Do more traders than usual move to the sidelines before long weekends to avoid the risk of bad news during the extended downtime, thereby depressing prices before the weekend and elevating them after with re-entry? To investigate, we analyze the behavior of the S&P 500 Index during the three trading days before and the three trading days after three-day weekends. Using daily closing levels of the S&P 500 Index for 1950-2011 (62 years and 351 three-day weekends), we find that:

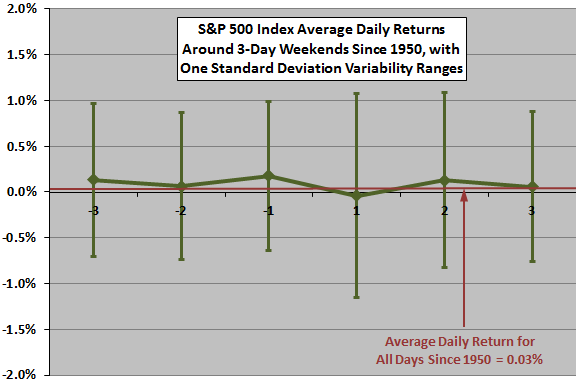

The following chart shows the average daily S&P 500 Index returns from three trading days before (-3 to -1) through three trading days after (1 to 3) three-day weekends over the entire sample period, with one standard deviation variability ranges. The mean daily return for all trading days in the sample is 0.03%. Results suggest tendencies toward abnormal strength the trading day before three-day weekends and abnormal weakness the trading day after. However, as usual for daily data, noise dominates signal.

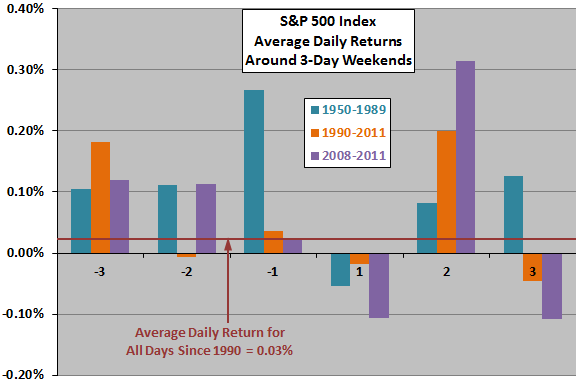

To check the reliability of these inferences, we look at three subsamples.

The next chart compares the average daily S&P 500 Index returns for three trading days before and after three-day weekends over three subperiods: 1950-1989 (214 observations); 1990-2011 (137 observations); and, 2008-2011 (only 29 observations). This chart has no variability ranges and uses a finer vertical scale than the preceding one. The subsamples do not confirm strength the trading day before three-day weekends, but they do confirm weakness the trading day after, with perhaps a rebound the next day.

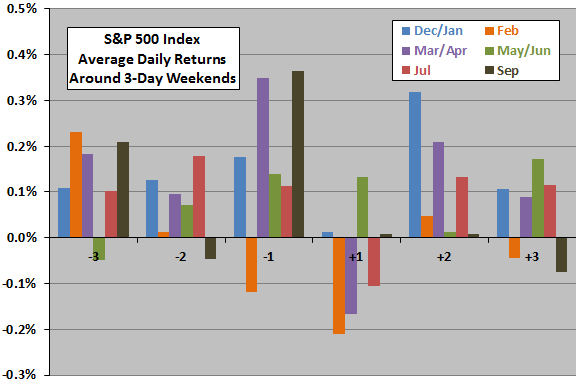

As another robustness test, we look at three-day weekends by calendar month.

The final chart shows the average daily S&P 500 Index returns from three trading days before and after three-day weekends by calendar month over the entire sample period. For example, the May/Jun observations represent Memorial Day, and the Sep observations represent Labor Day. The number of observations varies from 36 for Jul to 76 for Dec/Jan. Variability across subsamples weakens support for belief in reliable investor behavior around three-day weekends.

In summary, evidence from simple tests does not support a belief that traders tend to exit the market before three-day weekends and re-enter after. There may be some tendency toward extra bullishness (bearishness) before (after) three-day weekends, but this tendency is not very consistent.