As suggested by a reader, we evaluate here the stock market commentary since late 2000 of Bernie Schaeffer, Chairman of Schaeffer’s Investment Research and Senior Editor of “Bernie Schaeffer’s Option Advisor,” via Business Week, MarketWatch.com, TheStreet.com and SchaeffersResearch.com. According to the latter, “Mr. Schaeffer is widely recognized as an expert on equity and index options, investor sentiment and market timing.” The table below quotes forecast highlights from the cited source and shows the performance of the S&P 500 Index over various numbers of trading days after the publication date for each item. Grading takes into account more detailed market behavior when appropriate. Red plus (minus) signs to the right of specific forecasts indicate those graded right (wrong) based on subsequent market behavior, while red zeros denote any complex forecasts graded both right and wrong. We conclude that:

- Bernie Schaeffer uses a combination of fundamental, technical and sentiment analysis to make judgments about future stock market direction.

- Mr. Schaeffer is a prolific market commentator, but his archive at SchaeffersResearch.com extends back only a few months. Coverage of his forecasts in the business media has some large gaps.

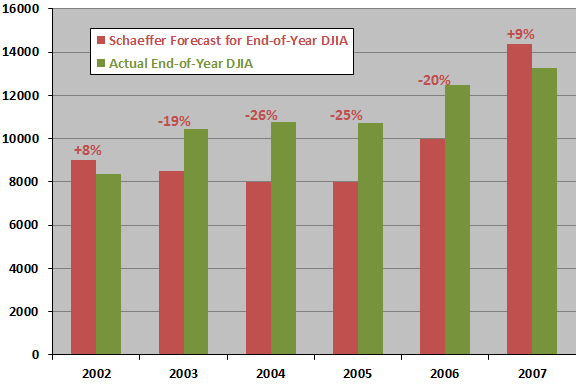

- His predictions for 2002-2007 yearly closes of the Dow Jones Industrial Average, as reported by Business Week, are off by a fairly large 16% average (see chart below).

- Bernie Schaeffer’s forecast sample is moderate, as is therefore confidence in the measurement of his accuracy.

Here are additional notes to augment the tabular summary:

From Peter Brimelow in MarketWatch (12/23/10): “The Terrible Ten for 2010… Bernie Schaeffer’s Option Advisor, Bernie Schaeffer: -11.0%…”

From Peter Brimelow in MarketWatch (12/24/09): “…puzzling is the survival of letters like…Bernie Schaeffer’s Option Advisor (down 12.17% over 10 years)…. [Down 33.1% in 2009.]”

In his MarketWatch.com column of 12/23/07, Peter Brimelow records that “Bernie Schaeffer’s Option Advisor” is among the ten worst performing newsletter portfolios for 2007, down 18.4% through 11/30/07.

From Chuck Jaffe in MarketWatch.com (4/1/05): “…Hulbert Financial Digest…has Schaeffer’s Option Advisor as one of its worst performers. But Schaeffer Investment Research and Hulbert have long squabbled over methodology, which leaves an investor squarely in the middle trying to figure out whose numbers to trust.”

From Aaron Task in TheStreet.com (12/30/03): “He’s Timer Digest’s No. 1 market-timer over the past three years and No. 5 for the past 10 years.”

In his MarketWatch.com column of 12/13/02, Peter Brimelow records that “Bernie Schaeffer’s Option Advisor” is the 5th best performing newsletter portfolio over the previous 12 months.

The following chart summarizes the accuracy of Bernie Schaeffer’s Business Week forecasts for yearly 2002-2007 closes of the Dow Jones Industrial Average. His forecasts are substantially too low for each of 2003-2006 and moderately too high for 2002 and 2007. In fact, he has the worst stock market forecasting record of any of the experts in Business Week’s annual survey.

