Is Piotroski’s FSCORE really as effective at picking stocks as indicated in the original study, which screens stocks with high book-to-market ratios to isolate those that will eventually provide high returns? In their April 2014 paper entitled “Implementability of Trading Strategies Based on Accounting Information: Piotroski (2000) Revisited”, Sohyung Kim and Cheol Lee re-examine the FSCORE testing methodology. Their broader goal is to investigate the effect of a problematic research approach used in many accounting-based studies. Specifically, they evaluate the difference in investment outcomes between:

- Accounting studies that typically accumulate returns for individual stocks starting three or four months after their respective fiscal year-ends.

- Finance studies that synchronize return accumulation with a common annual starting date (regardless of the fiscal year-ends of individual firms) via periodically reformed portfolios with a specified weighting scheme (such as equal weighting).

Accounting study assumptions may confound real-time position weighting due to lack of timely information on how many stocks should be in the portfolio, thereby incorporating look-ahead bias. The study replicates the original Piotroski methodology with equal position weighting, and then makes adjustments to synchronize return calculations by each year reforming a hedge portfolio that is long (short) the equally weighted stocks with high (low) FSCOREs based on a common starting date and most recently available firm fundamentals. Using monthly data for a broad sample of U.S. common stocks with enough information to calculate FSCOREs during 1976 through 2007, they find that:

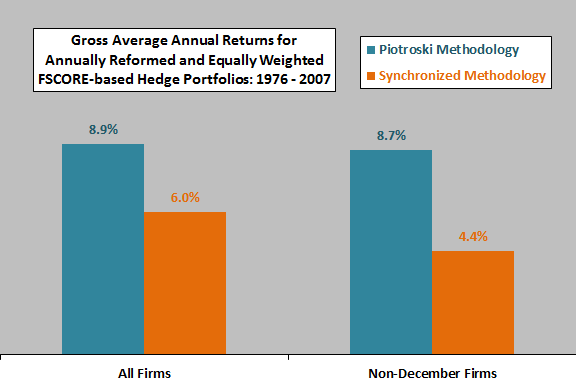

- The relationship between Piotroski’s fundamental signals and subsequent returns is partly driven by the accounting study approach to return calculations (see the chart below).

- Synchronizing return calculations based on common portfolio reformation dates reduces gross average annual hedge portfolio return by about one third, from 8.9% to 6.0%.

- Limiting the analysis to stocks with non-December fiscal year ends results in a larger gap between the Piotroski methodology and a synchronized portfolio methodology (8.7% versus 4.4%), confirming that these firms drive the gap for the overall sample.

- As found in the original research, hedge portfolio gross profits come mainly from smaller firms that may involve high risk and high trading frictions.

- Because the method used by Piotroski is typical of those employed in accounting-based studies, results suggests that such studies overstate realistic expected performance.

The following simple chart, constructed from data in the paper, illustrates the effect of synchronizing the return calculation intervals in the original FSCORE methodology to ensure that all portfolio components weights are known before forming annual hedge portfolios. Results show that: (1) synchronization reduces average gross annual returns by about one third; and, (2) the effect of synchronization concentrates, as expected, in firms with fiscal year ends other than December.

In summary, evidence indicates that a realistic portfolio construction approach reduces the gross effectiveness of Piotroski’s FSCORE methodology by about a third.

Cautions regarding findings include:

- As noted, reported returns are gross. Including costs of annual portfolio reformation and shorting costs would reduce these returns. Portfolios may be tilted toward small stocks with relatively high trading frictions and shorting costs. Shorting may be problematic for some stocks due to lack of counterparties.

- The portfolios examined involve more positions than many investors may be able to manage.

- FSCORE calculations involve considerable data collection and processing (or fees if delegated to a fund manager).