A subscriber asked how the “Simple Asset Class ETF Value Strategy” (SACEVS) performs when interest rates rise. This strategy seeks to exploit relative valuation of the term risk premium, the credit (default) risk premium and the equity risk premium via exchange-traded funds (ETF). To investigate, because the sample period available for mutual funds is much longer than that available for ETFs, we use instead data from “SACEVS Applied to Mutual Funds”. Specifically, each month we reform a Best Value portfolio (picking the asset associated with the most undervalued premium, or cash if no premiums are undervalued) and a Weighted portfolio (weighting assets associated with all undervalued premiums according to degree of undervaluation, or cash if no premiums are undervalued) using the following four assets:

- Monthly average 3-Month Treasury Bill (T-bill) Secondary Market Rate as an approximation of the return on Cash.

- Vanguard GNMA Investor Shares (VFIIX).

- Vanguard Long-Term Investment Grade Investor Shares (VWESX).

- Vanguard US Growth Investor Shares (VWUSX).

The benchmark is a monthly rebalanced portfolio of 60% stocks and 40% U.S. Treasuries (60-40 VWUSX-VFIIX). We use the T-bill yield as the short-term interest rate (SR) and the 10-year Constant Maturity U.S. Treasury note (T-note) yield as the long-term interest rate (LR). We say that each rate rises or falls when the associated average monthly yield increases or decreases during the SACEVS holding month. Using monthly risk premium estimates, SR and LR, and Best Value and Weighted returns during June 1980 through June 2017 (444 months), we find that:

Over the available sample period, SR rises (falls) during 210 (234) months. LR rises (falls) during 190 (254) months.

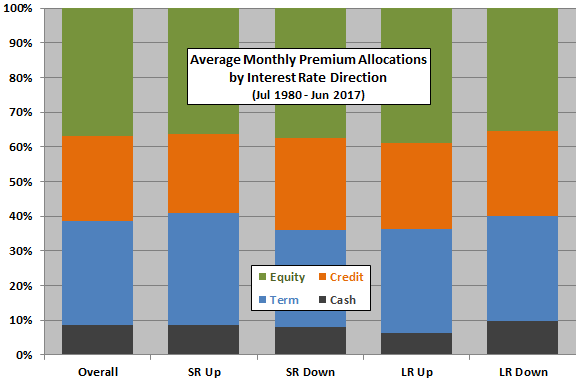

The following chart summarizes average monthly premium allocations (determined at the end of the prior month) overall and for four interest rate direction cases over the available sample period. An investor would not know the interest rate direction for a month when setting the allocation for that month. Results suggest that SACEVS tends to:

- Allocate relatively more to the term risk premium and less to the credit risk premium before SR rises, and the opposite just before SR falls.

- Allocate relatively more to the equity risk premium and less to cash before LR rises, and the opposite just before LR falls.

How do findings about allocations translate to strategy performance?

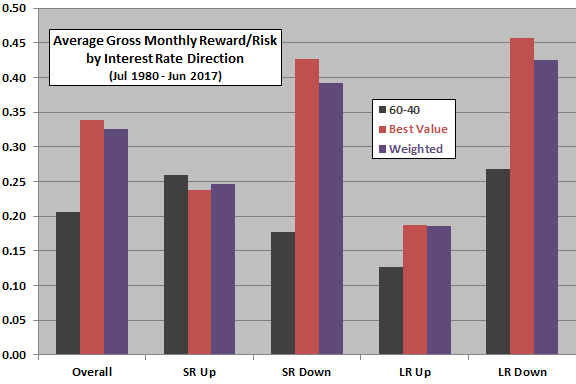

The next chart summarizes average gross monthly reward-risk ratios (average monthly return divided by standard deviation of monthly returns) overall and for the four interest rate direction scenarios over the available sample period. Calculations ignore portfolio reformation/rebalancing costs and tax implications of trading. Gross results suggest that, on an average risk-adjusted basis:

- SACEVS Best Value and Weighted beat the 60-40 benchmark overall and for falling SR, rising LR and falling LR, but lose slightly to the benchmark for rising SR.

- SACEVS performs much better when interest rates fall than when interest rates rise.

An investor who could predict the direction of interest rates would prefer both Best Value and Weighted to the 60-40 benchmark for most interest rate scenarios, but not for rising SR.

SACEVS outperformance generally derives from both a higher average monthly return and a lower monthly return volatility.

In summary, evidence from available data suggests that SACEVS works better when interest rates fall but compares favorably to the 60-40 benchmark whether interest rates rise or fall.

Cautions regarding findings include:

- Variables used to measure risk premiums in “SACEVS Applied to Mutual Funds” are somewhat different from those used in SACEVS as tracked.

- Per “SACEVS Applied to Mutual Funds”, strategy performance is sensitive to the lookback interval used to determine risk premium overvaluation/undervaluation.

- As noted, the above analyses ignore trading frictions. There may be none within a family of mutual funds.

- Interest rate direction measurements are blurred by use of monthly average interest rates. Other ways of measuring interest rate direction may affect findings.

- Other cautions in “SACEVS Applied to Mutual Funds” apply.