Do the returns of iPath S&P 500 VIX Short-term Futures ETN (VXX) and VelocityShares Daily Inverse VIX Short-term ETN (XIV) vary systematically across days of the week? To investigate, we look at daily close-to-open, open-to-close and close-to-close returns for both. Using daily split-adjusted opening and closing prices for VXX during February 2009 through July 2017 and for XIV during December 2010 through July 2017, we find that:

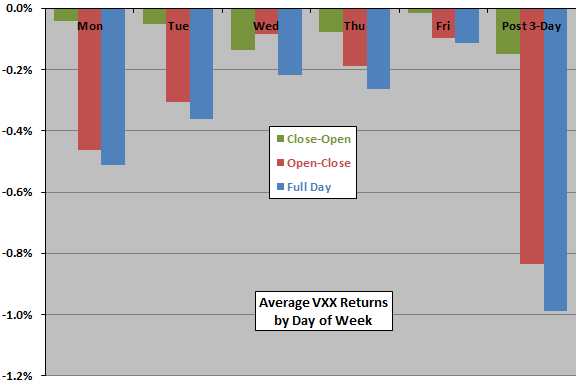

The following chart summarizes average daily returns for VXX by day of the week and for the day after 3-day weekends (Post 3-Day) over the available sample period. There are at least 402 observations for each day, but only 59 observations for Post 3-day. Notable points are:

- Average returns are uniformly negative and mostly decrease in magnitude across the week, with Monday and Tuesday most negative.

- Open-to-close mostly drives full-day average returns.

- Average returns are particularly negative after 3-day weekends.

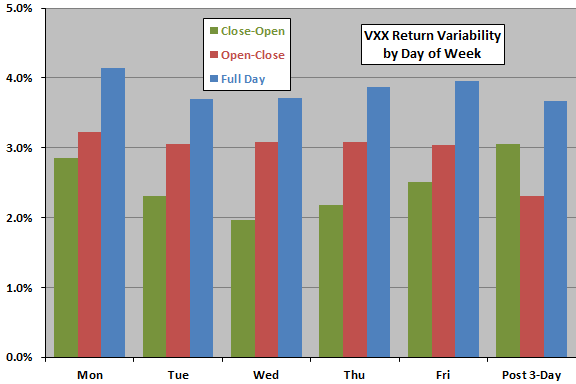

For additional insight, we look at VXX return variability (standard deviation of returns) by day of the week.

The next chart summarizes variability of daily VXX returns by day of the week and for the day after 3-day weekends over the available sample period. Notable points are:

- Monday returns are a little more variable than those for other days.

- There is no variability penalty for the particularly negative Post 3-Day average returns.

What about XIV?

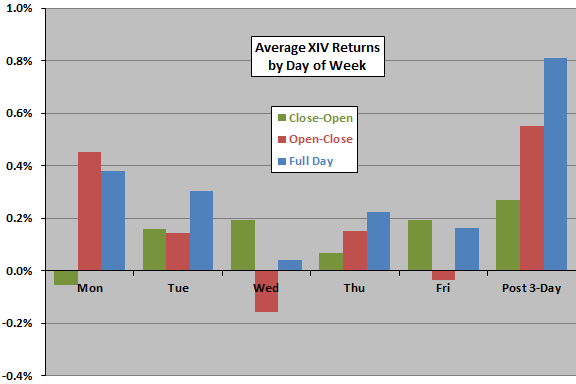

The next chart summarizes average daily returns for XIV by day of the week and for the day after 3-day weekends over the available sample period. There are at least 314 observations for each day, but only 46 observations for Post 3-day. Notable points are:

- The average return pattern is roughly a mirror image of that for VXX, but not all returns are positive.

- Average returns mostly decrease in magnitude across the week, with Monday and Tuesday average returns largest.

- Average returns are particularly positive after 3-day weekends.

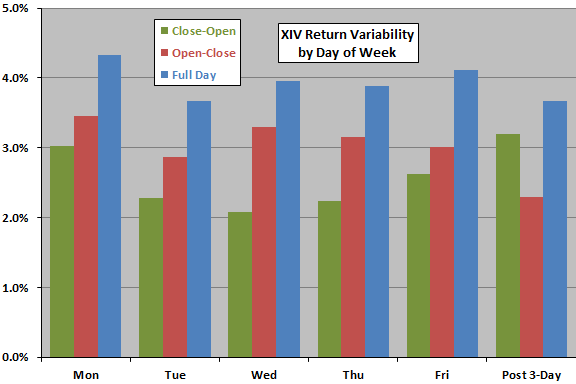

For additional insight, we look at XIV return variability across the week.

The final chart summarizes average variability of daily XIV returns by day of the week and for the day after 3-day weekends over the available sample period. Notable points are:

- Monday returns are again a little more variable than those for other days.

- Again, there is no variability penalty for the particularly positive Post 3-Day average returns.

In summary, evidence from available data suggests average daily returns for VXX (XIV) are all negative (mostly positive) and mostly decrease in magnitude across the week. VXX (XIV) returns after 3-day weekends are particularly negative (positive).

Cautions regarding findings include:

- Sample periods are not long in terms of variety of market conditions, and average return differences across days of the week may therefore not be reliable.

- VXX and XIV return distributions may be wild, confounding the predictive power of average and standard deviation statistics.

- Trading any findings involves frictions that would reduce returns.