Bernie Schaeffer’s forecast history is as follows:

| S&P 500 Index | ||||||

| Date | Comments from: Bernie Schaeffer via schaeffersresearch.com, BusinessWeek.com, MarketWatch.com, TheStreet.com | 21-Day Return | 63-Day Return | 126-Day Return | 254-Day Return | |

| 6/4/12 | …the ongoing combination of a relatively strong stock market overlaid with a backdrop of investor sentiment that can be argued to be bearish in the extreme bodes well for stock prices. | 7.5% | 9.5% | 10.3% | 28.5% | + |

| 2/6/12 | When I combine the S&P’s healthy relationship with its longer-term moving averages with what I see as a sentiment backdrop that’s inordinately negative, the bullish case for the market becomes quite compelling indeed. | 0.6% | 1.8% | 3.5% | 12.8% | + |

| 1/21/12 | …the fact that this crowd is also deluding itself about the extent of the market’s gyrations, plus the incontrovertible fact that there is a mother lode of sideline cash that can be deployed into equities by both individuals and by hedge funds, adds heft to the contrarian, bullish case for U.S. stocks. | 3.2% | 7.1% | 3.5% | 14.0% | + |

| 11/28/11 | …the possibility that a perfect storm of extreme investor fear may have marked at least a temporary respite from the dismal market action of recent weeks must be seriously considered. | 4.8% | 15.1% | 11.7% | 18.2% | + |

| 7/1/11 | …my market view is quite bullish, so I see short-term pullbacks as buying opportunities rather than as cause for alarm. | -6.4% | -13.4% | -5.7% | 2.1% | – |

| 5/16/11 | I’m targeting an additional stock market gain of 15-20% through year-end, which in the process would carry the SPX to an all-time high… | -4.8% | -11.3% | -6.8% | -1.9% | – |

| 4/25/11 | Consistent with my bullish posture on equities worldwide, I believe these…speed bumps will be overcome, and the rallies that follow could be quite powerful… | -1.4% | 0.7% | -9.0% | 4.8% | – |

| 3/9/11 | …the current sentiment backdrop has bullish implications yet to be fully realized. …while “cash on the sidelines” has the potential to boost the market, this is best accomplished when there is a significant catalyst to break the cash log jam. And the sorry prospect of missing out on further gains after the market has already doubled might just be the ticket to unlocking these cash hordes… | 1.0% | -2.7% | -11.7% | 3.9% | – |

| 2/22/11 | …the current bull market still has legs. | -1.4% | 1.4% | -14.6% | 3.8% | – |

| 11/17/10 | Bernie Schaeffer argues that stocks have room to run based on put and call activity. | 5.5% | 13.4% | 13.4% | 3.1% | + |

| 11/3/10 | …I feel there is a strong case for the contrarian call on this negative investor sentiment on U.S. stocks. | 2.2% | 8.9% | 8.9% | 4.6% | + |

| 4/6/10 | …I believe this [clearing its 160-month moving average] could be the ticket to an assault in the coming months on what could well be the next major S&P resistance level – 1,332… | -2.0% | -14.0% | -3.6% | 12.3% | – |

| 2/3/10 | …this consensus bearish view of the U.S. stock market is counter-trend, which makes it all the more remarkable and all the more actionable from a contrarian standpoint. …investors should take comfort… | 3.8% | 7.0% | 2.1% | 19.5% | + |

| 11/30/09 | …we could correct another 3%-4% and test the rising 80-day moving average…at this juncture I would define such a pullback as the most I’d expect… | 2.8% | 2.1% | -2.3% | 11.5% | – |

| 10/28/09 | The 80-day is currently sitting at 1,019, though it is rising a bit each day. Another 80-day test would be logical from my perspective… | 4.7% | 4.0% | 15.7% | 13.6% | – |

| 10/16/09 | …from a longer-term perspective the ongoing combination of strong price action with deep-seated skeptical sentiment remains a very compelling “one-two punch” for an aggressive allocation to stocks. | 2.0% | 4.4% | 10.1% | 8.3% | + |

| 10/9/09 | …either the contrarian laws of investing have been repealed, or this rally has quite a distance to run in both price and time before it becomes dangerous to be fully invested. | 2.0% | 6.9% | 11.7% | 9.9% | + |

| 9/21/09 | Based on what I see as a preponderance of very negative anecdotal sentiment in recent weeks, I’m starting to think this market may be safe from a major correction until 2010. | 2.5% | 3.0% | 9.5% | 5.7% | + |

| 9/14/09 | Is the prominence of “bearish check lists” a sign of the ‘disbelief” that accompanies a rally that has much further to go before it peaks? I’d suggest that this is the case… | 2.3% | 5.1% | 9.6% | 7.2% | + |

