A subscriber requested corroboration of the findings in “Simple Debt Class Mutual Fund Momentum Strategy” with a universe restricted to a family of bond funds (such as Fidelity) to enable low-cost fund switching. We therefore apply the strategy to the following ten Fidelity mutual funds:

Investment Grade Bond (FBNDX)

Intermediate Bond (FTHRX)

Government Income (FGOVX)

Mortgage Securities (FMSFX)

GNMA (FGMNX)

Short-Term Bond (FSHBX)

Limited Term Government (FFXSX)

Convertible Securities (FCVSX)

Intermediate Government Income (FSTGX)

Fidelity New Markets Income (FNMIX)

Per the prior test, we allocate all funds at the end of each month to the fund with the highest total return over the past three months (3-1). We determine the first winner in May 1994 to accommodate momentum measurement interval sensitivity testing. Using monthly dividend-adjusted closing prices for the ten funds during May 1993 (as limited by FNMIX) through January 2015 (261 months), we find that:

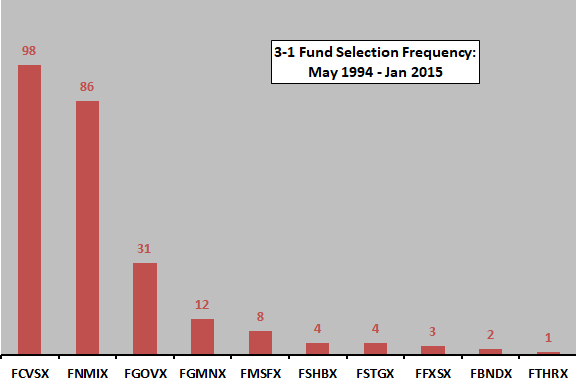

The following chart shows the distribution of 249 Fidelity bond fund 3-1 strategy winners over the entire sample period. Results indicate that several funds add little value. The strategy based on fewer funds may work about as well.

How do the winning funds translate into cumulative performance?

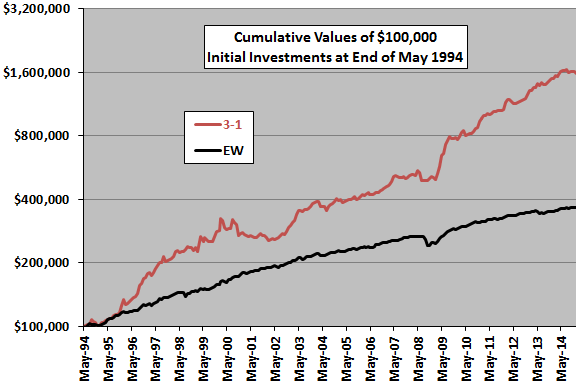

The next chart compares on a logarithmic scale the cumulative values of $100,000 initial investments in the 3-1 strategy and an equally weighted, monthly rebalanced combination of all ten funds over the sample period (EW). Calculations derive from the following assumptions:

- Reallocate at the close on the last trading day of each month (ignore the constraint that mutual fund prices are available only once a day after the close).

- There are no costs for switching funds.

- Ignore any tax implications of trading.

With these assumptions, the 3-1 strategy easily outperforms EW, but with higher volatility. Terminal values are $1.59 million and $0.37 million, respectively. The compound annual growth rate (CAGR) for the 3-1 strategy is about 14.3% over about 21 years, compared to 6.5% for EW.

Outperformance of the 3-1 strategy accelerates after the 2008 financial crisis, perhaps due to efforts of central banks worldwide to suppress interest rates. Through 2008 (after 2008), CAGR is about 11.8% (24.3%).

How do average monthly returns, as alternative measures of performance, compare?

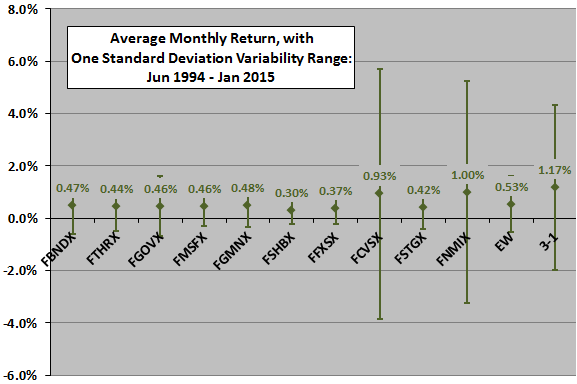

The next chart summarizes average monthly returns and standard deviations of monthly returns for the 3-1 strategy, the EW benchmark and all component mutual funds. Average monthly return for the 3-1 strategy beats those of all components, but with relatively high volatility. Gross monthly reward-to-risk ratios (rough Sharpe ratios) for the 3-1 strategy and the EW benchmark are 0.37 and 0.50, respectively.

