Does suppressing unrelated risks from stock factor portfolios improve performance? In their January 2017 paper entitled “Diversify and Purify Factor Premiums in Equity Markets”, Raul Leote de Carvalho, Lu Xiao, François Soupé and Patrick Dugnolle investigate how to improve the capture of four types of stock factor premiums: value (12 measures); quality (16 measures); low-risk (two measures); and, momentum (10 measures). They standardize the different factor measurement scales based on respective medians and standard deviations, and they discard outliers. Their baseline factors portfolios employ constant leverage (CL) by each month taking 100% long (100% short) positions in stocks with factor values associated with the highest (lowest) expected returns. They strip unrelated risks from baseline portfolios by:

- SN – imposing sector neutrality by segregating stocks into 10 sectors before ranking them for assignment to long and short sides of the factor portfolio.

- CV – replacing constant leverage by each month weighting each stock in the portfolio to target a specified volatility based on its actual volatility over the past three years.

- HB – hedging the market beta of the portfolio each month based on market betas of individual stocks calculated over the past three years by taking positions in the capitalization-weighted market portfolio and cash.

- HS – hedging the size beta of the portfolio each month based on size betas of individual stocks calculated over the past three years by taking positions in the equal-weighted market portfolio and the capitalization-weighted market portfolio.

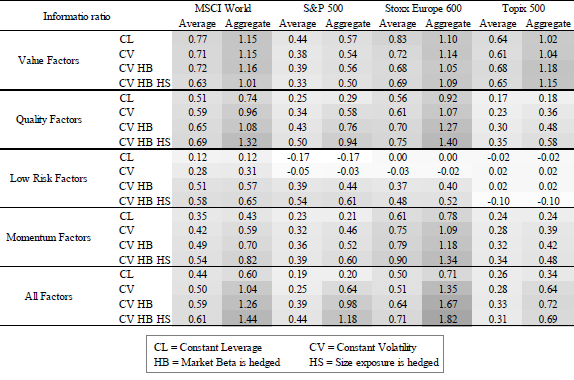

They examine effects of combining measures within factor types, combining types of factors and excluding short sides of factor portfolios. They also look at U.S., Europe and Japan separately. Their portfolio performance metric is the information ratio, annualized average return divided by annualized standard deviation of returns. Using data for stocks in the MSCI World Index since January 1997, in the S&P 500 Index since January 1990, in the STOXX Europe 600 Index since January 1992 and in the Japan Topix 500 Index since August 1993, all through November 2016, they find that:

- The simplest and most conventional approach (CL) to factor investing generally loses risk-adjusted performance because of exposures to market and size factors. Investors can boost gross information ratios (mostly due to volatility suppression) via volatility targeting, market beta hedging and size factor hedging. Specifically (see the table below):

- For quality and low-risk factor portfolios, volatility targeting (CV) increases gross information ratio.

- Hedging market beta (HB) generally increases factor/factor combination portfolio gross information ratios, more so for the low-risk factor but less so for the value factor.

- Hedging the size effect (HS) mostly increases gross information ratios exposures, but is harmful for the value factor.

- Diversifying across different measures within each factor mostly boosts gross information ratios. The exception is the low-risk factor.

- Diversifying across factors generally boosts gross information ratios.

- Neutralizing sector exposures boosts gross information ratios for value and (less so) low-risk factor portfolios, but not for quality and momentum factor portfolios.

- With few exceptions, portfolio short side contributions to gross information ratios are smaller than corresponding long sides, such that long-only factor portfolios are attractive ways to capture factor premiums (particularly for low-risk and momentum factors). Regional exceptions are the quality factor in Europe and the momentum factor in the U.S.

- Neutralizing regional exposures has mixed effects for factor portfolio gross information ratios, negative for value and low-risk factors but positive for momentum and unclear for quality.

- Factor portfolios tend to have fat tails compared to the normal distribution, suggesting crash-proneness.

- Stripping unrelated risks from factor portfolios drives very high monthly portfolio turnovers and therefore trading frictions.

The following table, taken from the paper, summarizes gross information ratios for value, quality, low-risk and momentum factor portfolios globally and regionally over specified sample periods for:

- The baseline CL portfolio outlined above.

- The CV alternative volatility-suppression approach outlined above.

- The CV approach augmented by the HB market risk suppression approach outlined above.

- The CV plus HB approach augmented by the HS size effect suppression approach outlined above.

For all portfolios, the table presents both the average information ratio for the individual measures within each factor and an aggregate based on full diversification across these measures. The “All Factors” section considers all measures for all factors. Shading denotes ranges of gross information ratios.

In summary, evidence indicates that suppression of unrelated risks mostly enhances gross information ratios for monthly reformed factor portfolios by suppressing portfolio volatility, and that diversification across factor measures and factors is beneficial.

Cautions regarding findings include:

- Reported information ratios are gross, not net. Factor/factor combination portfolio monthly turnovers likely generate material trading frictions. Risk hedging generally increases factor portfolio turnover and trading frictions. Shorting involves stock borrowing costs and may not always be feasible due to lack of shares to borrow. Also:

- Factor portfolio turnovers may differ, such that net comparisons of such portfolios may differ from gross comparisons.

- The authors assert, but do not demonstrate: “While not discussed here, there are efficient ways in particular based on the use of portfolio optimization that can efficiently reduce turnover without sacrificing the merits of the approach.”

- Information ratio does not fully explore portfolio performance.

- Factor portfolio formation and risk hedging involve considerable data collection/processing and many portfolio transactions on a monthly basis, such that:

- There may be timeliness issues in this evolution.

- These efforts are beyond the reach of most investors, who would bear fees when delegating to fund manager.

- There may be snooping bias in factor specifications, the factor measurement scale standardization process and approaches to risk hedging (such as lookback interval), thereby overstating expectations.

- Considering a large number of factors, factor combinations and hedging rules introduces further data snooping bias, such that the best-performing variations overstate expectations.