| 8/5/09 | …I would expect some hesitation in the rally…. The key question…is whether this will mark a termination point in what will have proved to be a rally in a bear market or whether the advance will resume. I feel there are some reasons to be optimistic. | 0.1% | 4.0% | 9.4% | 12.5% | + |

| 3/5/09 | …the weakness of the VIX may not be an indicator of investor complacency on the one hand or smart money confidence on the other, but rather an indication that investors have become resigned to the fact that we’re in a bear market. If so, this probably means that a market crash is unlikely, but equally unlikely is a ‘V-shaped’ market recovery. And the bearish trend is more likely than not to continue. | 23.4% | 36.5% | 46.2% | 67.1% | – |

| 2/4/09 | …I see the sentiment backdrop…as very dangerous from the perspective of its prognosis for the market. | -17.9% | 8.6% | 20.8% | 27.0% | + |

| 12/31/08 | …a continued defensive posture. …hedge any significant long positions… | -8.6% | -10.2% | 2.2% | 25.8% | + |

| 12/3/08 | …I would remain quite defensive, looking to hedge any long stock exposure… | 6.5% | -21.6% | 8.2% | 26.7% | + |

| 11/5/08 | …I would remain quite defensive, looking to hedge any long stock exposure… | -8.1% | -11.2% | -4.8% | 14.7% | + |

| 10/28/08 | …calls for a bottom are premature in both time and in price… | -5.6% | -7.1% | -7.1% | 10.2% | + |

| 9/3/08 | There are numerous indications that the market in general, and the financial sector in particular, put in a bottom on July 15th… | -12.6% | -36.0% | -44.1% | -20.3% | – |

| 5/7/08 | …this “mega-bearish” media tilt reflects the likelihood that the bad economic news has already been reflected in this market, and that the upside potential from a combination of short covering and the movement of some of the now huge store of sideline money back into the market comfortably exceeds the downside risk. | -2.6% | -8.1% | -30.9% | -34.9% | – |

| 3/5/08 | My advice at this juncture remains the same as I stated last month: “I would suggest a healthy dose of cash of 25-50%…” | 2.8% | 3.3% | -4.2% | -49.3% | – |

| 1/29/08 | So with the bull hanging on by his thumbs, how are we to play this market? I would suggest a healthy dose of cash of 25-50%… | 0.4% | 0.4% | -9.4% | -39.4% | + |

| 11/7/07 | The current bull market is very much alive. …this bull market is healthier than those of pre-1987 and Nasdaq pre-2000 and is considerably less vulnerable to crashes and “bubble pops.” …A growing and ongoing “short trade” will cap rallies due to supply offered by short sellers and will support pullbacks due to short covering. | 2.0% | -9.4% | -5.9% | -37.7% | – |

| 10/10/07 | …we will see new highs in the major averages before year-end. And I believe it won’t be long before the bears begin to cite “investor complacency” as evidenced by a “low VIX” as a reason to be bearish… | -5.6% | -9.8% | -12.9% | -35.8% | – |

| 8/8/07 | Pullbacks to support levels in a bull market when accompanied by climactic fear levels are almost always buying opportunities, and this diagnosis applies today. …it would be foolish to exit this market in response to the gloom and doom headlines. | -2.9% | 0.3% | -11.4% | -12.8% | – |

| 7/5/07 | …the big picture bullish case anchored by skeptical sentiment amidst strong technicals and decent fundamentals remains intact. | -6.1% | 1.4% | -5.1% | -16.5% | – |

| 6/25/07 | …the big picture bullish case anchored by skeptical sentiment amidst strong technicals and decent fundamentals remains intact. | 1.4% | 1.9% | -2.5% | -14.3% | + |

| 6/14/07 | I continue to view this convergence of events as a positive for the market. | 1.7% | -3.4% | -3.0% | -11.3% | – |

| 6/4/07 | Overall, this landscape strikes me as quite bullish… | -0.9% | -5.3% | -4.5% | -8.8% | – |

| 5/24/07 | …expect any pullback to generate more than enough bearish sentiment to set the stage for a major push by the S&P to all-time highs and beyond… | -0.6% | -2.9% | -4.5% | + | |

