Can investors straightforwardly diversify equity portfolios with volatility futures? In the January 2011 draft of their paper entitled “The Hazards of Volatility Diversification”, Carol Alexander and Dimitris Korovilas explore the potential benefits and costs of combining ‘buy-and-hold’ positions in volatility futures with a long-term equity portfolio. Specifically, they examine diversification of long exposure to the S&P 500 Index via S&P Depository Receipts (SPY) with a rolling long position in VIX futures. They distinguish “diversification” from “hedging” based on permanence of positions. They consider three VIX futures strategies using one-month-to-expiration, three-month-to-expiration or longest-maturity-available series, with rollover either at or five business days before expiration. Using daily trading data for VIX futures, SPY and the 1-month Treasury bills from March 26, 2004 through December 31, 2010 (about 69 months), they find that:

- The longest-maturity-available strategy for holding VIX futures carries the highest trading frictions, but the less frequent trading more than offsets higher friction such that this strategy produces the highest (least negative) overall net return.

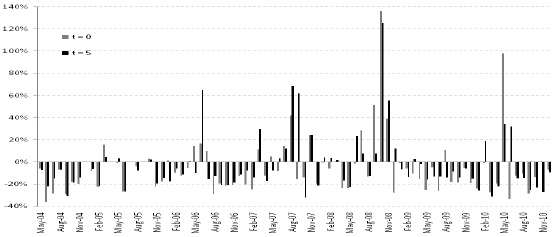

- Despite the negative correlation between equity returns and volatility, the strong negative net volatility risk premium precludes effective diversification when the stock markets is relatively tame (see the chart below).

- If initiated at the onset of a market crash, a substantial long position in volatility futures effectively diversifies a long equity exposure. However, by the time a crisis is evident, it is generally too late to diversify into volatility futures.

- As equities recover from a crash, the strongly negative volatility carry plus high transaction costs seriously erode stock market returns. In other words, volatility is so rapidly mean-reverting that effective volatility diversification is extremely difficult to implement.

The following chart, taken from the paper, approximates the monthly net return from a “buy-and-hold” VIX futures strategy based on one-month-to-expiration rollover, with rollover at maturity (t = 0) and at five business days prior to expiration (t = 5). For t=5, the return on VIX futures is negative during about three out of four months. For a few months at the onset of the credit crisis in late 2008, VIX futures contracts produce very large positive returns.

In summary, evidence from a limited sample period indicates that, because of average costliness, a long-term continuous position in volatility futures is likely ineffective for diversifying a long equity position.

Note that:

- The distinction between diversification and hedging in this paper seems less than useful.

- The VIX futures monthly return data indicates that a continuous, uninformed bet on occurrence of “bad” Black Swans is unlikely to be profitable.