Are there long-term positions in leveraged index exchange-traded funds (ETF) that beat buying and holding the underlying index? In his October 2018 paper entitled “Leveraged ETF Pairs: An Empirical Evaluation of Portfolio Performance”, Stanley Peterburgsky examines the performance of simple strategies involving leveraged and inverse leveraged ETFs. Specifically, he tests whether the following leveraged ETF portfolios are likely to outperform underlying total return indexes:

- A long position in SSO or UPRO, compared to the S&P 500 Index.

- 1/3 short UPRO (URTY) and 2/3 short SPXU (SRTY), compared to the S&P 500 (Russell 2000) Index.

- 1/4 short SSO (UWM) and 3/4 short SDS (TWM), compared to the S&P 500 (Russell 2000) Index.

- Short SH (RWM), compared to the S&P 500 (Russell 2000) Index.

All short positions have matching long positions in 1-month U.S. Treasury bills that drive some trading. For example, at the end of each trading day, if the UPRO/SRTY portfolio value is less than 90% (more than 110%) of the short balance, the strategy buys (shorts additional) shares of UPRO and SPXU in equal proportions to restore long-short balance. In addition, strategies 2 and 3 require occasional rebalancing of ETF pairs. Baseline strategies allows pair members to drift up to 20% apart before rebalancing. Sensitivity tests evaluate effects of tightening the rebalancing threshold to 10%. Key performance metrics are average annualized return, average annualized standard deviation of daily returns and average annualized Sharpe ratio. Using daily total returns for the specified leveraged ETFs and underlying indexes during 2010 (2/9/2010 for Russell 2000-based funds) through 2016, he finds that:

- Strategy 1 is unprofitable over the long term due to the rebalancing grind.

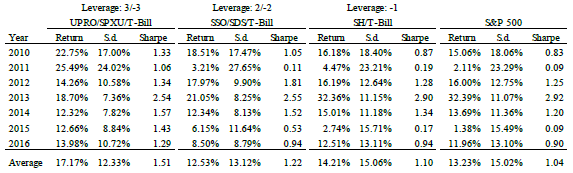

- Strategies 2 and 3 outperform underlying indexes based on average annualized gross Sharpe ratio, with outperformance mostly increasing with leverage. Specifically, average annualized gross Sharpe ratios for the baseline 20% rebalancing threshold are (see the table below):

- 1.51 for UPRO/SPXU/T-bills, 1.22 for SSO/SDS/T-bills and 1.10 for SH/T-bills, compared to 1.04 for the S&P 500 Index.

- 1.06 for URTY/SRTY/T-bills, 1.22 for UWM/TWM/T-bill and 0.95 for RWM/T-bills, compared to 0.83 for the Russell 2000 Index.

- Trading requirements are modest. For the 20% rebalancing threshold, UPRO/SPXU/T-bills (URTY/SRTY/T-bills) trades on average only 6.3 (14.1) times per year.

- However, over the sample period, it becomes progressively harder to borrow leveraged ETF shares (at least for retail investors). For instance, one major online brokerage rejects short sale orders of SPXU and SRTY in recent years. Another charges a hard-to-borrow fee for all ten of the above leveraged ETFs, more for triple leverage than for double.

- Tightening the rebalancing threshold for strategies 2 and 3 has mixed effects on performance. Specifically, average annualized gross Sharpe ratios for a 10% rebalancing threshold are:

- 1.26 for UPRO/SPXU/T-bills and 1.25 for SSO/SDS/T-bills, compared to 1.51 and 1.22, respectively, for the 20% threshold.

- 1.10 for URTY/SRTY/T-bills and 1.07 for UWM/TWM/T-bill, compared to 1.06 and 1.22, respectively, for the 20% threshold.

- However, tightening the threshold consistently increases trading.

- In general, outperformance of strategies 2, 3 and 4 relates positively to the volatility and negatively to the absolute return of the underlying index.

The following table, extracted from the paper, summarizes gross annualized returns, annualized standard deviations of daily returns and gross annualized Sharpe ratios for strategies 2, 3 and 4 above as applied to S&P 500 Index-related leveraged ETFs by year and overall. Results indicate generally attractive gross performance.

In summary, evidence indicates the potential for attractive returns from shorting combinations of leveraged and inverse leveraged equity index funds.

Cautions regarding findings include:

- Most quantitative results are gross, not net. The study does not quantify trading frictions, and does not consider broker fees or impact of trading on prices.

- As noted, retail investors face obstacles to shorting at brokers, perhaps because potential lenders of shares have difficulty hedging the loans.

- Findings may not extend to other asset classes, for which finding shares of ETFs to borrow may be more difficult.

See also “Monthly Rebalanced Shorting of Leveraged ETF Pairs” and “Leveraged ETF Pair Shorting Strategies”.