Are Real Estate Investment Trusts (REIT) as an asset class a good diversifier for the stock market? To check, we focus on monthly correlation of returns as a measure of diversification capacity for Vanguard REIT Index Fund Investor Shares (VGSIX), a mutual fund with a reasonably long track record “designed to track the performance of the MSCI US REIT Index.” We use S&P 500 Depository Receipts (SPY) as a proxy for the broad U.S. stock market. For comparison, we also consider returns for three REIT Exchange-Traded Funds (ETF): iShares Dow Jones US Real Estate (IYR), SPDR Dow Jones REIT (RWR), and Vanguard REIT Index ETF (VNQ). Using monthly dividend-adjusted returns for VGSIX and SPY for the period July 1996 through December 2010 (174 monthly returns), we find that:

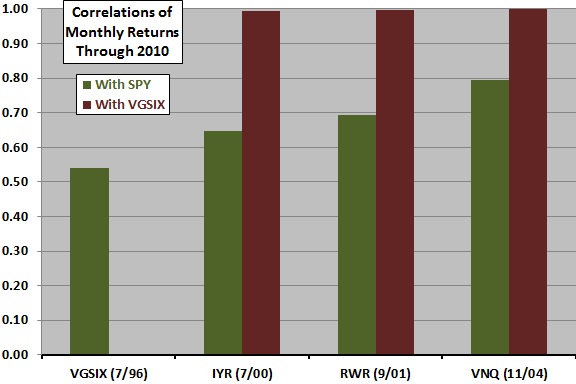

The following chart summarizes monthly return correlations between the REIT funds and SPY over available sample periods (start months indicated on the horizontal axis). Results indicate that:

- While the correlation between VGSIX returns and SPY returns is not high, it is materially positive, limiting its value as a diversifier for stocks.

- VGSIX very accurately represents the diversification capacities of more recently introduced REIT ETFs over the subperiods since their inceptions.

- The diversification capacity of REIT funds may be declining.

Are REIT funds better diversifiers for the broad stock market than sector ETFs?

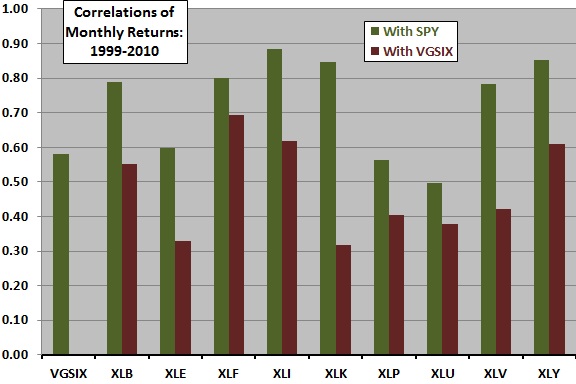

The next chart summarizes correlations of monthly dividend-adjusted returns between the nine sectors defined by the Select Sector Standard & Poor’s Depository Receipts (SPDR), all of which have trading data back to December 1998, and both SPY and VGSIX during 1999 through 2010:

Materials Select Sector SPDR (XLB)

Energy Select Sector SPDR (XLE)

Financial Select Sector SPDR (XLF)

Industrial Select Sector SPDR (XLI)

Technology Select Sector SPDR (XLK)

Consumer Staples Select Sector SPDR (XLP)

Utilities Select Sector SPDR (XLU)

Health Care Select Sector SPDR (XLV)

Consumer Discretionary Select SPDR (XLY)

For the available subperiod, results indicate that:

- Utilities, consumer staples and energy ETFs are roughly equivalent to REIT funds as simple stock market diversifiers.

- REIT funds most effectively diversify the technology and energy sector ETFs.

How stable is the diversification capacity of REIT funds over time?

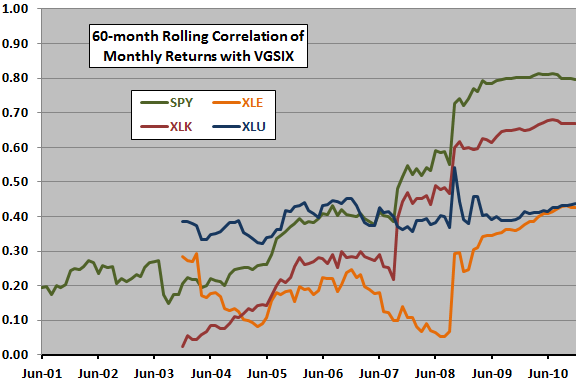

The final chart plots the 60-month rolling correlation of monthly returns for each of SPY, XLE, XLK and XLU with VGSIX over available samples. Results indicate that:

- While VGSIX is a reasonably good diversifier of the stock market in the early part of the available sample period, it has recently been a poor diversifier. The overall trend since 2003 may derive from the financialization of real estate via mortgage-backed securities and of REITs specifically via ETFs.

- The synchronized crash of late 2008 substantially boosts correlations (but that with XLU is transitory).

- More generally, maintaining diversification over horizons of a few years is highly problematic due to variation of correlations between asset categories over time.

In summary, REIT funds may in the past have been reasonably good diversifiers of the broad stock market, but their diversification capacity has essentially disappeared. Generally, financial markets may be adaptive with respect to diversification capacity.