Does the third moment (skewness) of commodity futures return distributions predict subsequent returns? In the October 2015 version of their paper entitled “Commodities as Lotteries: Skewness and the Returns of Commodity Futures”, Adrian Fernandez-Perez, Bart Frijns, Ana-Maria Fuertes and Joelle Miffre examine the relationship between skewness and future returns in commodity futures markets. They calculate futures series returns as the difference in logarithmic settlement prices based on holding the nearest-to-maturity contract until one month to maturity and then rolling to the second nearest contract. They compute futures series skewness based on the last 12 months of daily returns. They study skewness effects by ranking futures into fifths (quintiles) based on past skewness. Using daily settlement prices for 27 commodity futures contract series (12 agriculture, 5 energy, 4 livestock, 5 metal and random length lumber) during January 1987 through November 2014, they find that:

- Low (more negative) return skewness tends to accompany relatively high roll yield (backwardated).

- High skewness (lottery-like payoffs) tends to come with high maximum daily returns, low average prices and high idiosyncratic volatility.

- A fully-collateralized hedge portfolio that each month buys (sells) the quintile of commodities with lowest (highest) skewness generates average gross annualized excess return 8%, gross annual Sharpe ratio 0.78 and maximum drawdown -29%.

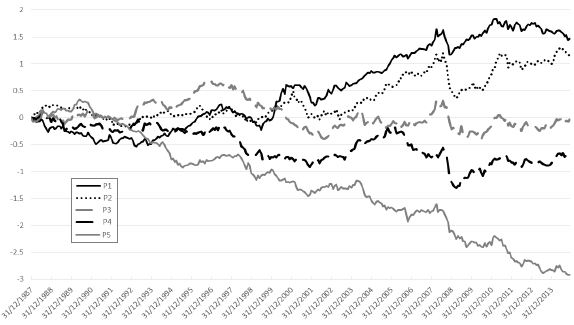

- Performance of the hedge portfolio comes more from the underperformance of high-skewness assets than outperformance of the low-skewness assets (see the chart below).

- The associated gross annual four-factor (market, term structure, momentum, hedging pressure) alpha is 6.6%, suggesting that multi-factor screening may be attractive.

- Performance of the skewness hedge portfolio is generally stronger than those of the risk factors. Gross annualized excess returns and gross annual Sharpe ratio are 4.6% and 0.39 for the term structure factor, 9.0% and 0.62 for the momentum factor and 5.8% and 0.48 for the hedging pressure factor.

- Exposures to backwardation and contango conditions do not fully explain the predictive power of skewness.

- Results are robust to alternative skewness specifications, most ranking and holding intervals, universe subsamples, liquidity, transaction costs and seasonality.

The following chart, taken from the paper, compares gross cumulative returns for five quintiles, reformed monthly by sorting the universe of commodity futures contract series on daily return skewness over the preceding 12 months. P1 (P5) has the lowest (highest) skewness. Cumulative performance decreases systematically from P1 to P5, with the cumulative loss for P5 greater in magnitude than the cumulative gain for P1. Gross average annualized return is 5.1% for P1 and -10.9% for P5. However, P1 displays relatively weak performance at the start and end of the sample period.

In summary, evidence indicates that past return skewness relates negatively and materially to future returns for commodity futures contract series.

Cautions regarding findings include:

- Highlighted results are gross, not net. Per tests in the paper, accounting for transaction costs modestly reduces average annualized return and Sharpe ratio of the hedge portfolio.

- Data collection/processing and exploitation are beyond the means of most investors, who would incur fees when delegating these steps to an advisor.

- As shown in chart, there are extended subperiods (the first 12 years and the last four years) during which the lowest skewness quintile (P1) does not have attractive performance.