In response to “SACEMS with SMA Filter”, a subscriber suggested instead crash protection via momentum breadth (proportion of assets with positive momentum) by:

- Switching to 100% cash when fewer than four of eight Simple Asset Class ETF Momentum Strategy (SACEMS) non-cash assets have positive past returns.

- Scaling from cash into winners when four to eight risk assets have positive past returns (no cash for eight).

- Replacing U.S. Treasury bills (T-bills), a proxy for broker money market rates, with iShares Barclays 7-10 Year Treasury Bond (IEF) as “Cash.”

To investigate, we each month rank assets from the following SACEMS universe based on total returns over a specified lookback interval. We also each month measure momentum breadth for the eight non-cash assets using the same lookback interval.

PowerShares DB Commodity Index Tracking (DBC)

iShares MSCI Emerging Markets Index (EEM)

iShares MSCI EAFE Index (EFA)

SPDR Gold Shares (GLD)

iShares Russell 2000 Index (IWM)

SPDR S&P 500 (SPY)

iShares Barclays 20+ Year Treasury Bond (TLT)

Vanguard REIT ETF (VNQ)

3-month Treasury bills (Cash)

While emphasizing the suggested momentum breadth crash protection threshold, we look at all possible thresholds. While emphasizing a baseline lookback interval, we consider lookback intervals ranging from one to 12 months for the suggested momentum breadth threshold. We focus on compound annual growth rates (CAGR) and maximum drawdowns (MaxDD) for the equal-weighted (EW) Top 3 SACEMS portfolio, but also look at Top 1 and EW Top 2. We also look at EW Top 3 portfolio turnover. Using monthly dividend-adjusted closing prices for SACEMS assets and IEF and the T-bill yield during February 2006 (the earliest all ETFs are available) through December 2018, we find that:

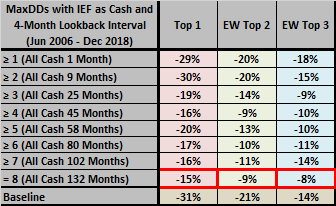

We start with a 4-month lookback interval as used in baseline SACEMS to pick winners and measure momentum breadth. We consider simplified momentum breadth crash protection that holds unscaled SACEMS winners (100% T-bills) when momentum breadth is above (below) a specified threshold. A 4-month lookback interval allows use of all ETFs starting June 2006.

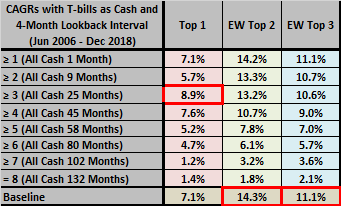

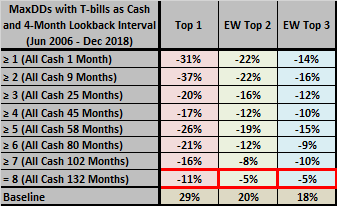

The following tables summarize effects on gross CAGRs (upper chart) and MaxDDs (lower chart) of SACEMS Top 1, EW Top 2 and EW Top 3 portfolios from adding simplified momentum breadth crash protection with T-bills as Cash and the baseline 4-month lookback interval. Notations are:

- Rows indicate momentum breadth. For example, > 4 means that at least four of eight SACEMS risk assets are positive, for which SACEMS portfolios are all in Cash during 45 of 150 months.

- Baseline is SACEMS without simplified momentum breadth crash protection.

- Bright red borders indicate the best performance for each portfolio.

Simplified momentum breadth crash protection generally offers lower CAGRs that baseline SACEMS, but also shallower MaxDDs.

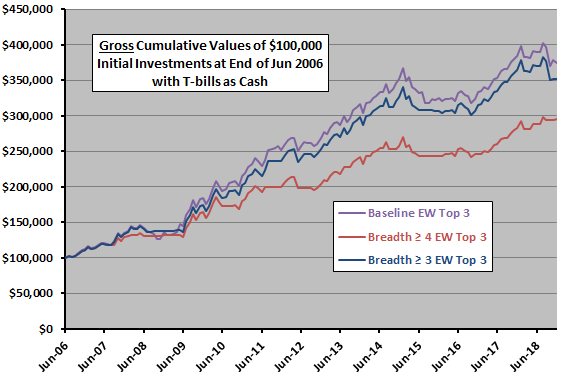

For perspective, we compare cumulative performances for three EW Top 3 variations.

The following chart compares gross values of $100,000 initial investments in the Baseline SACEMS EW Top 3 portfolio and in two EW Top 3 portfolios with simplified momentum breadth crash protection, T-bills as Cash and 4-month lookback interval. The momentum breadth > 3 portfolio is very similar to the baseline.

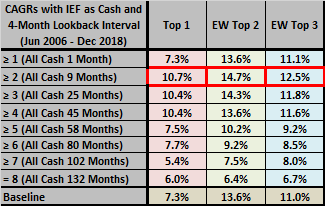

What happens when we substitute IEF for T-bills as “Cash?”

The next two tables summarize effects on gross CAGR (upper chart) and MaxDDs (lower chart) of SACEMS Top 1, EW Top 2 and EW Top 3 portfolios from adding simplified momentum breadth crash protection with IEF as “Cash” and the baseline 4-month lookback interval. Notations are as above. Notable points are:

- Using IEF changes some SACEMS winners, with small effects on the above baseline SACEMS performance.

- Using IEF with simplified momentum breadth crash protection generally boosts CAGRs compared to above and makes MaxDDs even shallower.

