Is there a preferred frequency and are there preferred months for rebalancing conventional asset class portfolio holdings? To investigate we consider annual, semiannual and quarterly rebalancing of a simple portfolio targeting a 60-40 stocks-bonds mix. We consider all possible combinations of calendar month ends as rebalancing points. We ignore rebalancing (and dividend-reinvestment) frictions and tax implications, thereby giving an advantage to frequent rebalancing. We focus on compound annual growth rate (CAGR) as the critical portfolio performance metric. Using dividend-adjusted monthly closes for SPDR S&P 500 (SPY) to represent stocks and Vanguard Total Bond Market Index (VBMFX) to represent bonds over the period January 1993 (SPY inception) through June 2017 (about 24 years), we find that:

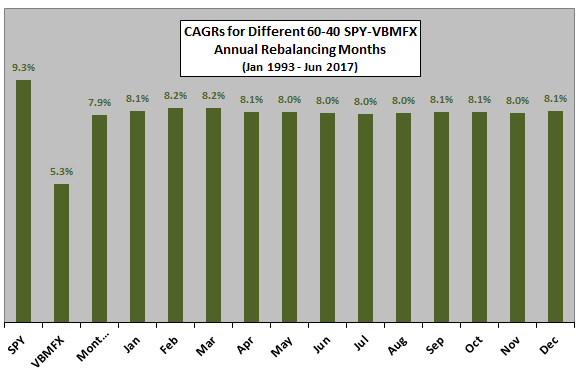

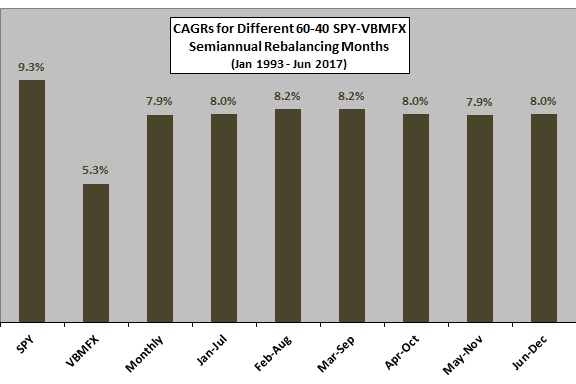

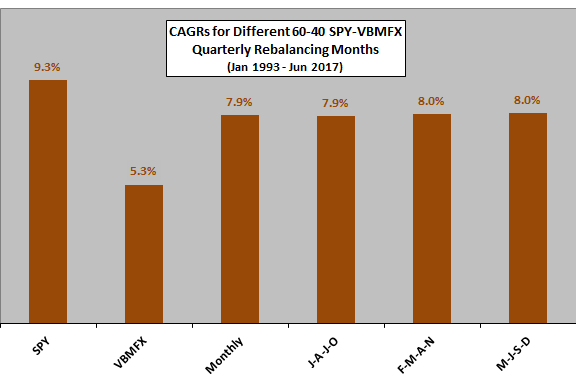

The following three charts summarize gross CAGRs for rebalancing a SPY-VBMFX portfolio to a 60-40 ratio over the available sample period:

- Top chart: Annual rebalancing at the end of each of the 12 calendar months (24-25 rebalances).

- Middle chart: Six combinations of semiannual rebalancing at the ends of paired calendar months (48-49 rebalances).

- Bottom chart: Three combinations of quarterly rebalancing at the ends of associated groups of four calendar months (97-98 rebalances).

Each chart includes comparable CAGRs for buying and holding SPY, buying and holding VBMFX and monthly rebalancing of a SPY-VBMFX portfolio to a 60-40 ratio. Notable points are:

- Least frequent annual rebalancing works just as well as semiannual and quarterly rebalancing.

- Rebalancing schedules that involve end of February and end of March appear slightly advantageous.

- Differences are small and may be noise.

Average gross CAGRs across annual, semiannual and quarterly combinations are 8.1%, 8.0% and 8.0%, respectively.

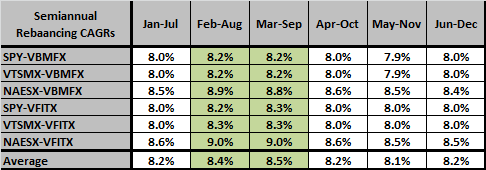

As a robustness test, we substitute Vanguard Total Stock Market Index (VTSMX) or Vanguard Small Cap Index (NAESX) for SPY and Vanguard Intermediate-Term Treasury (VFITX) for VBMFX using semiannual rebalancing over the sample period. The following table summarizes effects on CAGRs.

Results suggest that slight advantages for rebalancings at the end of February and the end of March are not unique to SPY-VBMFX. However, the alternate funds have fairly high return correlations with the baseline funds, so the robustness test is not compelling.

In summary, evidence from simple tests on a basic U.S. stocks-U.S. bonds portfolio with 60-40 allocations indicates that: (1) there is no penalty to rebalancing annually rather than semi-annually or quarterly; and, (2) there may be a slight advantage to rebalancing schedules that include the end of February or the end of March.

Cautions regarding findings include:

- Results may be specific to the available sample period and to U.S. markets.

- As noted, differences in performance may be just noise.

- Including more asset classes in the portfolio could increase rebalancing costs, thereby favoring a lower rebalancing frequency.