In other words, the momentum strategy tends to pick the most volatile components, as might be expected when assets tend to move together. But, it arguably picks them mostly at the right time.

Is the momentum effect consistent over time?

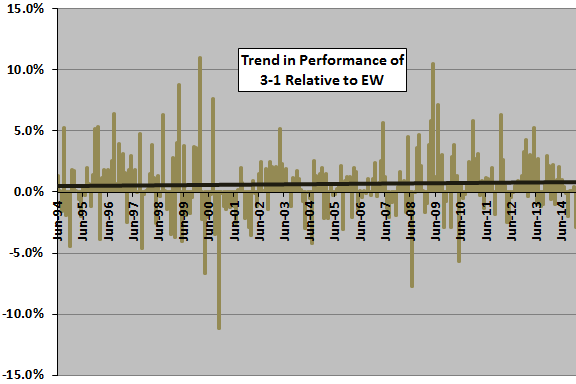

The next chart shows the monthly returns for the 3-1 strategy relative to the EW benchmark over the entire sample period, along with a best-fit trend line. Results indicate that the outperformance of the momentum strategy relative to equal weighting strengthens somewhat over time (as suggested by the break in performance at the end of 2008 above).

How robust are findings to the length of the momentum measurement interval?

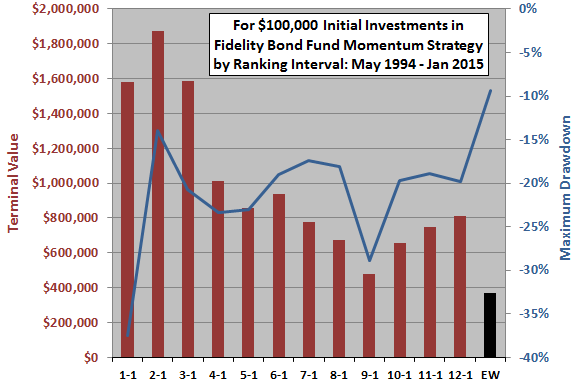

The final chart summarizes variations in terminal value and maximum (peak-to-trough) drawdown of the simple Fidelity bond fund momentum strategy for past return measurement intervals ranging from one month (1-1) to 12 months (12-1). All holding intervals are one month.

The 3-month momentum measurement interval is near optimal, so there is likely snooping bias (luck) in the outcome. However, 2-1 beats 3-1 (18% higher terminal value). In general, short measurement intervals work best for the selected set of funds and the available sample period.

In summary, evidence indicates that a simple relative momentum strategy applied to a set of Fidelity bond mutual funds encompassing several debt classes may be attractive (but degree of attractiveness may depend on a secular bull market for debt, and especially central bank policy of the last few years).

Cautions regarding findings include:

- The sample is not long in terms of number of equity bull and bear markets, and especially in terms of the number of interest rate cycles (essentially one secular decline). Tightening by central banks and a secular rise in interest rates may disrupt the strategy. The equity-like aspects of convertible bond funds somewhat mitigate this concern.

- As noted, it is not possible to generate signals and execute at the same close for mutual funds. A one-day delay in signal execution may affect results.

- While Fidelity currently charges no transaction fees for the funds used:

- Some funds may have frequent trading penalties. For example, current frictions for the most frequently selected fund (FCVSX) are: “Fidelity funds are available without paying a trading fee to Fidelity or a sales load to the fund. However, the fund may charge a short-term trading or redemption fee to protect the interests of long-term shareholders of the fund.”

- Transaction fees and other frictions may have changed over the sample period.

- Results offer only weak corroboration of findings in “Simple Debt Class Mutual Fund Momentum Strategy” because the sample periods are similar and the funds driving strategy profitability are the same.