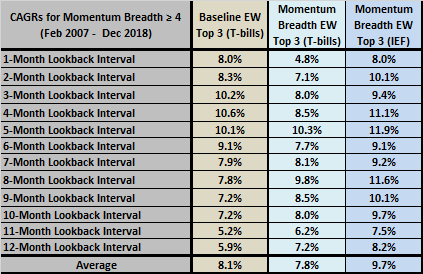

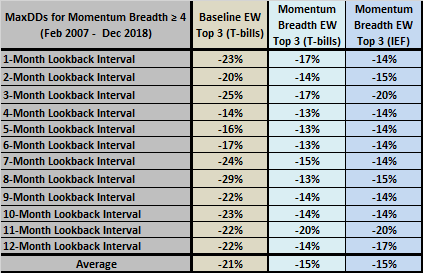

How sensitive are findings to choice of lookback interval?

The next two tables compare CAGRs (upper table) and MaxDDs (lower table) for EW Top 3 portfolios across lookback intervals one to 12 months, focusing on the suggested momentum breadth threshold > 4, as follows:

- Baseline EW Top 3 (T-bills) – Baseline SACEMS.

- Momentum Breadth EW Top 3 (T-bills) – SACEMS with simplified momentum breadth crash protection threshold set at > 4 and T-bills as Cash.

- Momentum Breadth EW Top 3 (IEF) – SACEMS with simplified momentum breadth crash protection threshold set at > 4 and IEF as “Cash.”

Notable points are:

- For CAGRs, Momentum Breadth EW Top 3 (T-bills) usually loses to Baseline EW Top 3 (T-bills) for shorter lookback intervals but wins for longer ones. Momentum Breadth EW Top 3 (IEF) usually wins.

- For MaxDDs, both Momentum Breadth EW Top 3 (T-bills) and Momentum Breadth EW Top 3 (IEF) always beat Baseline EW Top 3 (T-bills).

- There is a preferred range of lookback intervals for Baseline EW Top 3 (T-bills) of three to six months, but no clear preferred ranges for simplified momentum breadth variations.

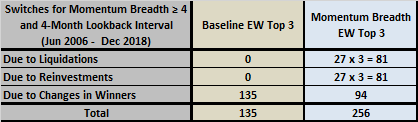

What about effects of momentum breadth crash protection on trading frictions?

The following table summarizes effects on number of asset switches from applying the simplified momentum breadth threshold > 4 to SACEMS EW Top 3 for a 4-month lookback interval over the full sample period. Calculation details are:

- The 135 switches due to changes in winners for Baseline EW Top 3 is an exact count.

- The 27 portfolio liquidations and reinvestments triggered by crash protection for Momentum Breadth EW Top 3 is an exact calculation. Multiplying this number by three accounts for the three positions in the portfolio.

- The 94 switches due to changes in winners for Momentum Breadth EW Top 3 is an estimate generated by applying average switches per month from Baseline EW Top 3 to the 105 months not in crash protection mode. The exact number of switches depends on actual sequencing of liquidation-reinvestment episodes.

- When using T-bills as Cash (a proxy for broker money market sweep), switches to or from Cash are one-way only. When using IEF as “Cash,” switches are two-way.

- The counts are for position changes only. They do not account for any trading to maintain equal weighting.

For this scenario, simplified momentum breadth crash protection substantially increases portfolio turnover and any associated trading frictions.

Implementing full momentum breadth crash protection as suggested by scaling into and out of winner positions as momentum breadth varies from four to eight (61 times when not affected by crash protection) adds many more trades (61 x 3 = 183), because monthly momentum breadth changes frequently.

Is using IEF as “Cash” reasonable?

It appears that a high return on “Cash” is very important to attractiveness of momentum breadth crash protection. However, IEF is not a risk-free asset. It carries U.S. Treasuries term risk and its monthly returns are somewhat volatile. Calling IEF a potential safe haven is more accurate than using it as a proxy for “Cash.”

For simplified momentum breadth crash protection with threshold > 4, the EW Top 3 portfolio is 100% IEF about a third of the time. Such a large expected out-of-sample commitment to IEF implies strong confidence that its safe haven behavior more than offsets additional trading frictions. Scaling into SACEMS winners as momentum breadth increases puts more eggs in the IEF basket and drives more trading, amplifying the need for such confidence.

In summary, evidence from available data indicate that SACEMS with momentum breadth crash protection may be attractive to very crash-averse investors (and more generally when used with a reliable, high-return safe haven) who can efficiently handle the associated increase in trading.

Cautions regarding findings include:

- The overall sample period is short in terms of variety of economic and market conditions.

- Performance statistics are gross, not net. Accounting for monthly portfolio reformation frictions would reduce performance. As noted above:

- Including simplified momentum breadth crash protection adds a material number of trades to SACEMS.

- Using an ETF as “Cash” doubles the number of trades for crash protection.

- Scaling into and out of winner positions as momentum breadth varies adds many more trades.

- The selection of momentum measurement lookback interval, momentum breadth threshold and safe haven asset offer data snooping opportunities, such that best-performing combinations may materially overstate out-of-sample expectations. Adding options for scaling winner positions as momentum breadth varies would add another dimension for snooping.

For additional depth and perspective, see “Conservative Breadth Rule for Asset Class Momentum Crash Protection” and “Multi-class Momentum Portfolio with ‘Canary’ Crash Protection”.

See “SACEMS with Momentum Breadth Protection Update” for an update of some of the above analyses.