Is systematic selling of equity index put or call options an attractive strategy? In their December 2015 paper entitled “Index Options Realized Returns Distributions from Passive Investment Strategies”, Jose Dapena and Julian Siri analyze equity index call and put option returns from the perspective of a seller. They view a systematic option seller as an insurance company: (1) collecting option premiums at the time of sale; (2) maintaining capital in the form of a margin requirement; and, (3) cash-settling at expiration. They consider options written on the Dow Jones Industrial Average, the S&P 500 Index or the NASDAQ 100 Index with maturities of approximately 60, 180 or 365 days. They consider options with moneyness between 0.95 and 1.05. They estimate return by subtracting value at expiration from initial (bid) price and dividing the difference by initial, average or maximum margin required per the CBOE Rulebook. They calculate average and maximum margin requirements based on daily values while each option is active. Using bid prices for specified options during January 1996 through July 2013, they find that:

- Selling puts is more profitable than selling calls at approximately the same return volatility.

- Specifically, calculated with maximum margin required:

- Average returns from selling 60-day, 180-day or 365-day call options are 0.4%, -0.13% and -0.44%, respectively, with standard deviations 16.8%, 24.4% and 26.5%.

- Average returns from selling 60-day, 180-day or 365-day put options are 6.5%, 13.9% and 14.2%, respectively, with standard deviations 17.6%, 23.3% and 27.8%.

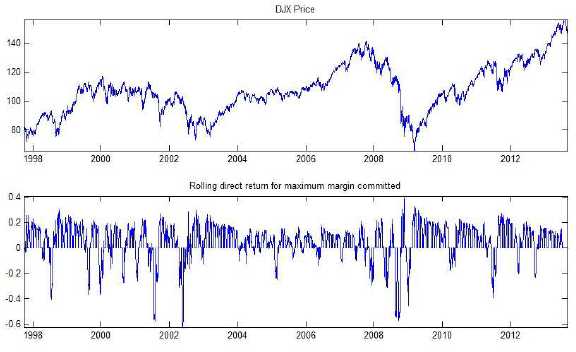

- However, the worst returns in all cases essentially wipe out committed capital (see, for example, the graphs below). In other words, the time series suffer crashes from which an investor cannot recover without adding capital.

The following graphs, taken from the paper, track over the sample period:

- In the upper graph, the Dow Jones Industrial Average divided by 100 (DJX).

- In the lower graph, contemporaneous returns (based on maximum margin required) for iteratively selling associated near at-the-money put options with about 60 days to expiration.

Results indicate that committing all capital to selling equity index put options often generates very attractive returns, but occasionally results in very large losses which may cluster.

In summary, evidence indicates that risking all capital on a strategy of selling unhedged equity index call or put options is untenable over the long run (even though selling puts is attractive based on average return).

Cautions regarding findings include:

- The treatment of required margin is ideal, in the sense that an option seller does not know at strategy initiation the maximum of the maximum margins required and would prudently maintain a large capital reserve. This reserve would reduce average strategy return.

- The samples of positions are not large in terms of option holding periods (for example, about 17.5 independent holding intervals for options with initial 365 days to expiration). In other words, the sample period may not be representative of all market conditions.

- Accounting for option sale/settlement fees would reduce reported returns.

See also:

- “Abnormal Returns from Selling Index Put Options?”

- “Is 40% Per Month Shorting Index Puts a Fair Return?”

- “Strategy Test”

- “Selling Calls or Puts According to Trend”

- “Simple Stock Index Option Strategies”