross size-adjusted return of 5.7% in the year after portfolio formation. See the chart below.

The following chart, taken from the paper, plots the average annual gross size-adjusted returns for stocks in the lowest and highest tenths (deciles) of institutional ownership breadth, each ranked into upper and lower halves of idiosyncratic volatility (idvol), from four years before portfolio formation (-3 through 0) to three years after portfolio formation (1 through 3). A stock’s idiosyncratic volatility is the standard deviation of daily differences between the stock’s return and the value-weighted market’s return over the prior 12 months.

Results indicate that:

- Stocks with low past institutional ownership breadth tend to outperform those with high past breadth for three years after portfolio formation.

- Those stocks within the lowest decile of past institutional ownership breadth with the highest idiosyncratic volatilities generate notably high returns in the first year after portfolio formation.

In summary, evidence indicates that investors may be able to outperform by focusing on stocks with relatively low institutional ownership breadth and high idiosyncratic volatility.

It seems plausible that trend in institutional ownership breadth may be meaningful, with a positive (negative) trend indicating relatively strong (weak) future stock returns.

Note that:

- Returns reported in the study are gross. Realistic trading frictions would reduce these returns.

- This research updates and extends that summarized in “Recognition: Is That a Good Thing?”.