Is the currency carry trade, as implemented by exchange-traded funds/notes (ETF/ETN), attractive? To investigate, we consider two currency carry trade ETF/ETNs, one live (with low trading volume) and one dead:

- PowerShares DB G10 Currency Harvest Fund (DBV) – tracks changes in the Deutsche Bank G10 Currency Future Harvest Index. This index consists of futures contracts on certain G10 currencies with up to 2:1 leverage to exploit the tendency that currencies with relatively high interest rates tend to appreciate relative to currencies with relatively low interest rates, reconstituted annually in November.

- iPath Optimized Currency Carry (ICITF) – provides exposure to the Barclays Optimized Currency Carry Index, which reflects the total return of a strategy that holds high-yielding G10 currencies financed by borrowing low-yielding G10 currencies. This fund stopped trading July 2018, but an indicative value is still available.

We focus on monthly return statistics, plus compound annual growth rates (CAGR) and maximum drawdowns (MaxDD). For reference (not benchmarking), we compare results to those for SPDR S&P 500 (SPY) and iShares Barclays 20+ Year Treasury Bond (TLT). Using monthly total returns for the two currency carry trade products, SPY and TLT as available through October 2020, we find that:

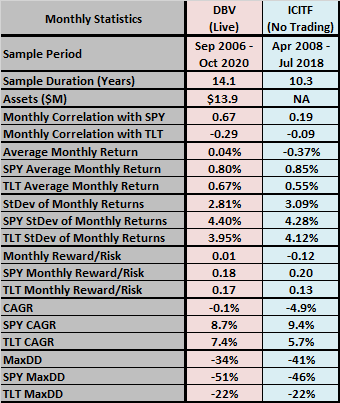

The following table summarizes sample periods, monthly performance data, CAGRs and MaxDDs for the two currency carry trade products, SPY and TLT over available sample periods. Monthly reward/risk is the ratio of average monthly return to standard deviation of monthly returns. Notable points are:

- The products are unattractive based on absolute returns.

- They have much deeper MaxDDs than TLT.

- Based on monthly return correlations, they might have some value to investors seeking diversification.

In summary, available evidence on attractiveness of currency carry trade ETF/ETNs is negative.

Cautions regarding findings include:

- Available sample periods are not long in terms of variety of global market conditions.

- As noted, trading in these products is thin or absent.

- While the absolute performance of the currency carry trade products is unattractive, they may still be performing as planned with respect to their benchmark indexes.