Do changes in the U.S. federal regulatory burden predict U.S. stock market returns? To check, we consider two measures of the regulatory burden:

- Annual number of pages in the Federal Register (FR) during 1936-2016 – “…in which all newly proposed rules are published along with final rules, executive orders, and other agency notices—provides a sense of the flow of new regulations issued during a given period and suggests how the regulatory burden will grow as Americans try to comply with the new mandates.”

- Annual number of pages in the Code of Federal Regulations (CFR) during 1975-2016 – “…the codification of all rules and regulations promulgated by federal agencies. Its size…provides a sense of the scope of existing regulations with which American businesses, workers, and consumers must comply.

Specifically, we relate annual changes in these measures to annual returns for the S&P 500 Index. Using the specified regulatory data and annual S&P 500 Index total returns during 1929 through 2016, we find that:

The average annual change in FR (CFR) pages over the available sample period is 2.4% (6.0%). The average annual S&P 500 Index return over the sample period used is 11.0%.

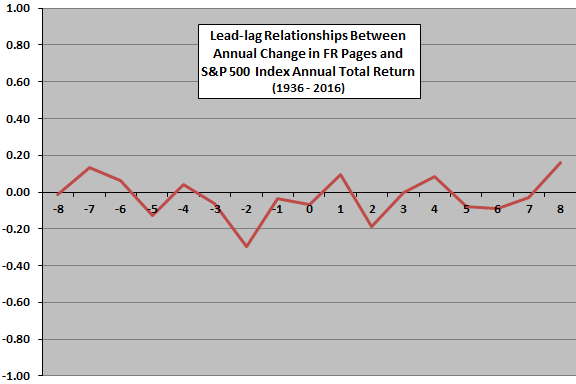

The following chart summarizes lead-lag correlations between annual change in FR pages and S&P 500 Index total return, ranging from return leads change in pages by eight years (-8) to change in pages leads return by eight years (8). Lack of any pronounced peaks, dips or streaks suggests that variation in correlation is just noise.

What about the size of the entire CFR?

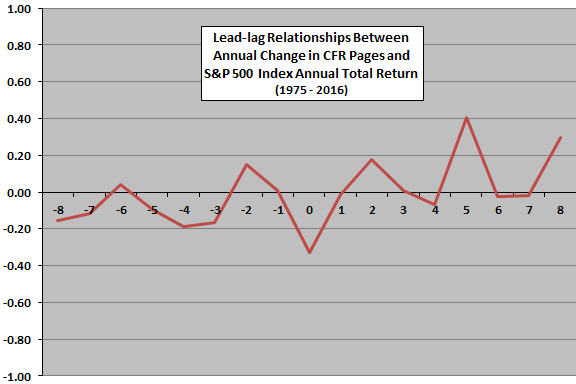

The following chart summarizes lead-lag correlations between annual change in CFR pages and S&P 500 Index total return, ranging from return leads change in pages by eight years (-8) to change in pages leads return by eight years (8). There may be some negative contemporaneous (0) relationship, but the magnitude of the correlation at year 5 is larger and inexplicable. It seems more likely the the interactions are noise.

In summary, available evidence offers little support for belief that changes in federal regulatory burden reliably affect the stock market.

Cautions regarding findings include:

- Sample periods, especially that for CFR page counts, are short.

- Analyses include no assessment of the import of specific regulatory actions.