Are some types of cars attractive alternative investments? In their September 2018 paper entitled “My Kingdom for a Horse (or a Classic Car)”, Dries Laurs and Luc Renneboog investigate price determinants and investment performance of classic cars from veteran cars (built 1888-1907) through modern classics (1975-1990). They estimate returns and risks for several classic car price indexes via a hedonic price methodology that accounts for physical attributes (such as engine displacement), condition, rarity, uniqueness and provenance. They then compare results to those for financial and other real asset classes. Using a sample of 29,002 global auction sales with hedonic model inputs, plus U.S. inflation data and price series for other asset classes, during 1998 through 2017, they find that:

- The total value of classic cars worldwide is about $120 billion.

- The auction segment of the classic cars market trades about $1.3 billion per year (private sales may be a multiple of this amount). Nationalities of cars sold are mostly American (52%), British (17%), German (12%) and Italian (17%). Ferrari dominates the top of the market.

- The hedonic model explains about 70% of variation in classic car prices, confirming model usefulness.

- Average annual gross nominal (real) returns for classic cars over the sample period are:

- 5.6% (3.4%) overall.

- 5.3% (3.2%), with annual volatility 15.6%, for 2,488 auction sales of Classic Car Club of America classics (American or foreign built, produced between 1915 and 1948).

- 6.3% (4.1%), with annual volatility 15.2%, for 911 auction sales of Hagerty’s Affordable Classics.

- 12.5% (10.0%), with annual volatility 22.6%, for 833 auction sales of Hagerty’s Blue Chip Classics.

- 11.3% (8.9%), 7.0% (4.7%), 6.3% (4.0%) and 4.5% (2.3%), respectively, for Italian, German, British and American classics.

- 13.8% (11.3%), 9.4% (7.0%) and 7.0% (4.7%), respectively, for Ferrari, Porsche and Mercedes-Benz classics.

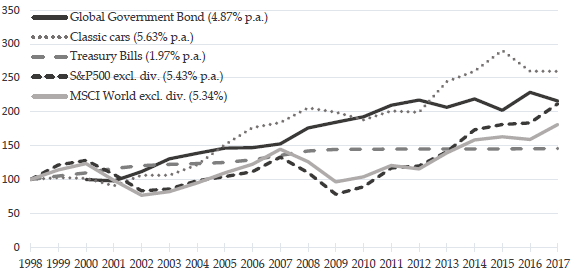

- Regarding gross annual Sharpe ratio of classic cars versus those of other asset classes over the sample period (see the chart below):

- Classic cars overall have a higher Sharpe ratio (0.35) than the S&P 500 Index (0.21), the MSCI World Index (0.16) and art (0.07). But, adding dividends would boost Sharpe ratios for the equity indexes to about 0.30.

- Classic cars have a lower Sharpe ratio than global government bonds (0.40) and gold (0.40).

- Correlations between classic car returns and those of other asset classes are generally low, indicating diversification benefits within a portfolio of other classes.

- Because owning and trading classic cars are costly, net average annual returns are likely 25%-50% lower than above. Specifically:

- Auction houses typically charge buyers and sellers roughly a combined 25% of sales price, encouraging long holding periods.

- The market is illiquid, such that a forced sale may mean a considerable discount.

- Classic cars require: storage in a controlled environment with security, restoration (when acquired in less than pristine condition), regular maintenance, insurance and taxes.

- However, in most countries, there are no capital gain taxes on classic car transactions.

The following chart, taken from the paper, compares nominal gross cumulative performance of the classic car index to those of several financial asset indexes over the sample period (all normalized to 100 at the start). Average annual gross nominal returns are in parenthesis in the legend.

In summary, evidence indicates that owning premium classic cars over a very long holding period may be an attractive alternative investment.

Cautions regarding findings include:

- As noted, owning and trading classic cars are very costly compared to owning financial assets.

- As noted, the classic car market is illiquid, such that forced selling is problematic.

- Most investors do not have the capital to consider a selection of premium classic cars as part of a diversified investment portfolio.