What variables are persistently effective in picking equity sectors for tactical (monthly) trading? In their July 2010 paper entitled “Global Tactical Sector Allocation: A Quantitative Approach”, Ronald Doeswijk and Pim van Vliet investigate the effectiveness of seven variables for tactical trading of ten global equity sector indexes. They test effectiveness of these variables separately and in combination, and after their respective publication dates. The seven variables are: one-month return momentum, 12-1 return momentum (over the 11 months prior to the last month), earnings revision trend, long-term return (over the four years prior to the last year) reversion, aggregate dividend yield, Federal Reserve policy (expansive or contractive) and sell-in-May seasonal. The ten sectors are energy, materials, industrials, consumer discretionary, consumer staples, health care, financials, information technology, telecommunication services and utilities. Testing consists of monthly construction of equally weighted long-short portfolios based on variable conditions. For the first five variables, portfolios are long (short) the top (bottom) three sectors. The Federal Reserve policy and sell-in-May seasonal variables indicate whether to be long or short cyclical versus defensive sectors. The authors calculate net profitability based on a constant 0.60% round-trip trading friction. Using monthly sector index total returns and values for non-return variables mostly over the period 1970 through 2008, they find that:

- Average monthly sector index total return ranges from 0.77% (consumer discretionary) to 1.14% (energy). Sector volatility, measured as standard deviation of monthly returns, ranges from 4.0% (consumer staples) to 6.3% (information technology).

- Strategies based on one-month momentum, 12-1 momentum, earnings revision trend and sell-in-May seasonal variables all generate significant abnormal returns over the entire sample period, and some outperformance persists after their respective publication dates.

- Long-term return reversion, aggregate dividend yield and Federal Reserve policy variables are not useful for global sector allocation.

- Average effectiveness of the seven variables in selecting sectors declines by about one third after their respective publication dates.

- Over the entire sample period, a hedge strategy that combines via a simple sector scoring system the two momentum variables and the sell-in-May seasonal variable:

- Generates an annual compound gross return of 12.9%, 5% higher than the best single-variable strategy (see the chart below), with the associated 507% turnover leaving an annual compound net return of 9.9%.

- Has a monthly (annual) success rate of 63% (82%).

- Exhibits about 17% annual return volatility and severe drawdowns.

- Assuming a one third post-publication decay, translates to an expected annual compound net return of about 5.6%.

- The Fama-French three-factor model (market, size and value) does not explain the abnormal returns of the combination strategy.

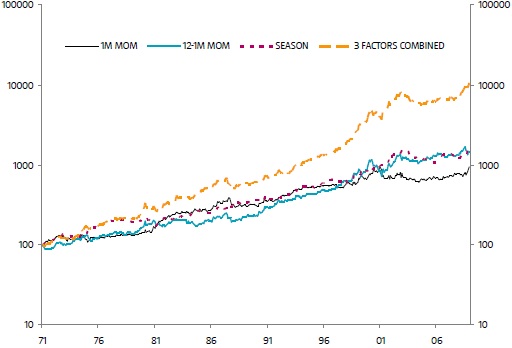

The following chart, taken from the paper, compares on a logarithmic scale over the entire 1971-2008 sample period the cumulative performances of individual one-month momentum, 12-month momentum and sell-in-May seasonal global sector allocation strategies, and a strategy that combines these three variables. The combination strategy employs a simple sector scoring system based on monthly quintile rankings for each of the two momentum variables (0, 1, 2, 3 or 4) and monthly seasonal attractiveness ratings (0, 2 or 4) such that maximum sector total score is 12. The combination portfolio is long (short) sectors scoring above 9 (below 3), with each sector position held until its score crosses below (above) 6. Based on these rules, the combination strategy is typically long two or three sectors and short two or three sectors. Results show that the combination strategy substantially outperforms all three individual strategies.

In summary, investors may be able to earn substantial abnormal returns via a strategy that allocates investments to global equity sectors based on a combination of momentum (short-term and intermediate-term) and seasonal (sell-in-May) indicators.

Reasons to be cautious about the findings of this study are:

- The study backtests use a static and modern level of trading friction. However, actual trading friction varies considerably during the sample period (see “Trading Frictions Over the Long Run”). Use of the dynamic historical level of trading friction could materially alter findings.

- While the post-publication effectiveness tests mitigate data snooping bias for the variables individually, there may be snooping bias associated with the sector scoring system used in constructing the combination strategy.

- Results may be sensitive to the speed with which an investor reacts to sector trading signals.

See “Simple Sector ETF Momentum Strategy Performance” and related entries for investigation of various momentum strategies as applied to U.S. equity sector exchange-traded funds since the end of 1998.