| 4/27/07 | …complacency has by no means set in, and this has very bullish implications for the staying power of this rally. | 1.6% | -0.8% | 1.5% | -5.7% | + |

| 4/4/07 | …the odds definitely favor a bullish resolution to the unrest we’ve recently experienced… | 4.6% | 5.9% | 7.5% | -5.1% | + |

| 3/7/07 | I’ve been on record from last October as calling for an all-time high in the SPX, and I now see this as a distinct possibility in the first half of this year. | 3.7% | 10.0% | 7.0% | -8.5% | + |

| 3/1/07 | …the U.S. stock market gives me no indication of being close to bubble territory. Contagion may create further downside in U.S. stocks, but I would label such downside as “buying opportunity” and not “watch out below.” | 1.3% | 9.1% | 2.1% | -5.4% | + |

| 2/20/07 | While this week may be plagued with broad-market weakness as traders pile back into their protective puts, this swelling of bearish bets simply forms the building blocks for the wall of worry that the market continues to climb over the long term. | -1.7% | 4.3% | -0.9% | -7.3% | + |

| 2/6/07 | I would suggest you enjoy contemplating the potential for a “melt-up” and also position yourself to enjoy the actual melt-up. | -3.2% | 4.1% | 1.4% | -8.1% | – |

| 12/27/06 | S&P 500 at mid-year and year-end 2007: 1475, 1580 | 0.1% | -0.3% | 5.5% | 1.4% | 0 |

| 11/29/06 | I continue to believe that the SPX is capable of reaching an all-time high by year-end or perhaps by January 2007… | 1.3% | -0.9% | 9.8% | 4.5% | – |

| 11/8/06 | …this rally could carry the S&P to new high ground by year-end, which would represent an additional gain of about 12 percent from current levels. | 1.7% | 3.8% | 8.5% | 6.9% | – |

| 10/9/06 | The following four premises underlie my expectation for a major year-end rally in the S&P… | 2.4% | 4.5% | 6.5% | 15.6% | + |

| 10/4/06 | …could be about to experience a potentially enormous increase in volatility, one in which potential risks and potential rewards are each abnormally high… In such a landscape, the prudent investor maintains an aggressive cash reserve to cushion against adverse movement… | 1.3% | 5.0% | 6.9% | 15.9% | – |

| 12/26/05 | S&P 500 at mid-year and year-end 2006: 1180, 1160 | 2.2% | 2.9% | -1.4% | 12.9% | – |

| 11/21/05 | …go out and have your fun and play selectively from the long side…, but I strongly recommend against you being 100% invested without put protection. | 0.6% | 3.0% | 0.1% | 11.6% | – |

| 11/2/05 | …it is sheer folly to be 100% invested in equities under these circumstances. | 4.1% | 4.6% | 8.0% | 13.6% | – |

| 12/29/04 | “a real possibility for the stock market to suffer a 20%-25% decline sometime in the next 12 months.” | -3.5% | -2.6% | -1.0% | 2.9% | – |

| 12/27/04 | S&P 500 at mid-year and year-end 2005: 950, 825 | -2.6% | -2.5% | -1.1% | 4.4% | – |

| 8/13/04 | …Schaeffer is concerned about a potential crash, suggesting we could see Dow 8000 by year-end… | 6.0% | 9.2% | 12.4% | 14.5% | – |

| 12/29/03 | S&P 500 at year-end 2004: 850 | 2.2% | 1.2% | 2.4% | 9.2% | – |

| 12/18/03 | Schaeffer is bearish because of contrary opinion; he sees too much bullishness and complacency. | 5.4% | 1.9% | 3.8% | 11.1% | – |

| 8/8/03 | …maintain a cash reserve of 25 to 50 percent to preserve capital in a risky environment… | 4.7% | 7.6% | 16.9% | 8.8% | – |

| 6/6/03 | …he’s not convinced that we’re in a new bull market. | 2.0% | 4.1% | 7.8% | 14.5% | – |

| 5/31/03 | “…I tend to side with the pessimists because they have logic on their side…” | 1.6% | 3.7% | 9.5% | 15.5% | – |

