What are the moving parts of an equity index covered call strategy, and what can investors do to enhance its performance? In the October 2015 update of their paper entitled “Covered Calls Uncovered”, Roni Israelov and Lars Nielsen decompose equity index covered call strategy returns into three risk premiums: (1) long equity; (2) short equity volatility; and, (3) long equity reversal (market timing). They then test a hedged covered call strategy designed to eliminate uncompensated risk from market timing through hedging. This hedged strategy each day measures the delta of the covered call and takes an offsetting position in the underlying index (via futures), continuing to collect the equity and volatility risk premiums without market timing risk. Using daily levels of the S&P 500 Index (plus dividends), the CBOE S&P 500 BuyWrite Index (BXM) and the CBOE S&P 500 2% OTM BuyWrite Index (BXY) during March 1996 through December 2014, they find that:

- Regarding the three components of the basic covered call strategy:

- The long equity exposure generates most of the risk and return.

- The short volatility exposure has gross annualized Sharpe ratio close to 1.0, and its risk contribution is less than 10%.

- The equity reversal exposure generates about 25% of risk with very little reward. Its risk contribution is largest just before call option expiration (nearly the same as equity risk on the day before expiration).

- Results are similar across three approximately equal subperiods.

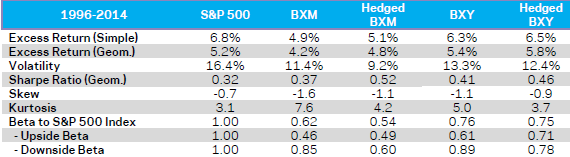

- Regarding the daily hedged covered call strategy described above (see the table below):

- Adding the hedge to BXM boosts gross annualized Sharpe ratio from 0.37 to 0.52 by reducing annualized volatility from 11.4% to 9.2%. With (without) the hedge, BXM has 0.49 (0.46) upside beta and 0.60 (0.85) downside beta.

- Similarly, adding the hedge to BXY boosts gross annualized Sharpe ratio from 0.41 to 0.46 by reducing annualized volatility from 13.3% to 12.4%. With (without) the hedge, BXY has 0.71 (0.61) upside beta and 0.78 (0.89) downside beta.

The following table, taken from the paper, summarizes gross performance statistics for the S&P 500 Index, BXM with and without a daily hedge, and BXY with and without a daily hedge over the entire sample period. The hedged BXM and BXY strategies require daily simulation of the indexes and daily adjustment of equity exposure via S&P 500 Index futures. Returns are in excess of U.S. 3-Month LIBOR. Volatility, skewness, kurtosis, beta, upside beta and downside beta derive from 21-day overlapping returns.

Results indicate that hedging to suppress market timing risk enhances gross performance. However, the trading frictions associated with daily hedge adjustments would work against enhancements.

In summary, evidence indicates that investors may be able to enhance the performance of an equity index covered call strategy by hedging away its market timing component.

Cautions regarding findings include:

- As noted, performance statistics are gross, not net. Accounting for trading frictions from iterative selling of index call options would reduce returns.

- Use of indexes rather than tradable assets ignores costs of maintaining a liquid fund. These costs would further reduce returns.

- As noted in the paper, the daily hedged covered call strategy has higher trading frictions than the basic covered call strategy. Moreover, if delegated, the hedged version would involve fees as well as incremental trading frictions.

See also, “Simple Stock Index Option Strategies”, “Russell 2000 Index Buy-Write Strategy Performance” and “Selling Calls or Puts According to Trend”.