Do momentum and reversal stock anomalies stripped of market, size and book-to-market risks (residual anomalies) outperform their conventional forms? In their March 2017 paper entitled “Residual Momentum and Reversal Strategies Revisited”, Joop Huij and Simon Lansdorp compare performances of residual and conventional momentum (using returns from 12 months ago to one month ago) and reversal (using last-month returns) strategies for U.S., European, Japanese, Asia-Pacific and emerging market stocks. They calculate anomaly performance from portfolios that are each month long (short) the equally weighted fifth, or quintile, of stocks with the highest (lowest) expected momentum and reversal returns. To check robustness, they focus on tests segmented into a residual anomaly discovery subperiod (January 1986 through December 2008) and a recent subperiod (January 2009 through December 2015). Using monthly returns as available (only since January 1993 for emerging markets) for the specified stocks, they find that:

- During 1986-2008 for U.S. stocks:

- Average gross annual return for residual (conventional) momentum is 13.1% (16.1%) with annual volatility 10.3% (21.6%). The gross annual return-to-risk ratio is therefore 1.28 (0.74).

- Average gross annual return for residual (conventional) reversal is 11.1% (4.4%) with annual volatility 9.4% (19.9%). The gross annual return-to-risk ratio is therefore 1.18 (0.22).

- During 1986-2008 for stocks in non-U.S. markets:

- Gross annual reward-to-risk ratios are consistently higher for residual than conventional momentum in all markets.

- Gross annual reward-to-risk ratios are consistently higher for residual than conventional reversal in all markets, though unattractive in some markets for residual reversal and nearly all markets for conventional reversal.

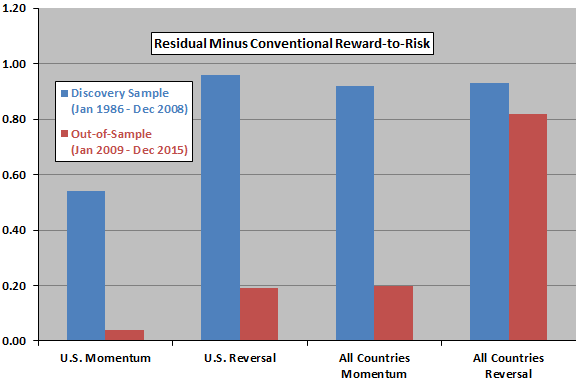

- During 2009-2015 (see the chart below):

- Gross annual reward-to-risk ratios are consistently higher for residual than conventional momentum in all markets, but both are unattractive for U.S. stocks.

- Gross annual reward-to-risk ratios are consistently higher for residual than conventional reversal in all markets, with conventional reversal generally unattractive.

- In 2009 (market rebound), residual momentum strongly outperforms conventional momentum in all markets, with gross annual return differences ranging from 25% to 40%. Conventional momentum generally outperforms residual momentum in subsequent (trending) years.

The following chart, constructed from data in the paper, compares gross annual residual-minus-conventional reward-to-risk ratio differences for momentum and reversal strategies in the U.S. alone and across all countries during the discovery sample subperiod (1986-2008) and an out-of-sample subperiod (2009-2015). Results consistently show that residual momentum and reversal outperform their conventional counterparts on a gross, risk-adjusted basis, though out-of-sample outperformance is mostly modest.

In summary, evidence indicates that residual momentum and reversal suppress volatility compared to their conventional counterparts and thereby achieve higher gross return-to-risk ratios in different stock markets and in recent data.

Cautions regarding findings include:

- Results are gross, not net. Accounting for monthly portfolio reformation and shorting costs would reduce anomaly performances. Shorting as specified may be costly or infeasible due to lack of shares to borrow. Costs and constraints may vary considerably across markets.

- The process of purifying momentum and reversal positions of dependence on market, size and book-to-market factors is beyond the reach of most investors, who would bear fees for delegating to an investment/fund manager.

See “Purified Short-term Stock Reversal” and “Stripping Risks from a Stock Momentum Strategy” for summaries of some of the original research. See also “Purified Stock Momentum with Crash Suppression” and “Suppressing Unrelated Risks from Stock Factor Portfolios”.