| 3/28/03 | “The market is in for a difficult consolidation (or sideways) movement at best… A major rally is out of the question until the confusion is resolved.” | 6.3% | 14.2% | 16.2% | 30.4% | – |

| 12/30/02 | He’s generally bearish, predicting the Dow will bottom at 6000 before rebounding to 8500 by next December. Ever the iconoclast, he’s also predicting a sharp rebound in tech and says the NASDAQ will finish the year at 2200. | -4.0% | -3.5% | 10.8% | 26.1% | + |

| 12/3/02 | …the stock market is in for a long-term decline. …the broad market will continue to be strong for the next month or two. | -1.3% | -9.9% | 7.1% | 15.3% | – |

| 11/13/02 | “…the potential risks are once again outweighing the potential rewards.” | 0.8% | -7.4% | 7.3% | 18.3% | + |

| 10/30/02 | While stressing disbelief that the Oct. 10 bottom will prove to be the bottom, Schaeffer argued in a report Tuesday that “the rally off the Oct. 10 bottom may carry quite a bit further than the one off the July bottom.” Schaeffer offered the 1100 area for the S&P 500…as the “logical termination point” for the current advance. | 5.1% | -5.2% | 2.9% | 18.9% | – |

| 9/24/02 | …Bernie Schaeffer… [is] eyeing Dow 6000 or slightly below as the likely area where the real major bottom arrives. | 9.4% | 9.3% | 6.8% | 21.7% | – |

| 8/28/02 | …recent history makes him skeptical the 5-week-old rally in equities is anything more than a bear market dalliance. | -9.9% | 1.6% | -8.8% | 11.3% | + |

| 8/6/02 | …a combination of bearish technical indicators, weakening fundamental measures, and hopeful investor sentiment indicate that the bear market is far from over. “The possibility of major additional damage before the ultimate bottom is far from remote.” | 2.3% | 4.8% | -1.3% | 13.7% | – |

| 7/29/02 | Scoffing at the idea that the market is bottoming out is Bernie Schaeffer… | 4.0% | -1.8% | -5.7% | 10.2% | + |

| 7/16/02 | “We are quite close to hitting bottom, but I still have yet to see sufficient hard evidence to be convinced that real fear is widespread that would signal a real bottom.” | 2.1% | -7.3% | 2.8% | 10.3% | + |

| 3/7/02 | Schaeffer…is betting on another down year, with the Dow at 9,000 at yearend. | -2.8% | -9.3% | -22.8% | -30.8% | + |

| 12/31/01 | S&P 500 at year-end 2002: 925 | -1.6% | -1.0% | -15.6% | -20.9% | + |

| 12/12/01 | “Bear market? No doubt.” | 0.1% | 1.4% | -11.2% | -19.9% | + |

| 11/11/01 | “The market has room to rally, but I’m keeping an eye on the exit door.” | 1.7% | -1.0% | -1.9% | -19.1% | – |

| 9/18/01 | …he wouldn’t be surprised if the market bounces from here. But he thinks that any such near-term rally would be short-lived… “As of now, long-term investors should stay on the sidelines.” | 4.3% | 8.7% | 13.3% | -18.1% | – |

| 9/6/01 | Schaeffer sees the Nasdaq Composite, which was nearing a five-month low of 1,700 Thursday, falling as low as 1,283. | -0.8% | 3.0% | 4.3% | -19.5% | + |

| 7/13/01 | This week’s advance will “prove to be as durable as the vapor rallies” earlier in the year… | -2.0% | -9.7% | -7.2% | -34.4% | + |

| 3/26/01 | Bernie Schaeffer reiterated …defensiveness/bearishness/caution… | 6.6% | 6.3% | -11.6% | -2.3% | – |

| 3/6/01 | “From my perspective the probable downside at this juncture strongly outweighs the probable upside.” | -12.0% | 1.1% | -9.6% | -8.0% | + |

| 2/8/01 | …short-term indicators tell a pretty grim story… | -11.4% | -5.8% | -11.2% | -18.7% | + |

| 11/15/00 | …says not to expect an economic turnaround until the Nasdaq hits 2600… | -5.6% | -4.5% | -7.3% | -16.7% | + |