How can investors best exploit research showing that low-beta (high-beta) stocks tend to outperform (underperform)? In their August 2015 paper entitled “Low-Beta Investment Strategies”, Olaf Kornz and Laura-Chloe Kuntz test 32 “zero-cost” (long-short) strategies designed to exploit the beta anomaly as applied to S&P 500 stocks. The strategies derive from three choices: (1) length of the rolling window used to calculate stock and market index betas (one, three, six or 12 months of daily returns); (2) portfolio holding period (12 months or three months); and, (3) portfolio tilt method (four alternatives). The four portfolio tilt alternatives are:

- Long Low-Beta/Short Index – long the equally weighted 50 stocks with the lowest betas, offset by a short position in the S&P 500 Index.

- Long-Short Low-High Beta Equal Weight – equal dollar values for a long side of the equally weighted 50 stocks with the lowest betas and a short side of the equally weighted 50 stocks with highest betas, plus a small position in the market to offset any long-short beta mismatch.

- Long-Short Low-High Beta Matched – a long side of the equally weighted 50 stocks with the lowest betas and a short side of the equally weighted 50 stocks with highest betas, in different dollar amounts determined to produce a portfolio beta of one.

- Short High-Beta/Long Index – short the equally weighted 50 stocks with the highest betas, offset by a long position in the S&P 500 Index.

Portfolio tilt alternatives also include positions in 1-month U.S. Treasury bill futures to satisfy an exact zero-cost assumption. The authors form portfolios monthly, such that there are 12 (four) overlapping portfolios with 12-month (3-month) holding periods. They also test the ability of the betas of aggregate high-beta stocks and aggregate low-beta stocks to predict market returns. Using daily returns for the S&P 500 index and its component stocks during September 1988 through October 2014, they find that:

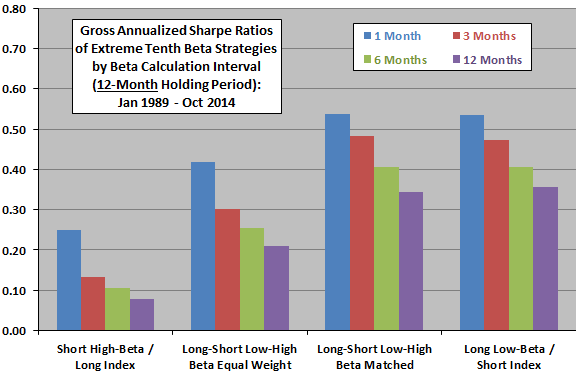

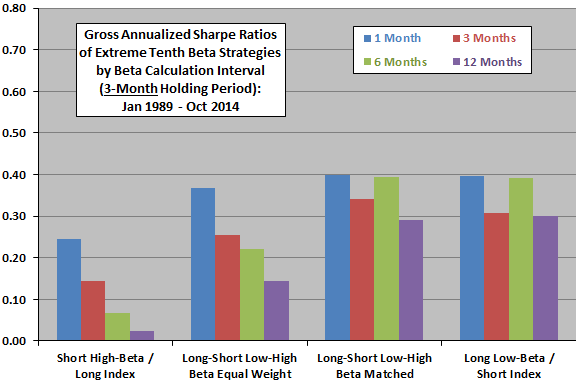

- Higher concentration in low-beta stocks, short beta calculation intervals and long holding periods generally work best (see the charts below). Specifically:

- A 1-month (12-month) rolling window for calculating betas is best (worst) for all four portfolio tilt alternatives based on gross average return and gross Sharpe ratio. However, the 1-month window results in the highest return volatilities.

- Holding short positions in high-beta stocks is unproductive compared to holding long positions in low-beta stocks.

- Annual rebalancing outperforms quarterly rebalancing, due mostly to higher average returns.

- Four-factor (market, size, book-to-market, momentum) alphas are modest compared to unadjusted returns.

- All portfolios exhibit positive exposure to the market (most strongly for the 1-month beta calculation interval). These exposures imply bias in beta estimates.

- Low-beta stocks exhibit a value tilt.

- The level of beta for a high-beta portfolio and the difference in betas between a high-beta and a low-beta portfolios have market timing implications.

- Extraordinarily high (low) betas for the high-beta portfolio and extraordinary large (small) differences between the betas of the high-beta portfolio and the low-beta portfolio indicate weak (strong) future market performance.

- Market timing strategies based on these observations generate attractive gross Sharpe ratios.

The following charts, constructed from data in the paper, compare gross annualized Sharpe ratios for the 32 beta anomaly stock strategies specified above. The upper chart shows Sharpe ratios across four beta calculation intervals and four beta tilt alternatives for a 12-month holding period. The lower chart shows comparable Sharpe ratios for a 3-month holding period. Results indicate that long positions in low-beta stocks, short beta calculation intervals and the longer holding interval work best.

In summary, evidence indicates that investors can exploit the beta anomaly best via long positions in low-beta stocks with short beta estimation intervals and long holding periods. Also, when high-beta stocks have extraordinarily high (low) betas, the stock market is likely to be weak (strong).

Cautions regarding findings include:

- Testing of many strategy variations on the same data introduces snooping bias, such that the best-performing strategy likely overstates expectations.

- Calculations are gross, not net. Costs of annual or quarterly portfolio rebalancing (buying/selling stocks and establishing index and interest rate futures positions) would reduce portfolio performance. Costs may differ for the four portfolio tilts.

- Use of overlapping portfolios enhances statistical confidence, but would be problematic in practice. Investors not employing overlapping portfolios face lower confidence levels for outcomes.

- Calculations assume borrowing cost for all short positions is the risk-free rate. Shorting some stocks may be materially more costly.

- Investors would generally access such strategies via a fund manager, thereby incurring fees that reduce net performance.